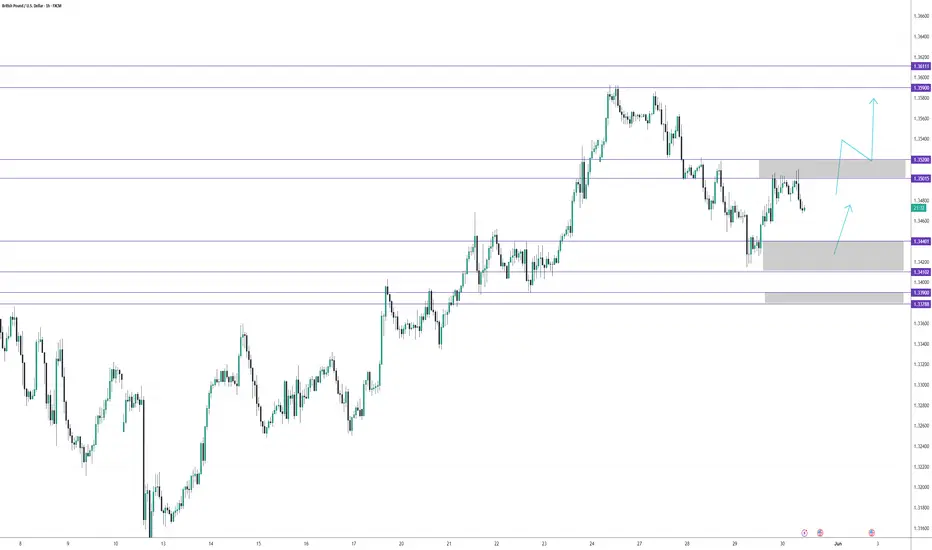

Scenario A: Bullish Pullback (Preferred)

Entry: Buy 1.341–1.344 on a clear bullish rejection candle

Stop-Loss: 1.338 (below the recent higher-low)

Take-Profit:

TP1: 1.352 (first resistance/lower-high)

TP2: 1.360 (recent swing-high)

Scenario B: Breakout Play

Trigger: H1 candle closes above 1.352

Entry: Long on a retest of 1.352 as new support

Stop-Loss: 1.350

Take-Profit: 1.361–1.365 (measured extension above the prior high)

Scenario C: Counter-Trend Short

Zone: 1.350–1.352 resistance area

Entry: Short on a bearish rejection candle up in that zone

Stop-Loss: 1.353

Take-Profit:

Target: 1.344 (minor support)

Extended: 1.341 (higher-low area)

Entry: Buy 1.341–1.344 on a clear bullish rejection candle

Stop-Loss: 1.338 (below the recent higher-low)

Take-Profit:

TP1: 1.352 (first resistance/lower-high)

TP2: 1.360 (recent swing-high)

Scenario B: Breakout Play

Trigger: H1 candle closes above 1.352

Entry: Long on a retest of 1.352 as new support

Stop-Loss: 1.350

Take-Profit: 1.361–1.365 (measured extension above the prior high)

Scenario C: Counter-Trend Short

Zone: 1.350–1.352 resistance area

Entry: Short on a bearish rejection candle up in that zone

Stop-Loss: 1.353

Take-Profit:

Target: 1.344 (minor support)

Extended: 1.341 (higher-low area)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.