📈 Recap & Context

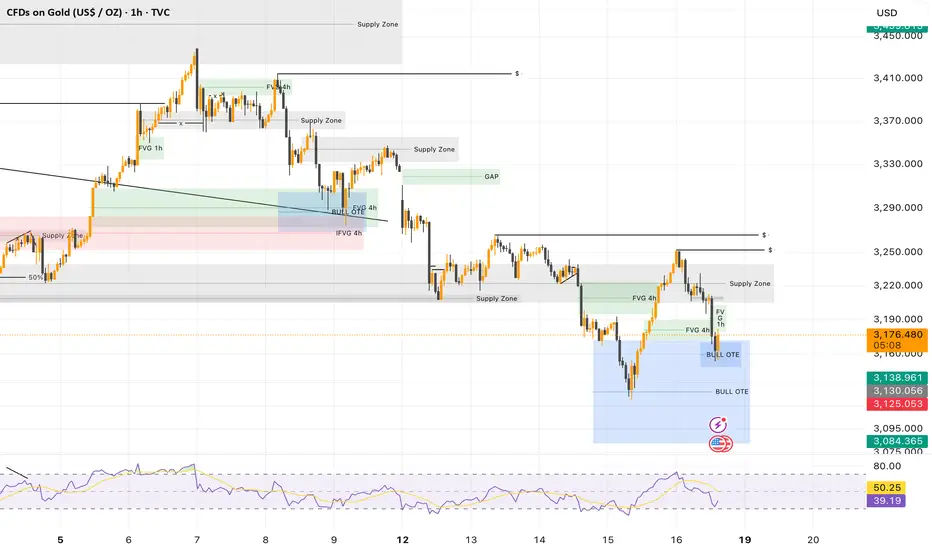

Yesterday, gold posted a strong bullish reaction from the Daily Bull OTE zone (~$3,080–$3,130), aligning with a long-term potential continuation setup.

However, in the early hours of today, we’ve seen a retracement right into the Bull OTE of yesterday’s impulsive move, giving us a potential higher low formation.

🔍 Current Key Zones

🟦 Bull OTE (1H) : Acted as support this morning after the rebound.

⬜️ Supply Zone @ $3,240–$3,260: Remains the main resistance area to break.

⬜️ FVG 4H + 1H: Acted as mid-retracement support and demand zone.

🧠 What to Monitor

✅ Bullish Scenario :

A clean re-entry above $3,225, ideally backed by volume, would strongly suggest the bullish continuation is in play, with targets back toward $3,300+.

⚠️ Bearish Scenario:

A strong rejection from the $3,225 supply could signal that yesterday’s bounce was just a reactionary move in a broader downtrend.

In that case, we might revisit deeper retracement zones from the yearly leg up — possibly around $3,080 or even $3,000–$2,960 again.

📌 Conclusion

Gold is at a mid-range inflection point.

Either it confirms strength by reclaiming the $3,240 zone with conviction,

or we risk seeing a deeper corrective wave before any trend resumption.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.