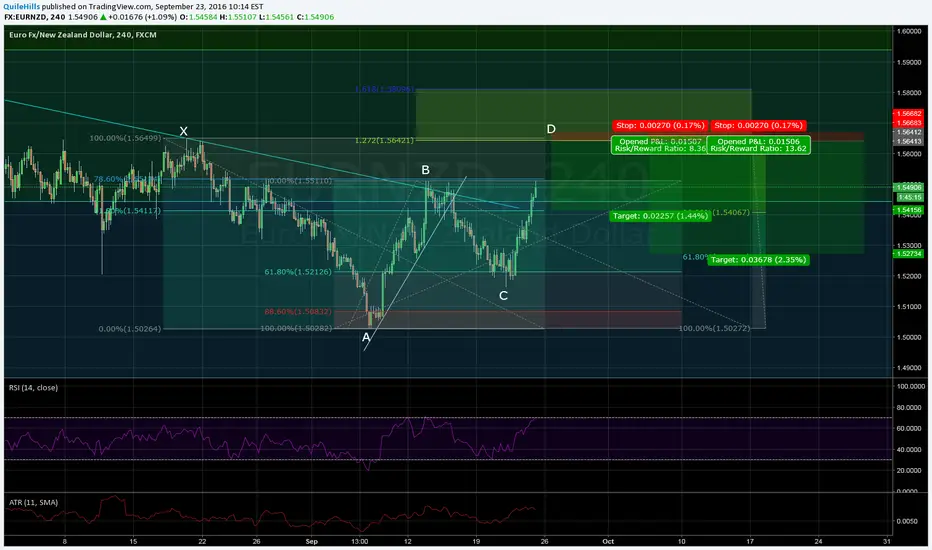

After just barely missing the 78.6% retracement of the impulse leg EURNZD is potentially going to set up a bearish Gartley for a short with a great risk reward targetting first the 38.2% retracement of point A-D followed by the 61.8% retracement of the same points.

With the 127.2% extension of the A-B leg coming so close to the origin of the first impulse leg you can set up a very tight stop loss for the order 10-20 pips above 'X' making for a healthy R:R

The positions shown have the SL just 10 pips over 'X', giving R:Rs of 8.36 and 13.62 for T1 and T2 respectively though if the set up completes I may be more forgiving with my SL, placing it 20 pips above 'X'.

With the 127.2% extension of the A-B leg coming so close to the origin of the first impulse leg you can set up a very tight stop loss for the order 10-20 pips above 'X' making for a healthy R:R

The positions shown have the SL just 10 pips over 'X', giving R:Rs of 8.36 and 13.62 for T1 and T2 respectively though if the set up completes I may be more forgiving with my SL, placing it 20 pips above 'X'.

Trade active

Opened but with a slightly more conservative SL than the position shown on this chart to give the trade some breathing room.Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.