FUNDAMENTAL ANALYSIS

Attention Traders! The tides are turning in the gold market, and smart money is positioning for a decline. With the recent breakthrough EU-US tariff deal, global trade tensions are easing, systematically eroding gold's appeal as a safe-haven asset. This pivotal shift is creating a compelling selling opportunity.

Risk-On Sentiment: The 15% tariff framework, significantly lower than initial threats, has brought a wave of optimism to the markets. As confidence in global stability grows, investors are rotating out of safe havens like gold and into riskier, higher-yielding assets, putting downward pressure on gold prices.

Diminished Uncertainty: Gold thrives on uncertainty. The clarity provided by the tariff agreement removes a major geopolitical overhang, lessening the need for a hedge against economic instability.

Focus Shifts: With trade concerns subsiding, the market's attention is now firmly on central bank policy and economic data. While a weaker dollar might offer some limited support, the overarching narrative is one of reduced safe-haven demand.

Your Opportunity:

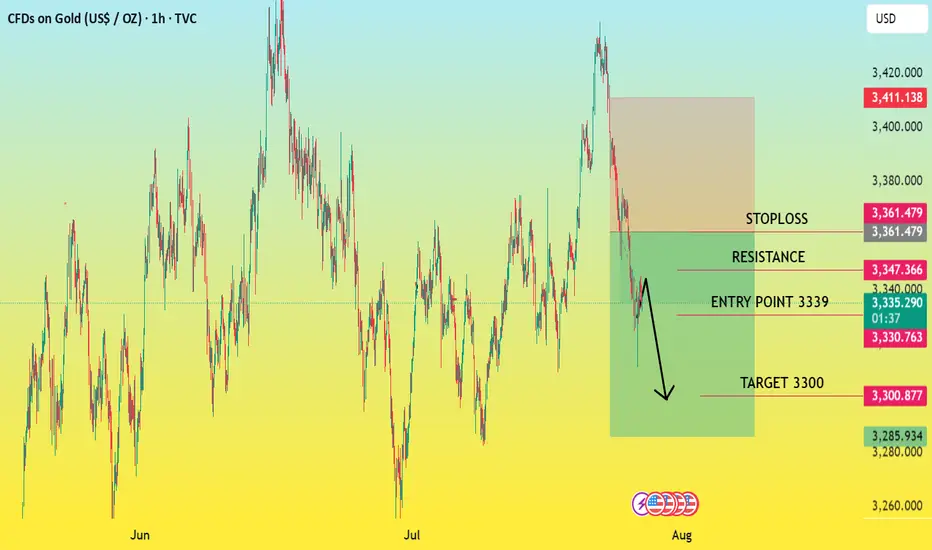

Our analysis suggests a clear downtrend. We are observing strong sell signals from $3339 down to $3300. This is your moment to ride the wave of shifting market dynamics.

Don't miss out on this strategic move. Position yourselves to profit as gold's safe-haven luster fades in the wake of renewed global trade optimism!

ENTRY POINT 3339

TARGET 3300

RESISTANCE 3352-48

STOPLOSS 3361

Attention Traders! The tides are turning in the gold market, and smart money is positioning for a decline. With the recent breakthrough EU-US tariff deal, global trade tensions are easing, systematically eroding gold's appeal as a safe-haven asset. This pivotal shift is creating a compelling selling opportunity.

Risk-On Sentiment: The 15% tariff framework, significantly lower than initial threats, has brought a wave of optimism to the markets. As confidence in global stability grows, investors are rotating out of safe havens like gold and into riskier, higher-yielding assets, putting downward pressure on gold prices.

Diminished Uncertainty: Gold thrives on uncertainty. The clarity provided by the tariff agreement removes a major geopolitical overhang, lessening the need for a hedge against economic instability.

Focus Shifts: With trade concerns subsiding, the market's attention is now firmly on central bank policy and economic data. While a weaker dollar might offer some limited support, the overarching narrative is one of reduced safe-haven demand.

Your Opportunity:

Our analysis suggests a clear downtrend. We are observing strong sell signals from $3339 down to $3300. This is your moment to ride the wave of shifting market dynamics.

Don't miss out on this strategic move. Position yourselves to profit as gold's safe-haven luster fades in the wake of renewed global trade optimism!

ENTRY POINT 3339

TARGET 3300

RESISTANCE 3352-48

STOPLOSS 3361

Trade active

target achieved on monday forex expert, with years of trading market experience. you can join my telegram channel for further assistance. t.me/xauusdgoldsignals56

you can also join xness via my link one.exnesstrack.org/a/lb8ut6oczq

you can also join xness via my link one.exnesstrack.org/a/lb8ut6oczq

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

forex expert, with years of trading market experience. you can join my telegram channel for further assistance. t.me/xauusdgoldsignals56

you can also join xness via my link one.exnesstrack.org/a/lb8ut6oczq

you can also join xness via my link one.exnesstrack.org/a/lb8ut6oczq

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.