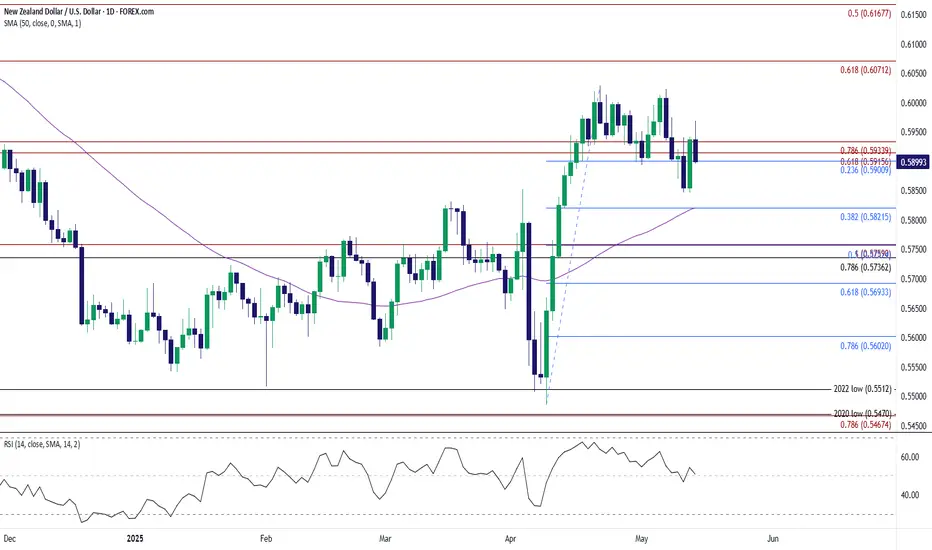

NZD/USD gives back the rebound from earlier this week to hold below the monthly high (0.6023), and lack of momentum to hold above the 0.5900 (23.6% Fibonacci retracement) to 0.5930 (78.6% Fibonacci extension) region may push the exchange rate towards 0.5820 (38.2% Fibonacci retracement).

Next area of interest comes in around 0.5740 (78.6% Fibonacci retracement) to 0.5760 (100% Fibonacci extension), but the recent weakness in NZD/USD may turn out to be temporary should it defend the advance from the weekly low (0.5847).

A move above the monthly high (0.6023) may lead to a test of the April high (0.6029), with a breach above the November high (0.6038) opening up 0.6070 (61.8% Fibonacci extension).

--- Written by David Song, Senior Strategist at FOREX.com

Next area of interest comes in around 0.5740 (78.6% Fibonacci retracement) to 0.5760 (100% Fibonacci extension), but the recent weakness in NZD/USD may turn out to be temporary should it defend the advance from the weekly low (0.5847).

A move above the monthly high (0.6023) may lead to a test of the April high (0.6029), with a breach above the November high (0.6038) opening up 0.6070 (61.8% Fibonacci extension).

--- Written by David Song, Senior Strategist at FOREX.com

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.