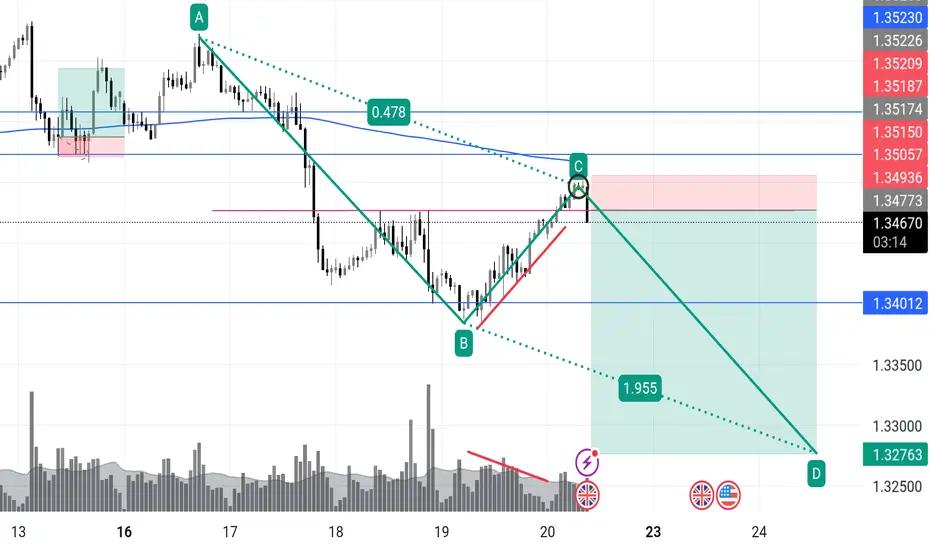

Classic Wyckoff upthrust, this is A+

We’ve got a clear AB=CD completion at C, tagging previous support-turned-resistance, while the volume on the climb is drying up (classic clue of passive buyers getting trapped). The channel top + Fibonacci confluence + previous swing zone adds weight.

🔻 Trade Idea:

Entry: 1.3477

Stop: 1.3521 (above wick highs and structure)

Target 1: 1.3401 (break structure)

Target 2: 1.3276 (full measured move / spring's origin)

Risk-Reward: ~3.5R

Volume divergence confirms exhaustion.

Ideal reaction would break through mid-line and sustain under 1.3401.

🔍 Watch For:

Bearish engulfing confirmation on 1h

Volume spike during breakdown = smart money selling

If price lingers above 1.3515, trap invalid

We’ve got a clear AB=CD completion at C, tagging previous support-turned-resistance, while the volume on the climb is drying up (classic clue of passive buyers getting trapped). The channel top + Fibonacci confluence + previous swing zone adds weight.

🔻 Trade Idea:

Entry: 1.3477

Stop: 1.3521 (above wick highs and structure)

Target 1: 1.3401 (break structure)

Target 2: 1.3276 (full measured move / spring's origin)

Risk-Reward: ~3.5R

Volume divergence confirms exhaustion.

Ideal reaction would break through mid-line and sustain under 1.3401.

🔍 Watch For:

Bearish engulfing confirmation on 1h

Volume spike during breakdown = smart money selling

If price lingers above 1.3515, trap invalid

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.