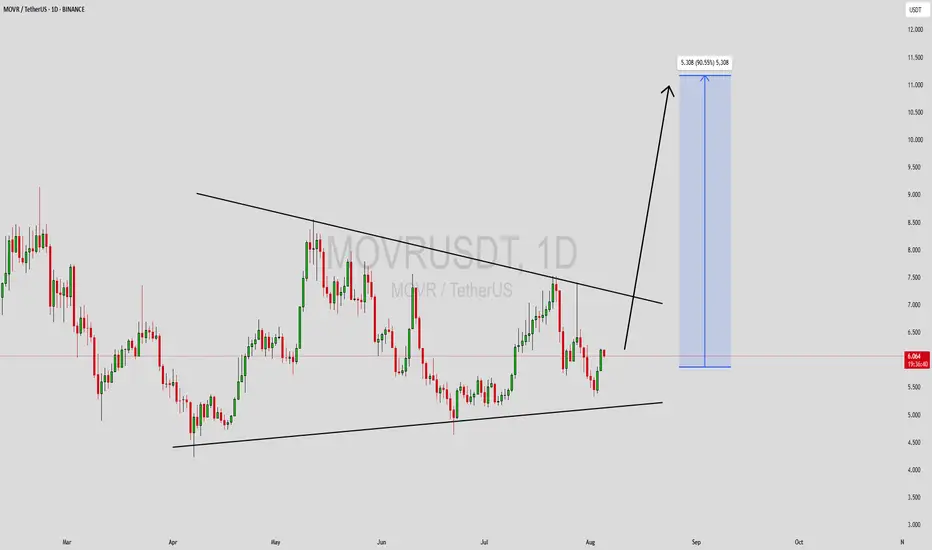

MOVRUSDT is currently trading within a Descending Channel Pattern, a formation that typically precedes a strong breakout to the upside once the downward pressure begins to fade. This pattern indicates a period of consolidation where lower highs and lower lows are formed in a controlled channel, often signaling that selling momentum is weakening. As price approaches the lower bound and shows signs of strength, traders often anticipate a bullish breakout. With MOVR showing strong support at current levels, this could be the early signs of a reversal.

The volume backing this structure is encouraging, reflecting accumulation behavior—where informed investors begin positioning ahead of a potential trend change. When descending channel breakouts occur with solid volume confirmation, they tend to result in rapid and extended moves. Based on the current chart structure, the expected upside potential is in the range of 80% to 90%, offering a compelling risk-to-reward setup for both swing and medium-term traders.

Investor interest around MOVRUSDT has been gradually increasing, driven by renewed attention to its underlying ecosystem and growing traction among crypto communities. The project’s fundamentals and continued development have kept it on the radar of market watchers. In a bullish market environment, assets like MOVR—trading near structural support and within a clear reversal pattern—often attract sharp inflows, accelerating their breakout trajectory.

This is a prime opportunity for those seeking breakout setups. MOVRUSDT combines a favorable technical pattern with strong volume and growing investor sentiment, making it a high-potential candidate for the next leg up. Monitor closely for breakout confirmation to capitalize on the projected upside move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

The volume backing this structure is encouraging, reflecting accumulation behavior—where informed investors begin positioning ahead of a potential trend change. When descending channel breakouts occur with solid volume confirmation, they tend to result in rapid and extended moves. Based on the current chart structure, the expected upside potential is in the range of 80% to 90%, offering a compelling risk-to-reward setup for both swing and medium-term traders.

Investor interest around MOVRUSDT has been gradually increasing, driven by renewed attention to its underlying ecosystem and growing traction among crypto communities. The project’s fundamentals and continued development have kept it on the radar of market watchers. In a bullish market environment, assets like MOVR—trading near structural support and within a clear reversal pattern—often attract sharp inflows, accelerating their breakout trajectory.

This is a prime opportunity for those seeking breakout setups. MOVRUSDT combines a favorable technical pattern with strong volume and growing investor sentiment, making it a high-potential candidate for the next leg up. Monitor closely for breakout confirmation to capitalize on the projected upside move.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

🟢🟢🟢Join Our Telegram Here to Get Trades With Entry And Exit 🟢🟢🟢

cryptotelegram.bio.link/

🟢🟢🟢

cryptotelegram.bio.link/

🟢🟢🟢

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

🟢🟢🟢Join Our Telegram Here to Get Trades With Entry And Exit 🟢🟢🟢

cryptotelegram.bio.link/

🟢🟢🟢

cryptotelegram.bio.link/

🟢🟢🟢

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.