Market's at all time highs. Fed cut again, came out, saw their shadow and said 6 more weeks of summer.

I think it's decision time for whether or not you want to be bullish or bearish for the medium term. Seasonality on the bull side over the next two months. But we're up 24% YTD... Volatility is very low.

- Small caps look like a place that's rather opportunistic right now.

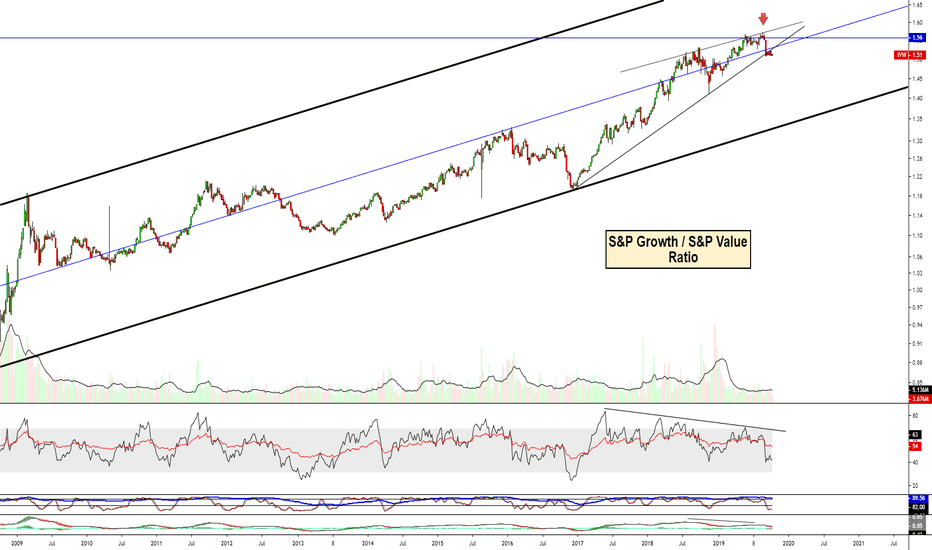

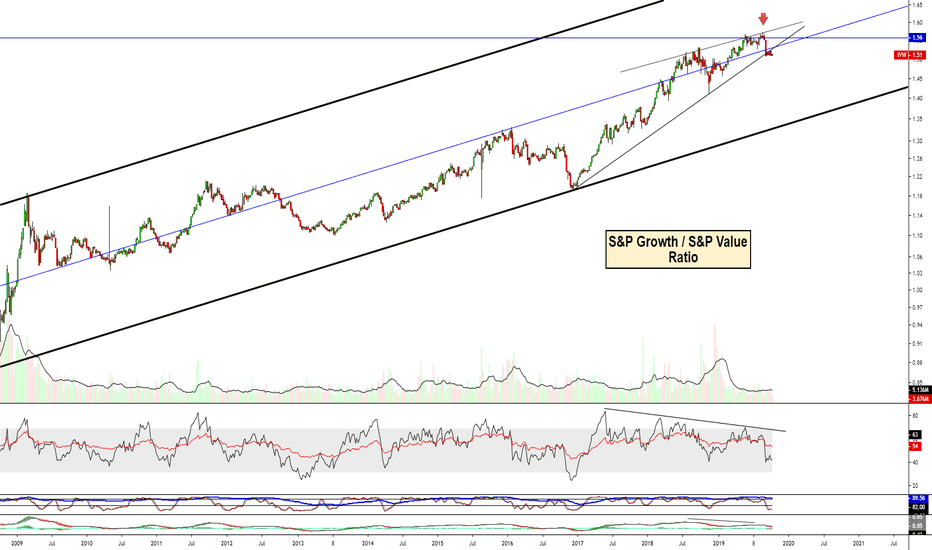

- Value has been beating growth for the last 5-6 weeks.

- Earnings are about halfway over with and a majority are beating expectations.

- Emerging markets looks pretty opportunistic right now, not China though so have to be picky.

- Bond volatility is back.

- Gold volatility is just starting to pick up.

- Financials, Healthcare, consumer discretionary all look attractive.

Last Week's Post:

Food for thought:

Homebuilders:

Real Estate:

Mexico:

South Korea:

Regional Banks:

Dollar:

Growth vs. Value:

SPX 2hr:

Unemployment:

Healthcare vs. SPY:

Discretionary vs. SPY:

Growth vs. Value:

Emerging Markets vs. SPY:

Consume Staples:

Emerging Markets Weekly:

Low Volatility stocks vs. High Beta stocks:

Good luck next week

-RH

I think it's decision time for whether or not you want to be bullish or bearish for the medium term. Seasonality on the bull side over the next two months. But we're up 24% YTD... Volatility is very low.

- Small caps look like a place that's rather opportunistic right now.

- Value has been beating growth for the last 5-6 weeks.

- Earnings are about halfway over with and a majority are beating expectations.

- Emerging markets looks pretty opportunistic right now, not China though so have to be picky.

- Bond volatility is back.

- Gold volatility is just starting to pick up.

- Financials, Healthcare, consumer discretionary all look attractive.

Last Week's Post:

Food for thought:

Homebuilders:

Real Estate:

Mexico:

South Korea:

Regional Banks:

Dollar:

Growth vs. Value:

SPX 2hr:

Unemployment:

Healthcare vs. SPY:

Discretionary vs. SPY:

Growth vs. Value:

Emerging Markets vs. SPY:

Consume Staples:

Emerging Markets Weekly:

Low Volatility stocks vs. High Beta stocks:

Good luck next week

-RH

Note

PSA:Sentiment is extremely high. Historically, we move sideways to lower after reaching such optimistic levels. It's not sustainable. We're talking 90-95th percentile levels, which is the only time it's worth mentioning.

I don't anticipate a crash or anything, but do think expectations over the next 1-3 weeks should be tempered.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.