EURGBP 04/06 – PMI Divergence & ECB Rate Decision Looms: 0.84 Key Level in Play

EUR/GBP is hovering around the 0.8420 mark after mixed PMI releases from the Eurozone and Germany. Traders are cautiously awaiting the ECB’s interest rate decision this Thursday, while the Bank of England signals potential easing — but remains non-committal on timing.

🌍 MACRO OUTLOOK

Eurozone & German PMI:

Eurozone Composite PMI eased to 50.2, still above forecasts (49.5) but reflecting slowing momentum.

German Composite dropped to 48.5; Services fell further to 47.1 — signaling contraction risk in Europe’s largest economy.

ECB Dovish Expectations:

Core inflation fell to 1.9% YoY in May — below the 2% ECB target for the first time in eight months.

Markets are fully pricing in a 25bps rate cut this week.

BoE Shifts Cautiously Dovish:

Governor Andrew Bailey acknowledged that monetary easing is likely, but warned of "uncertainty ahead."

The MPC is split — some fear sticky inflation; others warn that rates staying too high too long may damage growth.

Market Sentiment:

EUR remains pressured by ECB dovish expectations.

GBP is also under pressure from weak UK macro indicators and global trade tensions.

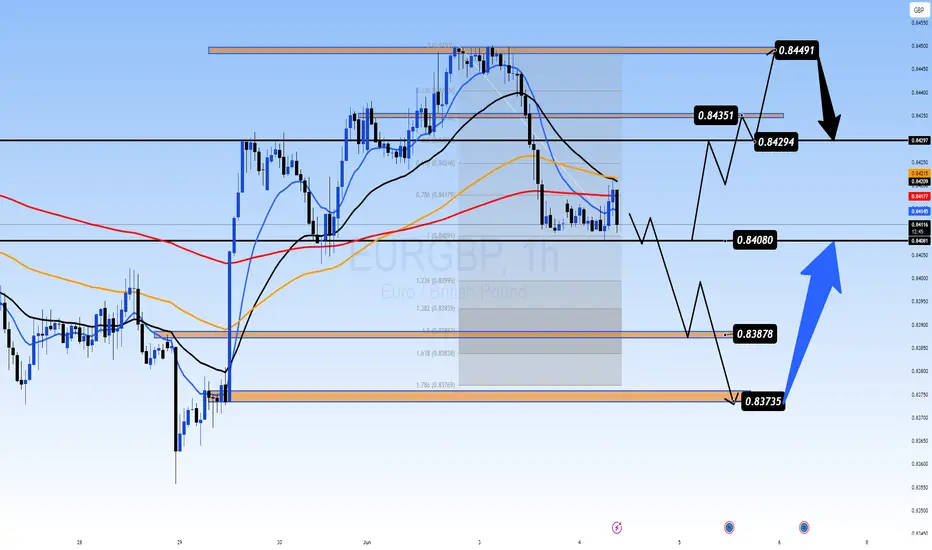

📉 TECHNICAL OUTLOOK (H1 Chart)

Price is consolidating near the EMA200 (0.8409) — a crucial dynamic support.

A tight sideways range has formed; 0.8408 is a key horizontal level to watch for breakout/breakdown confirmation.

Break below 0.8408 could send price toward Fibo 1.618 at 0.8383 or psychological support at 0.8373.

If bulls defend 0.8408, we may see a bounce toward 0.8429 → 0.8449 resistance zone.

🔑 KEY TRADE ZONES

🟢 BUY ZONE: 0.8380 – 0.8373

SL: 0.8358

TP: 0.8400 → 0.8415 → 0.8429 → 0.8435

🔴 SELL ZONE: 0.8448 – 0.8450

SL: 0.8460

TP: 0.8435 → 0.8420 → 0.8408 → 0.8388

⚠️ TRADE STRATEGY

Watch the 0.8408 area closely. If price holds → short-term BUY scalp opportunities.

If it breaks strongly → consider SELL toward lower Fibo/structure levels at 0.838x.

Be cautious around ECB release — avoid trading during the spike. Wait for structure confirmation post-news.

📌 CONCLUSION

"EUR/GBP is entering a critical zone near 0.8400. With ECB and BoE both leaning dovish, expect increased volatility. Hold or break at this key level will likely define the next directional leg. Stay patient and let the market show its hand."

EUR/GBP is hovering around the 0.8420 mark after mixed PMI releases from the Eurozone and Germany. Traders are cautiously awaiting the ECB’s interest rate decision this Thursday, while the Bank of England signals potential easing — but remains non-committal on timing.

🌍 MACRO OUTLOOK

Eurozone & German PMI:

Eurozone Composite PMI eased to 50.2, still above forecasts (49.5) but reflecting slowing momentum.

German Composite dropped to 48.5; Services fell further to 47.1 — signaling contraction risk in Europe’s largest economy.

ECB Dovish Expectations:

Core inflation fell to 1.9% YoY in May — below the 2% ECB target for the first time in eight months.

Markets are fully pricing in a 25bps rate cut this week.

BoE Shifts Cautiously Dovish:

Governor Andrew Bailey acknowledged that monetary easing is likely, but warned of "uncertainty ahead."

The MPC is split — some fear sticky inflation; others warn that rates staying too high too long may damage growth.

Market Sentiment:

EUR remains pressured by ECB dovish expectations.

GBP is also under pressure from weak UK macro indicators and global trade tensions.

📉 TECHNICAL OUTLOOK (H1 Chart)

Price is consolidating near the EMA200 (0.8409) — a crucial dynamic support.

A tight sideways range has formed; 0.8408 is a key horizontal level to watch for breakout/breakdown confirmation.

Break below 0.8408 could send price toward Fibo 1.618 at 0.8383 or psychological support at 0.8373.

If bulls defend 0.8408, we may see a bounce toward 0.8429 → 0.8449 resistance zone.

🔑 KEY TRADE ZONES

🟢 BUY ZONE: 0.8380 – 0.8373

SL: 0.8358

TP: 0.8400 → 0.8415 → 0.8429 → 0.8435

🔴 SELL ZONE: 0.8448 – 0.8450

SL: 0.8460

TP: 0.8435 → 0.8420 → 0.8408 → 0.8388

⚠️ TRADE STRATEGY

Watch the 0.8408 area closely. If price holds → short-term BUY scalp opportunities.

If it breaks strongly → consider SELL toward lower Fibo/structure levels at 0.838x.

Be cautious around ECB release — avoid trading during the spike. Wait for structure confirmation post-news.

📌 CONCLUSION

"EUR/GBP is entering a critical zone near 0.8400. With ECB and BoE both leaning dovish, expect increased volatility. Hold or break at this key level will likely define the next directional leg. Stay patient and let the market show its hand."

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals Vip

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals Vip

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals Vip

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals Vip

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.