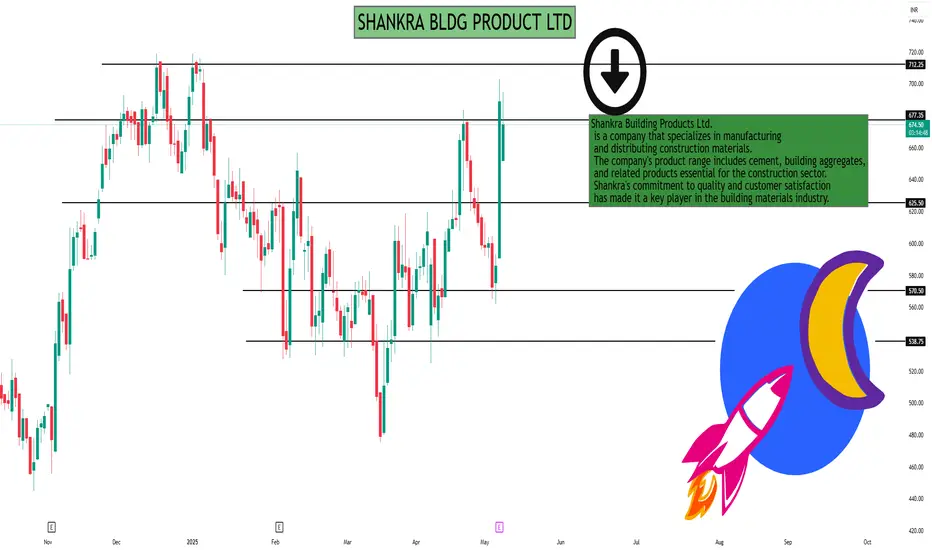

As of May 9, 2025, Shankara Building Products Ltd. (NSE: SHANKARA) is trading at ₹689.05, reflecting a 17.62% increase over the past 24 hours .

📊 Intraday Support & Resistance Levels

Based on technical analyses, the following are the key intraday support and resistance levels for SHANKARA:

Standard Pivot Points:

Support Levels:

S1: ₹647.02

S2: ₹625.53

S3: ₹586.52

Resistance Levels:

R1: ₹707.52

R2: ₹746.53

R3: ₹768.02

Pivot Point: ₹686.03

Camarilla Pivot Points:

Support Levels:

S1: ₹659.00

S2: ₹653.46

S3: ₹647.91

Resistance Levels:

R1: ₹670.10

R2: ₹675.64

R3: ₹681.19

Pivot Point: ₹647.02

+2

Fibonacci Pivot Points:

Support Levels:

S1: ₹647.02

S2: ₹623.91

S3: ₹609.63

Resistance Levels:

R1: ₹670.13

R2: ₹684.41

R3: ₹707.52

Pivot Point: ₹647.02

🔍 Technical Indicators

Moving Averages (MA): The stock is currently trading above its short-term moving averages, indicating a bullish trend.

Relative Strength Index (RSI): The RSI is in the overbought zone, suggesting that the stock may be overvalued in the short term.

MACD: The MACD line is above the signal line, reinforcing the bullish momentum.

📈 Trading Insights

Given the current price of ₹689.05, the stock is trading near its R1 resistance level of ₹707.52. Traders should monitor for a breakout above this level for potential upward movement. Conversely, if the stock retraces, the S1 support level at ₹647.02 may provide a buying opportunity.

📊 Intraday Support & Resistance Levels

Based on technical analyses, the following are the key intraday support and resistance levels for SHANKARA:

Standard Pivot Points:

Support Levels:

S1: ₹647.02

S2: ₹625.53

S3: ₹586.52

Resistance Levels:

R1: ₹707.52

R2: ₹746.53

R3: ₹768.02

Pivot Point: ₹686.03

Camarilla Pivot Points:

Support Levels:

S1: ₹659.00

S2: ₹653.46

S3: ₹647.91

Resistance Levels:

R1: ₹670.10

R2: ₹675.64

R3: ₹681.19

Pivot Point: ₹647.02

+2

Fibonacci Pivot Points:

Support Levels:

S1: ₹647.02

S2: ₹623.91

S3: ₹609.63

Resistance Levels:

R1: ₹670.13

R2: ₹684.41

R3: ₹707.52

Pivot Point: ₹647.02

🔍 Technical Indicators

Moving Averages (MA): The stock is currently trading above its short-term moving averages, indicating a bullish trend.

Relative Strength Index (RSI): The RSI is in the overbought zone, suggesting that the stock may be overvalued in the short term.

MACD: The MACD line is above the signal line, reinforcing the bullish momentum.

📈 Trading Insights

Given the current price of ₹689.05, the stock is trading near its R1 resistance level of ₹707.52. Traders should monitor for a breakout above this level for potential upward movement. Conversely, if the stock retraces, the S1 support level at ₹647.02 may provide a buying opportunity.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Hello Guys ..

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

WhatsApp link- wa.link/d997q0

Email - techncialexpress@gmail.com ...

Script Coder/Trader//Investor from India. Drop a comment or DM if you have any questions! Let’s grow together!

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.