We've been looking for the top of SPY (SPX) for some time. Yet it is very choppy lately. What's going on?

Is it possible that we are in an Ending Diagonal Pattern?

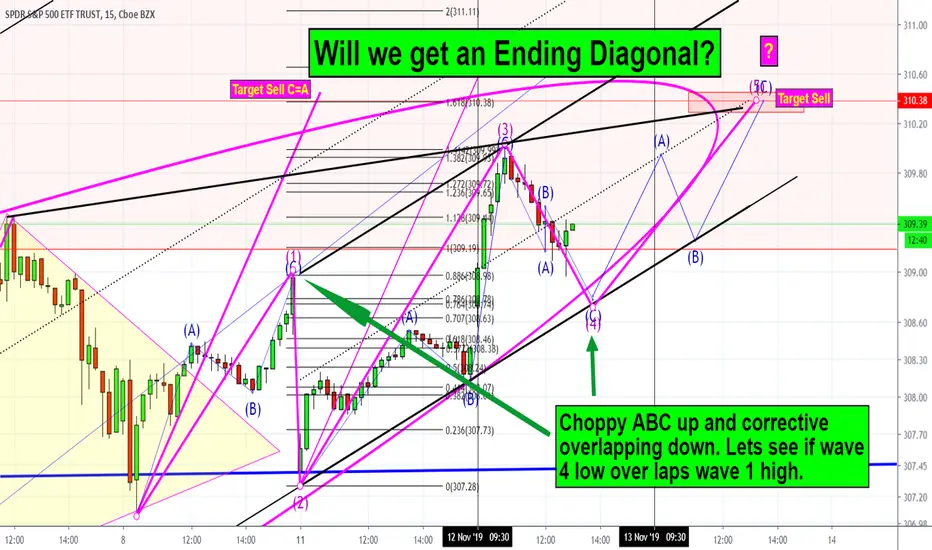

Please look at the chart shown and notice the ABC moves up and down.

Notice how the up moves are not the normal 5 waves up in a motive wave as per usual Elliott charting.

Instead the up moves are bigger than the corrective down waves, yet we only see 3 waves in each direction ( ABC )

If this is an Ending Diagonal , we should see the wave 4 low actually go lower than the wave 1 high.

That "breaks Elliott wave rules- wave 4 is never lower than wave 1" ... except for Ending diagonals.

If the pattern holds true, after wave 4 low, we should see another ABC back up for wave 5 as shown.

That would complete the ending diagonal and present a great Short selling opportunity!

So at this point we are still cautiously bullish until this pattern finishes in the next few days.

Then look out below!

Is it possible that we are in an Ending Diagonal Pattern?

Please look at the chart shown and notice the ABC moves up and down.

Notice how the up moves are not the normal 5 waves up in a motive wave as per usual Elliott charting.

Instead the up moves are bigger than the corrective down waves, yet we only see 3 waves in each direction ( ABC )

If this is an Ending Diagonal , we should see the wave 4 low actually go lower than the wave 1 high.

That "breaks Elliott wave rules- wave 4 is never lower than wave 1" ... except for Ending diagonals.

If the pattern holds true, after wave 4 low, we should see another ABC back up for wave 5 as shown.

That would complete the ending diagonal and present a great Short selling opportunity!

So at this point we are still cautiously bullish until this pattern finishes in the next few days.

Then look out below!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.