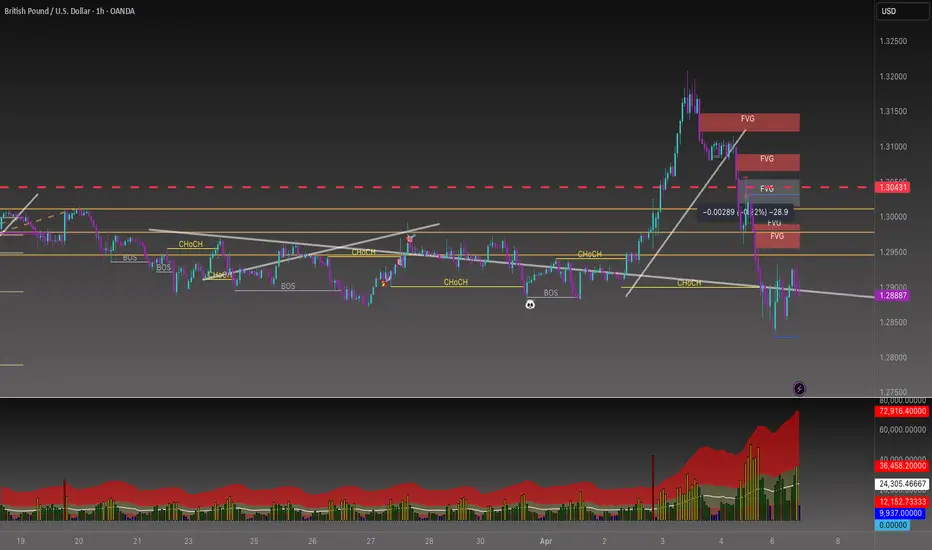

The market might have finished its liquidity grab below recent lows—the so-called “sweep” near 1.2900—and could be ready to bounce back if the broader timeframe stays bullish.

1. Entry Signal:

A clear 1-hour close above 1.2950–1.2960 (and perhaps a retest) would indicate that buyers are stepping back in.

2. Entry Idea:

Go long if the price breaks and holds above the short-term structure or if it retests an H1 FVG/demand zone around 1.2900–1.2920, forming bullish reversal candles.

3. Stop Loss:

Place your stop below the recent low or the FVG/demand zone (around 1.2880–1.2900). If the price continues dropping below this level, your bullish thesis is invalidated.

4. Take Profit Targets:

Aim for the upper FVG near 1.3000–1.3050, with partial profits taken at key psychological levels (like 1.3000) or previous swing highs.

5. Rationale:

If the higher timeframe trend remains bullish, the current dip might just be a “discount” opportunity for smart money to load up on longs. Reclaiming key structure levels on the H1 chart would confirm that bullish momentum is returning.

1. Entry Signal:

A clear 1-hour close above 1.2950–1.2960 (and perhaps a retest) would indicate that buyers are stepping back in.

2. Entry Idea:

Go long if the price breaks and holds above the short-term structure or if it retests an H1 FVG/demand zone around 1.2900–1.2920, forming bullish reversal candles.

3. Stop Loss:

Place your stop below the recent low or the FVG/demand zone (around 1.2880–1.2900). If the price continues dropping below this level, your bullish thesis is invalidated.

4. Take Profit Targets:

Aim for the upper FVG near 1.3000–1.3050, with partial profits taken at key psychological levels (like 1.3000) or previous swing highs.

5. Rationale:

If the higher timeframe trend remains bullish, the current dip might just be a “discount” opportunity for smart money to load up on longs. Reclaiming key structure levels on the H1 chart would confirm that bullish momentum is returning.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.