🔍 ICT (Inner Circle Trader) is a trading methodology developed by Michael J. Huddleston. It focuses on market structure, smart money concepts (SMC), and how institutions manipulate liquidity to trap retail traders.

📚 It's not about indicators or over-complication — it's about reading the price action like a pro, understanding where liquidity is, and trading with the banks, not against them.

📐 1. Market Structure

Understand Highs & Lows: Identify break of structure (BOS) and change of character (CHOCH)

Follow the macro to micro flow: D1 > H4 > M15 for precision entries

🧱 2. Order Blocks (OBs)

An order block is the last bullish or bearish candle before a major price move.

Banks and institutions place large orders here.

Smart traders look for price to return to these areas (mitigation), then enter with tight stop losses.

👉 Think of OBs as institutional footprints on the chart.

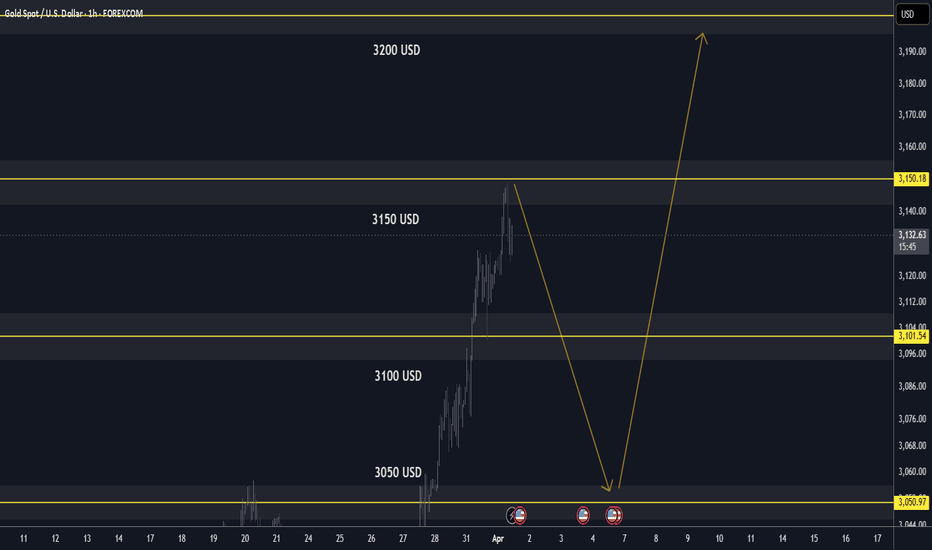

💧 3. Liquidity Zones

Equal highs/lows, trendline touches, support/resistance — these are liquidity traps.

ICT teaches that price often hunts liquidity before reversing. That’s why many retail traders get stopped out.

Learn to trade into liquidity, not off it.

🔄 4. Fair Value Gaps (FVGs)

Also called imbalances — when price moves too fast and leaves gaps.

Price often retraces to "fill the gap" — a key entry point for ICT traders.

🥇 ICT for Gold & Forex in 2025

💰 Why It Works for XAUUSD & Majors:

Gold is a highly manipulated asset, perfect for ICT-style trading.

It responds beautifully to liquidity grabs, order blocks, and Asian–London–New York session transitions.

Forex majors (EUR/USD, GBP/USD, etc.) are also ideal since they’re heavily influenced by institutional flow and news-driven liquidity hunts.

🕐 Timing Is Everything

Trade Killzones:

📍 London Killzone: 2AM–5AM EST

📍 New York Killzone: 7AM–10AM EST

These are high-volume sessions where institutions make their moves.

📈 Typical ICT Setup

▪️Spot liquidity zone above or below recent price

▪️Wait for liquidity sweep (stop hunt)

▪️Identify nearby order block or FVG

▪️Enter on a pullback into OB/FVG

▪️Set tight SL just past the recent swing

Target internal range, opposing OB, or next liquidity level

👨💻 Why FX/GOLD Traders Love ICT

✅ It’s clean, no indicators, and highly logical

✅ Great for part-time trading — 1 or 2 trades a day

✅ Feels like "leveling up" your understanding of the market

✅ Perfect for backtesting and journaling on platforms like TradingView or SmartCharts

✅ Easy to integrate into algo-based systems or EAs for semi-automation

If you’re tired of indicators and guessing, and want to trade like the institutions, ICT is a game changer. In 2025, more prop firms and traders are applying ICT concepts to dominate markets like gold, forex, and even crypto.

🧭 Master the method. Understand the logic. Ride with the smart money.

🔥 Welcome to the next level of trading.

📚 It's not about indicators or over-complication — it's about reading the price action like a pro, understanding where liquidity is, and trading with the banks, not against them.

📐 1. Market Structure

Understand Highs & Lows: Identify break of structure (BOS) and change of character (CHOCH)

Follow the macro to micro flow: D1 > H4 > M15 for precision entries

🧱 2. Order Blocks (OBs)

An order block is the last bullish or bearish candle before a major price move.

Banks and institutions place large orders here.

Smart traders look for price to return to these areas (mitigation), then enter with tight stop losses.

👉 Think of OBs as institutional footprints on the chart.

💧 3. Liquidity Zones

Equal highs/lows, trendline touches, support/resistance — these are liquidity traps.

ICT teaches that price often hunts liquidity before reversing. That’s why many retail traders get stopped out.

Learn to trade into liquidity, not off it.

🔄 4. Fair Value Gaps (FVGs)

Also called imbalances — when price moves too fast and leaves gaps.

Price often retraces to "fill the gap" — a key entry point for ICT traders.

🥇 ICT for Gold & Forex in 2025

💰 Why It Works for XAUUSD & Majors:

Gold is a highly manipulated asset, perfect for ICT-style trading.

It responds beautifully to liquidity grabs, order blocks, and Asian–London–New York session transitions.

Forex majors (EUR/USD, GBP/USD, etc.) are also ideal since they’re heavily influenced by institutional flow and news-driven liquidity hunts.

🕐 Timing Is Everything

Trade Killzones:

📍 London Killzone: 2AM–5AM EST

📍 New York Killzone: 7AM–10AM EST

These are high-volume sessions where institutions make their moves.

📈 Typical ICT Setup

▪️Spot liquidity zone above or below recent price

▪️Wait for liquidity sweep (stop hunt)

▪️Identify nearby order block or FVG

▪️Enter on a pullback into OB/FVG

▪️Set tight SL just past the recent swing

Target internal range, opposing OB, or next liquidity level

👨💻 Why FX/GOLD Traders Love ICT

✅ It’s clean, no indicators, and highly logical

✅ Great for part-time trading — 1 or 2 trades a day

✅ Feels like "leveling up" your understanding of the market

✅ Perfect for backtesting and journaling on platforms like TradingView or SmartCharts

✅ Easy to integrate into algo-based systems or EAs for semi-automation

If you’re tired of indicators and guessing, and want to trade like the institutions, ICT is a game changer. In 2025, more prop firms and traders are applying ICT concepts to dominate markets like gold, forex, and even crypto.

🧭 Master the method. Understand the logic. Ride with the smart money.

🔥 Welcome to the next level of trading.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.