My 2nd Long Term Target was hit and surpassed.

Sentiment is complacent. Complacency is different from Greed. Still bearish, but more sneaky. I'm a strong believer in sentiment and I believe we're going to need to work off this extreme reading one way or the other. Historically, we move sideways to lower after reaching such optimistic levels. It's not sustainable. We're talking 90-95th percentile levels, which is the only time it's worth mentioning.

I don't anticipate a crash or anything, but do think expectations over the next 1-3 weeks should be tempered.

Last Week:

**Unemployment:

High Yield: (Non-confirmation)

Stock Pick: (Deep Value)

Homebuilders: (Interest Rates)

Real Estate: (Interest Rates)

G7 Friend: (International)

Regional Banks: (Retest?)

Dollar: (Strength via lack of bearishness?)

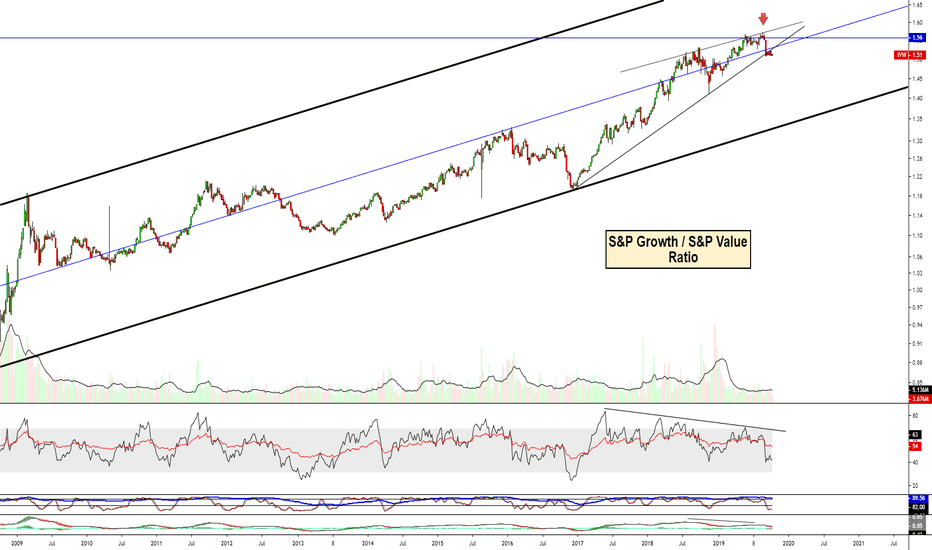

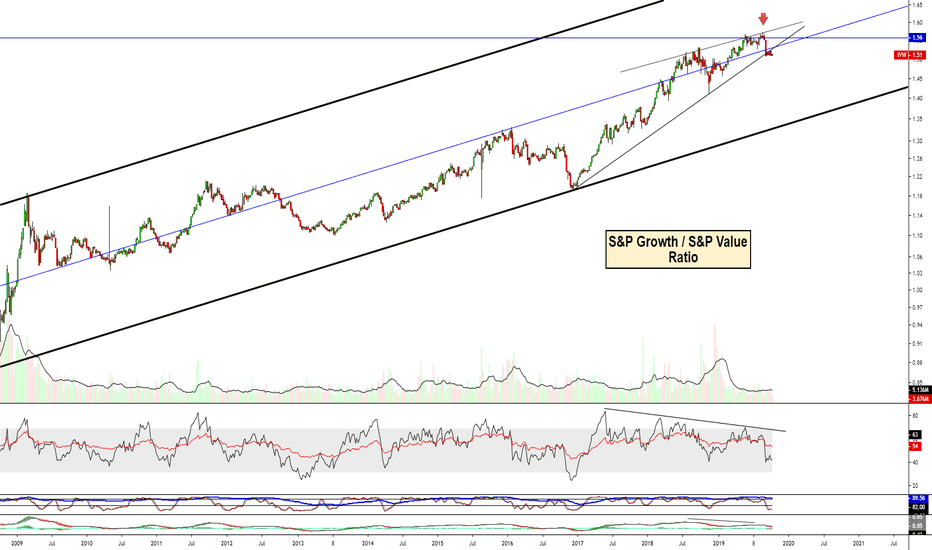

Growth vs. Value Ratio: (Reversal?)

Healthcare vs. SPY Ratio: (Breakout?)

Consumer Discretionary vs. Consumer Staples Ratio: (Failure?)

Emerging Markets vs. SPY Ratio: (Failure?)

Low Volatility vs. High Beta: (Risk on)

Sentiment is complacent. Complacency is different from Greed. Still bearish, but more sneaky. I'm a strong believer in sentiment and I believe we're going to need to work off this extreme reading one way or the other. Historically, we move sideways to lower after reaching such optimistic levels. It's not sustainable. We're talking 90-95th percentile levels, which is the only time it's worth mentioning.

I don't anticipate a crash or anything, but do think expectations over the next 1-3 weeks should be tempered.

Last Week:

**Unemployment:

High Yield: (Non-confirmation)

Stock Pick: (Deep Value)

Homebuilders: (Interest Rates)

Real Estate: (Interest Rates)

G7 Friend: (International)

Regional Banks: (Retest?)

Dollar: (Strength via lack of bearishness?)

Growth vs. Value Ratio: (Reversal?)

Healthcare vs. SPY Ratio: (Breakout?)

Consumer Discretionary vs. Consumer Staples Ratio: (Failure?)

Emerging Markets vs. SPY Ratio: (Failure?)

Low Volatility vs. High Beta: (Risk on)

Note

All charts are from several weeks ago. Click on them to see how the chart has played out since original posting.

Note

HYG - Debt Market Leads Equity MarketDisclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.