Our Past Euro Currency Index Analysis of March 2021:

Elementary Analysis:

The Euro Currency Index (EUR_I) represents the arithmetic ratio of four major currencies against the Euro: US Dollar, British Pound, Japanese Yen and Swiss Franc. All ratios are expressed in units of currency per Euro. The index was launched in 2004 by the exchange portal Stooq.com. Underlying are 100 points on 4 January 1971.[clarification needed] Before the introduction of the European single currency on 1 January 1999 an exchange rate of 1 Euro = 1.95583 Deutsche mark was calculated.

Based on the progression, Euro Currency Index can show the strength or weakness of the Euro. A rising index indicates an appreciation of the Euro against the currencies in the currency basket, a falling index in contrast, a devaluation. Relationships to commodity indices are recognizable. A rising Euro Currency Index means a tendency of falling commodity prices. This is especially true for agricultural commodities and the price of oil. Even the prices of precious metals (gold and silver) are correlated with the index.

Arithmetically weighted Euro Currency Index is comparable to the trade-weighted Euro Effective exchange rate index of the European Central Bank (ECB). The index of ECB measures much more accurately the value of the Euro, compared to the Euro Currency Index, since the competitiveness of European goods in comparison to other countries and trading partners is included in it.

The Euro Currency Index started on 4 January 1971 with 100 points. Before the introduction of the European single currency on 1 January 1999, an exchange rate of 1 Euro = 1.95583 Deutsche Mark was calculated.

Fundamental Analysis:

On April 19, 1971, the Euro Currency Index gained 99.67 points calculated with an all-time low. Until 3 December 1979, the index rose by 68.0 percent to 167.43 points. With the depreciation of the Deutsche Mark against the major currencies, the index fell to mid-1980s. On 3 May 1985, the Euro Currency Index was at level 122.26 points, up by 27.0 percent. The strength of the Deutsche Mark against almost all global currencies set the index in the following years to rise again. On 5 October 1992, a value of 195.98 points was determined. The increase in 1985 was 60.3 percent. On 25 October 2000, the index closed at 130.83 points, up by 33.2 percent.

In 2000 began a multi-year upward movement of the Euro. On 29 December 2008, the index marked 209.65 points, an all-time high. The profit since year 2000 is 60.2 percent. In the course of the international financial crisis, from which the U.S. real estate crisis originated in the summer of 2007, the index began to decline. On 6 February 2009 a value of 187.84 points was determined. In the following eight months, the European single currency rebounded from the lows. On 13 October 2009, the index rose by 208.45 points, near its historical high point.

A financial crisis in several member states of the Euro zone in 2010 led to the outbreak of the Euro crisis. Particularly affected is Greece (see Greek government-debt crisis from 2010), but also other countries such as Ireland, Spain, Italy and Portugal. The weakness of the Euro against almost all global currencies caused the index to fall from 29 June 2010 to 175.31 points. In the following months, the European Stability Mechanism was developed, which provides for mutual assistance in case of emergency to avoid the bankruptcy of the Member States. By May 4, 2011, the index rose to a level of 200.20 points. With the intensification of the sovereign debt crisis in the Euro zone, the Euro Currency Index fell 24 July 2012 with 168.38 points, its lowest level since March 29, 2006. Compared to the all-time high of 29 December 2008, this represents a decrease of 19.7 percent .

as we have analyzed this Index last year on March 2021, we had Speculated that, the Euro zone will Depreciate and weaken Financially and Economically due to some known (So Called Pandemic) and unknown (censored) reasons such as Brexit etc. however we can see the market has showing some Bearish trend and started its Rally again and it shows the Index has reaccumulated and Corrected itself on a good note.

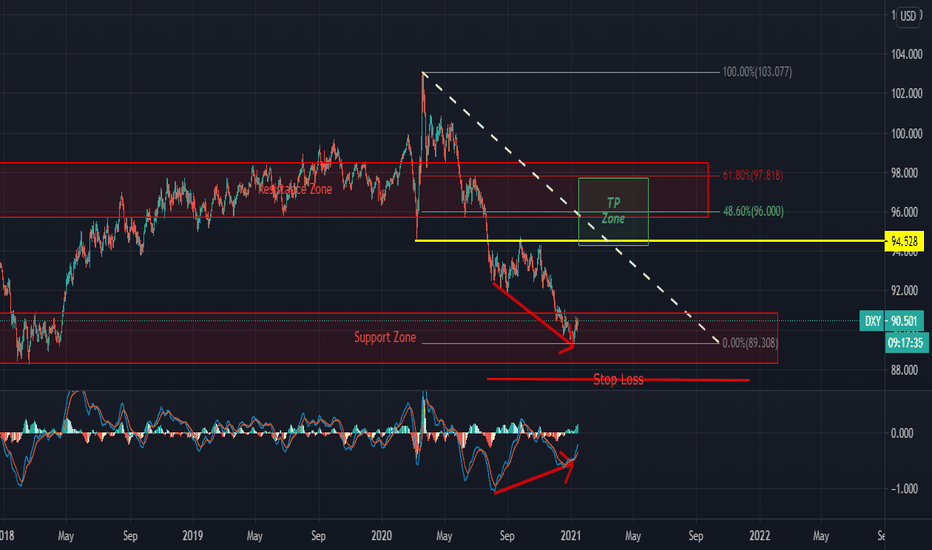

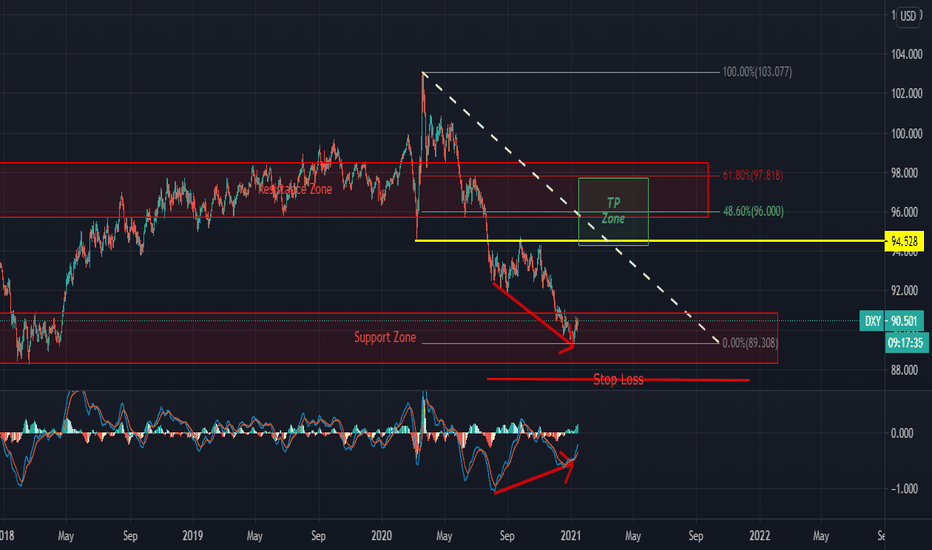

there are some confluences such as the negative correlation of the Euro Index (EXY) with US Dollar Index (DXY) which shows that the DXY was Rising when the EXY was falling in our Past Analysis which are as follow:

DXY:

EXY:

Looking at the Top Charts, we can clearly see that the Charts and their Price Action is negative correlation coefficient with each other, that means while the US Doller was getting Strong the Euro was weakening hence if we look at the current situations in US politics and Markets, which we have analyzed earlier this week along with the DXY. we can see that there are heavy Falls and calamities to come on the US economy which ultimately will result the rise of the counterparty currencies' such as Euro and GBP.

For better understanding of the situation it is good to look at the DXY and its Current situation and our analysis on that:

from March 2018 to March 2020 the entire Euro Zone countries where struggling and Correcting their economies as the Brexit and Its effects on the rest of the European businesses and Markets were ambiguous, we can call this fact as Market Distribution and Values correction. then we can see the Corona Pandemic which was an other nail in the Europe economic coffin and Brought the entire economic to its low point which had triggered the Risk Management Departments of the governments to Practice their Policies and release the Stimulants Packages in order to Prevent their Economies from more Drastically Falls and crisis. which worked as an excellent Market Fuel and uplift the Strength of their economies temporally but soon they realized the upcoming inflation and they stopped their Stimulant's Plans so does the market and Prices came to their inheritance intrinsic values and once again we could see the Prices has fallen back to their normal Level so does the EXY level.

at present we can see the EXY is at its lows but is very ready to Reaccumulating and reneging for the next Bullish cycle.

hence we can drive our conclusion that the Euro shall appreciate against the Doller and even some other low weight Index Makers.

looking at the current inflation rate in US and China, Iran... we can see that soon these countries and their respected Markets shall come to an Hoult which will help out the EXY to Appreciate ultimately.

we do not know exactly how much time will it take for it, but to us it is very clear that, it is the upcoming scenario for the Globalist and their respective European Parties...

Technical Analysis:

Tt is very well Observable that there exists a Bullish Divergence of Price and MACD from March 2015 to January 2017 which is the most significant sign of the Past Bearish Trend reversal and Start of the new Bullish Trend Post Feb 2017 to March 2018.

looking at the chart from March 2020 to January 2022 we can see the price has made a Double Top followed by the Retracement to the 61.8% of Fibonacci Levels of its Bullish wave from 2020 to 2022.

There exist a Hidden Bullish divergence of Price and MACD from March 2020 to January 2022, which is a very significant sign of Bullish trend Continuation where the Price is reneging and reaccumulating for its upcoming bullish cycles.

There total of 3 Main Targets defined with Fibonacci trend Based Extension of the Last Bullish cycle and 2 Targets Defined with the Previous Bullish cycle.

all the defined Targets are having confluences with each other so we can be certain that the Price shall show some Reaction at these points.

there are 3 Support areas defined by Fibonacci retracement and Pivot areas of the past Bullish cycles where we can expect the Price to reverse its bearish trend incase of more Fall to the lower levels and creation of dipper Hidden bullish Divergence.

as you can see we have used 2 Fibonacci trend base extension tools and Specified their Confluences areas as the Possible Resistance Zones.

Remember the 4 TP and the Ultimate TP will gets confirmed as the price Triggers the 3 TP followed by some Market correction and Retracements.

Elementary Analysis:

The Euro Currency Index (EUR_I) represents the arithmetic ratio of four major currencies against the Euro: US Dollar, British Pound, Japanese Yen and Swiss Franc. All ratios are expressed in units of currency per Euro. The index was launched in 2004 by the exchange portal Stooq.com. Underlying are 100 points on 4 January 1971.[clarification needed] Before the introduction of the European single currency on 1 January 1999 an exchange rate of 1 Euro = 1.95583 Deutsche mark was calculated.

Based on the progression, Euro Currency Index can show the strength or weakness of the Euro. A rising index indicates an appreciation of the Euro against the currencies in the currency basket, a falling index in contrast, a devaluation. Relationships to commodity indices are recognizable. A rising Euro Currency Index means a tendency of falling commodity prices. This is especially true for agricultural commodities and the price of oil. Even the prices of precious metals (gold and silver) are correlated with the index.

Arithmetically weighted Euro Currency Index is comparable to the trade-weighted Euro Effective exchange rate index of the European Central Bank (ECB). The index of ECB measures much more accurately the value of the Euro, compared to the Euro Currency Index, since the competitiveness of European goods in comparison to other countries and trading partners is included in it.

The Euro Currency Index started on 4 January 1971 with 100 points. Before the introduction of the European single currency on 1 January 1999, an exchange rate of 1 Euro = 1.95583 Deutsche Mark was calculated.

Fundamental Analysis:

On April 19, 1971, the Euro Currency Index gained 99.67 points calculated with an all-time low. Until 3 December 1979, the index rose by 68.0 percent to 167.43 points. With the depreciation of the Deutsche Mark against the major currencies, the index fell to mid-1980s. On 3 May 1985, the Euro Currency Index was at level 122.26 points, up by 27.0 percent. The strength of the Deutsche Mark against almost all global currencies set the index in the following years to rise again. On 5 October 1992, a value of 195.98 points was determined. The increase in 1985 was 60.3 percent. On 25 October 2000, the index closed at 130.83 points, up by 33.2 percent.

In 2000 began a multi-year upward movement of the Euro. On 29 December 2008, the index marked 209.65 points, an all-time high. The profit since year 2000 is 60.2 percent. In the course of the international financial crisis, from which the U.S. real estate crisis originated in the summer of 2007, the index began to decline. On 6 February 2009 a value of 187.84 points was determined. In the following eight months, the European single currency rebounded from the lows. On 13 October 2009, the index rose by 208.45 points, near its historical high point.

A financial crisis in several member states of the Euro zone in 2010 led to the outbreak of the Euro crisis. Particularly affected is Greece (see Greek government-debt crisis from 2010), but also other countries such as Ireland, Spain, Italy and Portugal. The weakness of the Euro against almost all global currencies caused the index to fall from 29 June 2010 to 175.31 points. In the following months, the European Stability Mechanism was developed, which provides for mutual assistance in case of emergency to avoid the bankruptcy of the Member States. By May 4, 2011, the index rose to a level of 200.20 points. With the intensification of the sovereign debt crisis in the Euro zone, the Euro Currency Index fell 24 July 2012 with 168.38 points, its lowest level since March 29, 2006. Compared to the all-time high of 29 December 2008, this represents a decrease of 19.7 percent .

as we have analyzed this Index last year on March 2021, we had Speculated that, the Euro zone will Depreciate and weaken Financially and Economically due to some known (So Called Pandemic) and unknown (censored) reasons such as Brexit etc. however we can see the market has showing some Bearish trend and started its Rally again and it shows the Index has reaccumulated and Corrected itself on a good note.

there are some confluences such as the negative correlation of the Euro Index (EXY) with US Dollar Index (DXY) which shows that the DXY was Rising when the EXY was falling in our Past Analysis which are as follow:

DXY:

EXY:

Looking at the Top Charts, we can clearly see that the Charts and their Price Action is negative correlation coefficient with each other, that means while the US Doller was getting Strong the Euro was weakening hence if we look at the current situations in US politics and Markets, which we have analyzed earlier this week along with the DXY. we can see that there are heavy Falls and calamities to come on the US economy which ultimately will result the rise of the counterparty currencies' such as Euro and GBP.

For better understanding of the situation it is good to look at the DXY and its Current situation and our analysis on that:

from March 2018 to March 2020 the entire Euro Zone countries where struggling and Correcting their economies as the Brexit and Its effects on the rest of the European businesses and Markets were ambiguous, we can call this fact as Market Distribution and Values correction. then we can see the Corona Pandemic which was an other nail in the Europe economic coffin and Brought the entire economic to its low point which had triggered the Risk Management Departments of the governments to Practice their Policies and release the Stimulants Packages in order to Prevent their Economies from more Drastically Falls and crisis. which worked as an excellent Market Fuel and uplift the Strength of their economies temporally but soon they realized the upcoming inflation and they stopped their Stimulant's Plans so does the market and Prices came to their inheritance intrinsic values and once again we could see the Prices has fallen back to their normal Level so does the EXY level.

at present we can see the EXY is at its lows but is very ready to Reaccumulating and reneging for the next Bullish cycle.

hence we can drive our conclusion that the Euro shall appreciate against the Doller and even some other low weight Index Makers.

looking at the current inflation rate in US and China, Iran... we can see that soon these countries and their respected Markets shall come to an Hoult which will help out the EXY to Appreciate ultimately.

we do not know exactly how much time will it take for it, but to us it is very clear that, it is the upcoming scenario for the Globalist and their respective European Parties...

Technical Analysis:

Tt is very well Observable that there exists a Bullish Divergence of Price and MACD from March 2015 to January 2017 which is the most significant sign of the Past Bearish Trend reversal and Start of the new Bullish Trend Post Feb 2017 to March 2018.

looking at the chart from March 2020 to January 2022 we can see the price has made a Double Top followed by the Retracement to the 61.8% of Fibonacci Levels of its Bullish wave from 2020 to 2022.

There exist a Hidden Bullish divergence of Price and MACD from March 2020 to January 2022, which is a very significant sign of Bullish trend Continuation where the Price is reneging and reaccumulating for its upcoming bullish cycles.

There total of 3 Main Targets defined with Fibonacci trend Based Extension of the Last Bullish cycle and 2 Targets Defined with the Previous Bullish cycle.

all the defined Targets are having confluences with each other so we can be certain that the Price shall show some Reaction at these points.

there are 3 Support areas defined by Fibonacci retracement and Pivot areas of the past Bullish cycles where we can expect the Price to reverse its bearish trend incase of more Fall to the lower levels and creation of dipper Hidden bullish Divergence.

as you can see we have used 2 Fibonacci trend base extension tools and Specified their Confluences areas as the Possible Resistance Zones.

Remember the 4 TP and the Ultimate TP will gets confirmed as the price Triggers the 3 TP followed by some Market correction and Retracements.

Trade active

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.