Market Structure:

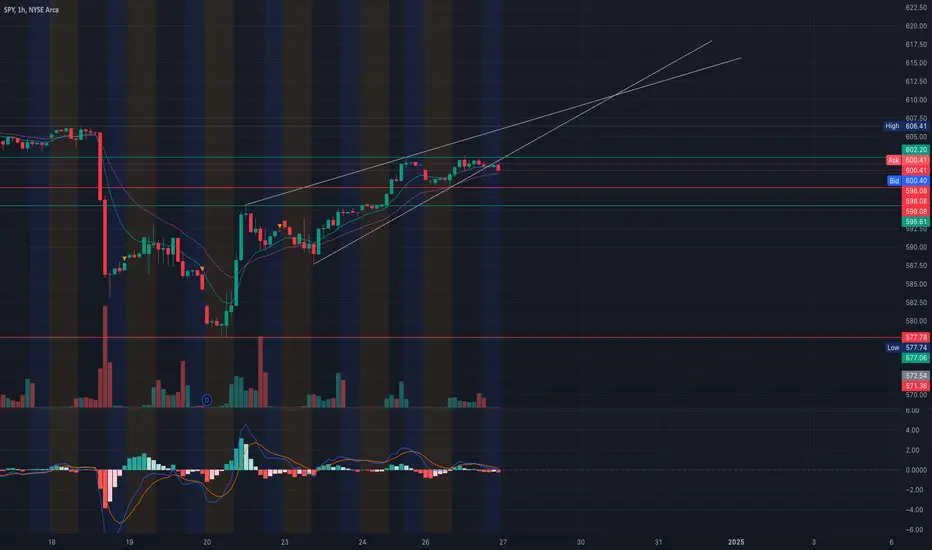

* SPY is trending within an ascending wedge pattern, holding above key EMAs (9 and 21), suggesting bullish momentum with caution near resistance levels.

* Current price at $600 indicates a consolidation phase near critical Gamma resistance levels, with the potential for a breakout or pullback.

Key Levels to Watch:

* Support Zones:

* $598: Immediate support, aligned with the Gamma 2nd PUT wall.

* $597: Strong support from the Gamma 3rd PUT wall and wedge base.

* Resistance Zones:

* $602: Critical resistance; breaking above signals bullish continuation.

* $604: Next resistance target near Gamma levels and technical confluence.

Indicator Insights:

* MACD: Flat but in bullish territory; watch for crossover to confirm momentum.

* Volume: Declining during consolidation; expect a spike for a breakout or breakdown.

* Options Oscillator: IVR (2.6) indicates low implied volatility, favoring directional plays near GEX levels.

Scalping Strategy:

1. Bullish Setup:

* Enter on a break above $602 with high volume.

* Targets: $604 and $606.

* Stop Loss: Below $601.

2. Bearish Setup:

* Enter on a breakdown below $598 with bearish momentum.

* Targets: $597 and $595.

* Stop Loss: Above $599.

3. Tools to Use:

* Use RSI and VWAP for intraday momentum confirmation.

* React quickly to price action at Gamma-determined levels ($598, $602).

Swing Trading Strategy:

1. Bullish Scenario:

* Enter on a daily close above $602 with volume confirmation.

* Targets: $604 and $606 for a short-term swing.

* Stop Loss: Below $600.

2. Bearish Scenario:

* Enter if SPY closes below $598 and sustains bearish momentum.

* Targets: $595 and $590.

* Stop Loss: Above $599.

3. Indicators to Monitor:

* EMA (9/21) for momentum confirmation.

* Volume spikes to confirm direction near key levels.

Options Strategy Based on GEX:

1. Bullish Options Play:

* Buy a Call Option with a $600 strike expiring in 1-2 weeks.

* Target: Exit near $604 or $606.

* Stop Loss: Close the trade if SPY falls below $598.

2. Bearish Options Play:

* Buy a Put Option with a $598 strike expiring in 1-2 weeks.

* Target: Exit near $597 or $595.

* Stop Loss: Close the trade if SPY rises above $599.

3. Neutral Strategy:

* Sell a Put Credit Spread at $598/$596, profiting from SPY staying above $598.

* Maximum profit achieved if SPY remains above $598 by expiration.

4. Advanced Gamma Strategy:

* If SPY holds above $602, consider selling a Call Spread at $604/$606 to collect premium while capping risk.

Actionable Plan for SPY:

* Scalpers should focus on intraday moves between $598 and $602, with quick reactions to price action.

* Swing traders can capitalize on breakouts above $602 or breakdowns below $598 with clear targets and stops.

* Options traders should leverage low IV and GEX levels for directional or neutral premium-selling strategies.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research and trade responsibly.

* SPY is trending within an ascending wedge pattern, holding above key EMAs (9 and 21), suggesting bullish momentum with caution near resistance levels.

* Current price at $600 indicates a consolidation phase near critical Gamma resistance levels, with the potential for a breakout or pullback.

Key Levels to Watch:

* Support Zones:

* $598: Immediate support, aligned with the Gamma 2nd PUT wall.

* $597: Strong support from the Gamma 3rd PUT wall and wedge base.

* Resistance Zones:

* $602: Critical resistance; breaking above signals bullish continuation.

* $604: Next resistance target near Gamma levels and technical confluence.

Indicator Insights:

* MACD: Flat but in bullish territory; watch for crossover to confirm momentum.

* Volume: Declining during consolidation; expect a spike for a breakout or breakdown.

* Options Oscillator: IVR (2.6) indicates low implied volatility, favoring directional plays near GEX levels.

Scalping Strategy:

1. Bullish Setup:

* Enter on a break above $602 with high volume.

* Targets: $604 and $606.

* Stop Loss: Below $601.

2. Bearish Setup:

* Enter on a breakdown below $598 with bearish momentum.

* Targets: $597 and $595.

* Stop Loss: Above $599.

3. Tools to Use:

* Use RSI and VWAP for intraday momentum confirmation.

* React quickly to price action at Gamma-determined levels ($598, $602).

Swing Trading Strategy:

1. Bullish Scenario:

* Enter on a daily close above $602 with volume confirmation.

* Targets: $604 and $606 for a short-term swing.

* Stop Loss: Below $600.

2. Bearish Scenario:

* Enter if SPY closes below $598 and sustains bearish momentum.

* Targets: $595 and $590.

* Stop Loss: Above $599.

3. Indicators to Monitor:

* EMA (9/21) for momentum confirmation.

* Volume spikes to confirm direction near key levels.

Options Strategy Based on GEX:

1. Bullish Options Play:

* Buy a Call Option with a $600 strike expiring in 1-2 weeks.

* Target: Exit near $604 or $606.

* Stop Loss: Close the trade if SPY falls below $598.

2. Bearish Options Play:

* Buy a Put Option with a $598 strike expiring in 1-2 weeks.

* Target: Exit near $597 or $595.

* Stop Loss: Close the trade if SPY rises above $599.

3. Neutral Strategy:

* Sell a Put Credit Spread at $598/$596, profiting from SPY staying above $598.

* Maximum profit achieved if SPY remains above $598 by expiration.

4. Advanced Gamma Strategy:

* If SPY holds above $602, consider selling a Call Spread at $604/$606 to collect premium while capping risk.

Actionable Plan for SPY:

* Scalpers should focus on intraday moves between $598 and $602, with quick reactions to price action.

* Swing traders can capitalize on breakouts above $602 or breakdowns below $598 with clear targets and stops.

* Options traders should leverage low IV and GEX levels for directional or neutral premium-selling strategies.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research and trade responsibly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.