The SPY has undergone what some might characterize as a strategically influenced decline, following an extreme three-standard-deviation move to the downside in under 20 days. The market appears to be adjusting its expectations in response to the evolving policy landscape under Trump’s administration and the broader transition to a new government.

I am inclined to believe this as a form of "controlled demolition," potentially orchestrated to accelerate the Federal Reserve’s decision to cut interest rates sooner rather than later.

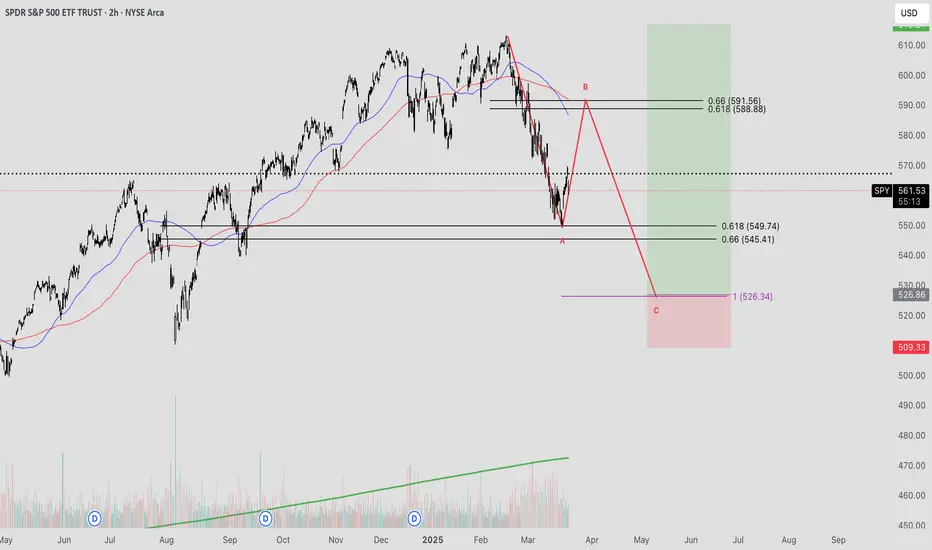

With this in mind, I will remain attentive to the broader market structure, particularly monitoring for a potential ABC corrective pattern that could shape near-term price action.

At the moment, price is rebounding from a critical support zone, aligning with the 0.618 Fibonacci retracement of the uptrend initiated in November 2024. Given the market's current state of being significantly oversold, a period of relief would be preferable to provide liquidity at higher price levels.

The immediate target for this retracement is the 0.618 level of the ongoing downtrend, which coincides with the previous range’s Value Area Low or potentially the Point of Control should a stronger rally materialize.

Beyond this, the anticipated broader ABC correction is expected to unfold, with a target around 530 on the SPY—precisely at the major VWAP level from late 2023, which previously marked the end of the bear market. This level is further in confluence with the 1-1 trend based Fibonacci extension of the swing high, which may signal the magnitude of the corrective move. I will have a better idea of where the correction may conclude once the swing high is in.

This decline is likely to present substantial opportunities for both long-term investors and active traders alike.

Let’s see how the market dynamics evolve from here.

I am inclined to believe this as a form of "controlled demolition," potentially orchestrated to accelerate the Federal Reserve’s decision to cut interest rates sooner rather than later.

With this in mind, I will remain attentive to the broader market structure, particularly monitoring for a potential ABC corrective pattern that could shape near-term price action.

At the moment, price is rebounding from a critical support zone, aligning with the 0.618 Fibonacci retracement of the uptrend initiated in November 2024. Given the market's current state of being significantly oversold, a period of relief would be preferable to provide liquidity at higher price levels.

The immediate target for this retracement is the 0.618 level of the ongoing downtrend, which coincides with the previous range’s Value Area Low or potentially the Point of Control should a stronger rally materialize.

Beyond this, the anticipated broader ABC correction is expected to unfold, with a target around 530 on the SPY—precisely at the major VWAP level from late 2023, which previously marked the end of the bear market. This level is further in confluence with the 1-1 trend based Fibonacci extension of the swing high, which may signal the magnitude of the corrective move. I will have a better idea of where the correction may conclude once the swing high is in.

This decline is likely to present substantial opportunities for both long-term investors and active traders alike.

Let’s see how the market dynamics evolve from here.

Note

Didnt quite hit my pivot zone, so this would invalidate this idea at the moment and perhaps we wait for a rally here at the 618 before looking for shorts. Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.