🟢 Nifty Analysis EOD – June 3, 2025 – Tuesday 🔴

Opening Sentiment vs. Reality: A Day of Dual Personality

Nifty opened with a 70-point gap-up above the previous day’s high, carrying a positive vibe. In just one minute, it surged another 57 points, marking the day’s high at 24,845. However, that bullish momentum didn’t last. The index faced strong resistance, leading to a sharp 243-point drop within 15 minutes, breaching CPR and the previous swing low to hit the first Current Day Low (CDL) at 24,601.30.

Despite the jolt, Nifty showed resilience—bounced back from the 24,625–24,640 zone, recovered to VWAP, and even retested the PDH. Yet again, it failed to hold above 24,700, echoing the morning's rejection. A second wave of selling took Nifty to a fresh low of 24,502.15 mid-session.

The closing wasn’t any better. Nifty quietly slid again, retested the breakout zone, and closed at 24,542.50, nearly at the intraday low—a day that started with hope ended on a pessimistic note.

Interestingly, India VIX also dropped, despite the downward market move—signalling premium crush and a double whammy for option buyers who got the direction right but profits wrong.

🛡 5 Min Chart with Levels

📊 Daily Summary Highlights

✅ Gap-up Start but sharp reversal

📉 Both PDH and PDL tested intraday

📉 Marubozu Engulfing Candle

⚠️ Closed below Higher Swing Low – a potential trend-shift signal

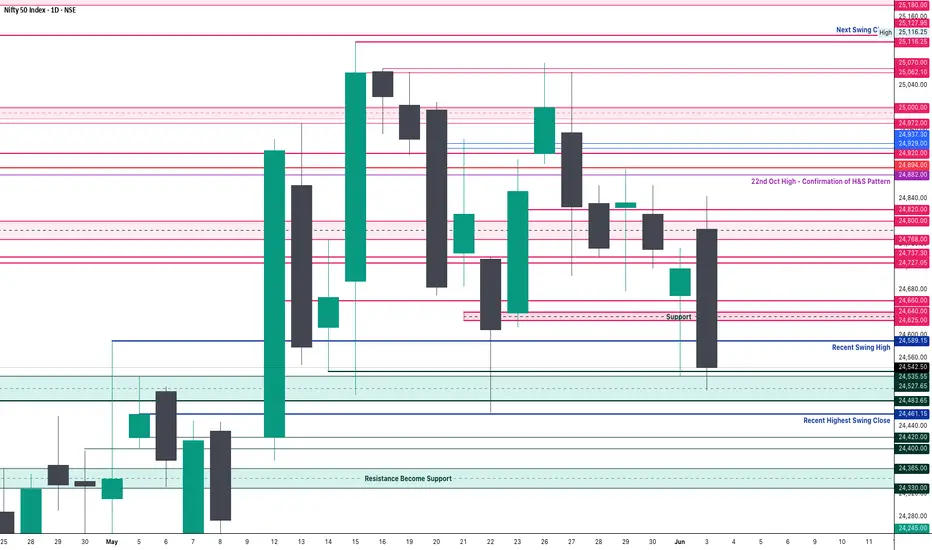

🕯 Daily Time Frame Chart

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,786.30

High: 24,845.10

Low: 24,502.15

Close: 24,542.50

Net Change: −174.10 (−0.70%)

🕯 Candle Structure

Real Body: 243.80 pts (Big red candle)

Upper Wick: 58.80 pts

Lower Wick: 40.35 pts

Interpretation

A classic bearish reversal day. Price opened higher, reached a new high, but was aggressively sold off, closing near the day’s low. This large-bodied red candle with small wicks shows clear control by the bears.

Candle Type

🟥 Bearish Marubozu-like Candle

Strong rejection at highs

Bearish dominance confirmed

Lower close signals momentum continuation to the downside

Key Insight

24,845 now acts as a firm resistance.

Break below 24,500 could accelerate correction.

Bulls need to defend 24,500–24,520 zone decisively to avoid further weakness.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 279.13

IB Range: 243.80 → Medium IB

Market Structure: Balanced

Trades:

🔻 12:50 PM – Short Triggered → 📍 1:1 Target Achieved, but timeout

📌 Support & Resistance Zones

Resistance Levels

24,600

24,625 ~ 24,640

24,660

24,727 ~ 24,737

24,768 ~ 24,800

24,820

24,882

24,894 (Strong Resistance)

Support Levels

24,530 ~ 24,480

24,460

24,420 ~ 24,400

24,365 ~ 24,330

24,245 ~ 24,240

💭 Final Thoughts

The market showcased a classic reversal and punished emotional entries. Despite the gap-up euphoria, technical levels reigned supreme. The break below swing low could signal caution for bulls in the coming sessions.

📌 "Respect the levels, not the emotions. Every bounce is not a bottom; every fall isn’t a crash."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Opening Sentiment vs. Reality: A Day of Dual Personality

Nifty opened with a 70-point gap-up above the previous day’s high, carrying a positive vibe. In just one minute, it surged another 57 points, marking the day’s high at 24,845. However, that bullish momentum didn’t last. The index faced strong resistance, leading to a sharp 243-point drop within 15 minutes, breaching CPR and the previous swing low to hit the first Current Day Low (CDL) at 24,601.30.

Despite the jolt, Nifty showed resilience—bounced back from the 24,625–24,640 zone, recovered to VWAP, and even retested the PDH. Yet again, it failed to hold above 24,700, echoing the morning's rejection. A second wave of selling took Nifty to a fresh low of 24,502.15 mid-session.

The closing wasn’t any better. Nifty quietly slid again, retested the breakout zone, and closed at 24,542.50, nearly at the intraday low—a day that started with hope ended on a pessimistic note.

Interestingly, India VIX also dropped, despite the downward market move—signalling premium crush and a double whammy for option buyers who got the direction right but profits wrong.

🛡 5 Min Chart with Levels

📊 Daily Summary Highlights

✅ Gap-up Start but sharp reversal

📉 Both PDH and PDL tested intraday

📉 Marubozu Engulfing Candle

⚠️ Closed below Higher Swing Low – a potential trend-shift signal

🕯 Daily Time Frame Chart

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,786.30

High: 24,845.10

Low: 24,502.15

Close: 24,542.50

Net Change: −174.10 (−0.70%)

🕯 Candle Structure

Real Body: 243.80 pts (Big red candle)

Upper Wick: 58.80 pts

Lower Wick: 40.35 pts

Interpretation

A classic bearish reversal day. Price opened higher, reached a new high, but was aggressively sold off, closing near the day’s low. This large-bodied red candle with small wicks shows clear control by the bears.

Candle Type

🟥 Bearish Marubozu-like Candle

Strong rejection at highs

Bearish dominance confirmed

Lower close signals momentum continuation to the downside

Key Insight

24,845 now acts as a firm resistance.

Break below 24,500 could accelerate correction.

Bulls need to defend 24,500–24,520 zone decisively to avoid further weakness.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 279.13

IB Range: 243.80 → Medium IB

Market Structure: Balanced

Trades:

🔻 12:50 PM – Short Triggered → 📍 1:1 Target Achieved, but timeout

📌 Support & Resistance Zones

Resistance Levels

24,600

24,625 ~ 24,640

24,660

24,727 ~ 24,737

24,768 ~ 24,800

24,820

24,882

24,894 (Strong Resistance)

Support Levels

24,530 ~ 24,480

24,460

24,420 ~ 24,400

24,365 ~ 24,330

24,245 ~ 24,240

💭 Final Thoughts

The market showcased a classic reversal and punished emotional entries. Despite the gap-up euphoria, technical levels reigned supreme. The break below swing low could signal caution for bulls in the coming sessions.

📌 "Respect the levels, not the emotions. Every bounce is not a bottom; every fall isn’t a crash."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Read my blogs here:

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

substack.com/@kzatakia

Follow me on Telegram:

t.me/swingtraderhub

Follow me on X:

x.com/kzatakia

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.