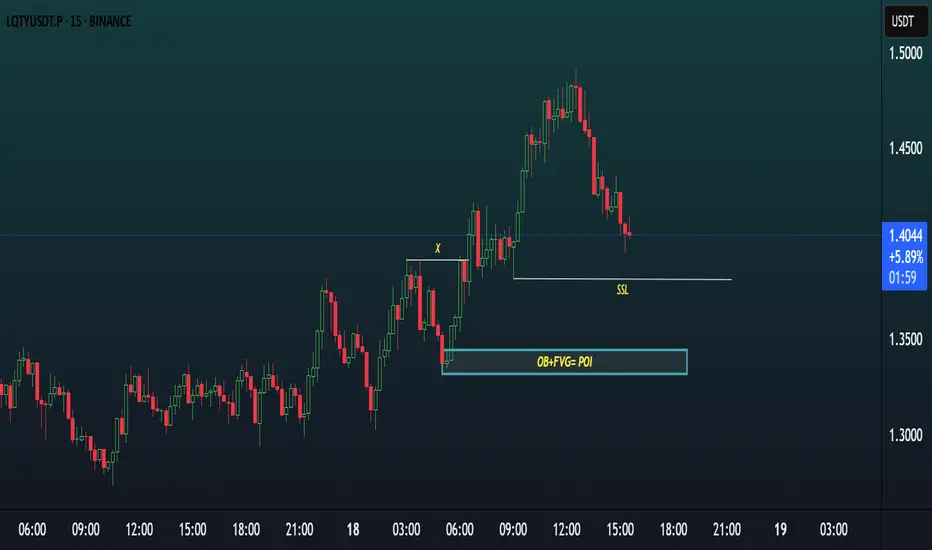

Chart Overview

Pair: LQTY/USDT Perpetual

Timeframe: 15 Minutes

Current Price: 1.4194

Market Direction: Bullish (retracement into demand expected)

📌

Setup Summary

Strategy: Smart Money Concept (SMC)

Key Elements:

Break of structure ✅

SSL (Sell-Side Liquidity) sweep ✅

OB + FVG confluence zone = POI ✅

🧠

Detailed Breakdown

1.

Break of Structure (BoS)

Price broke above the previous high marked by “X,” confirming a bullish shift in structure.

This suggests that buyers are currently in control of the market.

2.

SSL (Sell-Side Liquidity)

Liquidity resting below recent lows (marked as SSL) is a common target for smart money.

Expectation: Price will dip into this zone, sweeping liquidity before moving up.

3.

OB + FVG = POI

The POI (Point of Interest) box includes:

A Bullish Order Block (last down candle before the move up)

A Fair Value Gap (FVG) caused by imbalance in the impulsive move

This makes the zone between 1.300–1.360 a high-probability reversal area.

4.

Price Action

The chart shows price is currently in a retracement phase with red candles.

If price dips into the POI zone and reacts, a bullish bounce toward 1.50–1.58 is expected.

✅

Confirmation Tips

Wait for bullish confirmation on 1m or 5m timeframe inside POI zone:

Bullish engulfing

Break of minor structure

Volume spike or RSI divergence

🧩

Conclusion

This is a textbook SMC setup with:

Market structure break

Liquidity sweep

Confluence of OB + FVG

Clean demand zone entry point

High probability of bullish reversal if price reacts well to POI.

Pair: LQTY/USDT Perpetual

Timeframe: 15 Minutes

Current Price: 1.4194

Market Direction: Bullish (retracement into demand expected)

📌

Setup Summary

Strategy: Smart Money Concept (SMC)

Key Elements:

Break of structure ✅

SSL (Sell-Side Liquidity) sweep ✅

OB + FVG confluence zone = POI ✅

🧠

Detailed Breakdown

1.

Break of Structure (BoS)

Price broke above the previous high marked by “X,” confirming a bullish shift in structure.

This suggests that buyers are currently in control of the market.

2.

SSL (Sell-Side Liquidity)

Liquidity resting below recent lows (marked as SSL) is a common target for smart money.

Expectation: Price will dip into this zone, sweeping liquidity before moving up.

3.

OB + FVG = POI

The POI (Point of Interest) box includes:

A Bullish Order Block (last down candle before the move up)

A Fair Value Gap (FVG) caused by imbalance in the impulsive move

This makes the zone between 1.300–1.360 a high-probability reversal area.

4.

Price Action

The chart shows price is currently in a retracement phase with red candles.

If price dips into the POI zone and reacts, a bullish bounce toward 1.50–1.58 is expected.

✅

Confirmation Tips

Wait for bullish confirmation on 1m or 5m timeframe inside POI zone:

Bullish engulfing

Break of minor structure

Volume spike or RSI divergence

🧩

Conclusion

This is a textbook SMC setup with:

Market structure break

Liquidity sweep

Confluence of OB + FVG

Clean demand zone entry point

High probability of bullish reversal if price reacts well to POI.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.