Markets are more predictable than we have been led to believe. Here we are going to examine the 9 year cycles found in the Nasdaq composite.

This is a follow-up idea from my previous idea which was Lesson one in Market Cycles in the DOW JONES INDUSTRIAL AVERAGE. Please follow that link for a more detailed explanation on this.

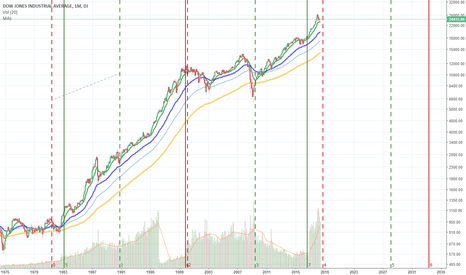

In the Nasdaq we can see an (approx) 9 year half cycle which is very consistent. It actually is closer to approx 9 year 3 months. But you should know that the time between each line is EXACTLY the same. In the method I use, I use the fib time zone tool to create lines which all have the EXACT amount of time between each line.

As I said in my previous idea, there are multiple cycles on different time frames and different frequencies all occurring simultaneously. If we only focus on one particular cycle, we will not have enough information to know how to trade. But when we calculate the net effect of several cycles, we will have a much better idea and information for FUTURE predictions. Please read my previous idea for more info on that.

In addition to the 17 year Secular bull and Secular bear markets, we can see this 9 year (approx) cycle which also is present in DJIA.

The green line represents the LOW Point or trough of the cycle and the RED line represents the PEAK of the cycle. The GREEN ZONE starts at the GREEN LINE and goes to the RED LINE. The RED ZONE starts and the RED LINE and goes to the GREEN LINE. Remember that a GREEN ZONE will have stronger GROWTH - GREEN = GROWTH and RED = REST. But the 9 year cycle and 17 cycles are not the only cycles occurring. There are others. So the individual cycle will not explain all of the movements int he chart.

Can you see how near the end of the GREEN ZONE (before the red line) the growth gets stronger? And near the end of the RED ZONE, it gets weaker. Imagine this a cycle of fluctuating energy -- the green is a positive energy and the red is a negative energy. The energy is highest as we reach the end of the GREEN ZONE, and energy is lowest when we reach the end of the RED ZONE.

We will also explore other cycles and other charts soon. I will soon make a chart where I will show both the 17 year cycle and 9 year cycle on the SAME CHART. There you will see how when both cycles are GREEN the growth gets much stronger. Please STAY TUNED for more IDEAS.

I also will be analyzing BITCOIN using the same method. You may save my profile so you can see more ideas as I post them.

Please feel free to give your comments and click like if you like the idea.

This is a follow-up idea from my previous idea which was Lesson one in Market Cycles in the DOW JONES INDUSTRIAL AVERAGE. Please follow that link for a more detailed explanation on this.

In the Nasdaq we can see an (approx) 9 year half cycle which is very consistent. It actually is closer to approx 9 year 3 months. But you should know that the time between each line is EXACTLY the same. In the method I use, I use the fib time zone tool to create lines which all have the EXACT amount of time between each line.

As I said in my previous idea, there are multiple cycles on different time frames and different frequencies all occurring simultaneously. If we only focus on one particular cycle, we will not have enough information to know how to trade. But when we calculate the net effect of several cycles, we will have a much better idea and information for FUTURE predictions. Please read my previous idea for more info on that.

In addition to the 17 year Secular bull and Secular bear markets, we can see this 9 year (approx) cycle which also is present in DJIA.

The green line represents the LOW Point or trough of the cycle and the RED line represents the PEAK of the cycle. The GREEN ZONE starts at the GREEN LINE and goes to the RED LINE. The RED ZONE starts and the RED LINE and goes to the GREEN LINE. Remember that a GREEN ZONE will have stronger GROWTH - GREEN = GROWTH and RED = REST. But the 9 year cycle and 17 cycles are not the only cycles occurring. There are others. So the individual cycle will not explain all of the movements int he chart.

Can you see how near the end of the GREEN ZONE (before the red line) the growth gets stronger? And near the end of the RED ZONE, it gets weaker. Imagine this a cycle of fluctuating energy -- the green is a positive energy and the red is a negative energy. The energy is highest as we reach the end of the GREEN ZONE, and energy is lowest when we reach the end of the RED ZONE.

We will also explore other cycles and other charts soon. I will soon make a chart where I will show both the 17 year cycle and 9 year cycle on the SAME CHART. There you will see how when both cycles are GREEN the growth gets much stronger. Please STAY TUNED for more IDEAS.

I also will be analyzing BITCOIN using the same method. You may save my profile so you can see more ideas as I post them.

Please feel free to give your comments and click like if you like the idea.

Note

Note that the next RED LINE UPCOMING lands around the beginning of November 2018. If the 9 year cycle was the ONLY cycle, this would mean that November 2018 would be the PEAK of the current cycle. But since there are other cycles occurring as well, the actual high point of the stock market may vary- usually within a couple of months. If you stay with my ideas, we can fine tine to a more precise time when we may see the stock market peak.Note

Link to lesson 2 - combining the 9 y cycle and 17 y cycleRelated publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.