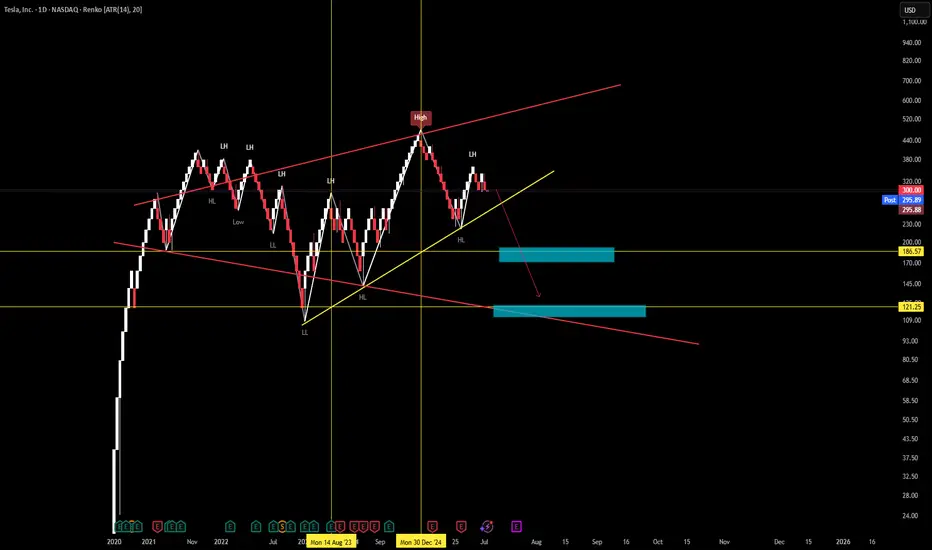

tsla well what you see is what you get. Yet TradingViewwants a description, yet you dont need one is you open your eyes

Summary: Tesla Q2 2025 Earnings and Share Price RisksTesla’s Q2 2025 earnings, due July 23, 2025, come amid its shift to an AI-driven company, emphasizing Full Self-Driving (FSD) and Cybercab robotaxis. However, several factors could drive a share price drop: Weak EV Demand: Expected Q2 deliveries of ~387,000 vehicles, down 13% year-over-year, with softness in Europe and China.

Earnings Pressure: Projected revenue of $24.98B (up 2%) but EPS of $0.39-$0.41, down from $0.91 in Q2 2024, due to declining profits and rising AI costs.

Valuation Concerns: Tesla’s P/E ratio of ~185x forward earnings is triple the Nasdaq-100, risking correction if AI progress disappoints.

Regulatory and Safety Risks: Robotaxi scaling faces regulatory hurdles and safety concerns, with no significant revenue until mid-2026.

Brand and Political Backlash: Musk’s political ties have led to protests and sales declines in key markets, contributing to a 9% stock drop since November 2024.

Insider Selling: Recent sales by Tesla insiders signal potential concerns.

Despite robotaxi optimism and analyst price targets up to $411, near-term challenges like an earnings miss, weak guidance, or AI delays could trigger a share price decline.

Summary: Tesla Q2 2025 Earnings and Share Price RisksTesla’s Q2 2025 earnings, due July 23, 2025, come amid its shift to an AI-driven company, emphasizing Full Self-Driving (FSD) and Cybercab robotaxis. However, several factors could drive a share price drop: Weak EV Demand: Expected Q2 deliveries of ~387,000 vehicles, down 13% year-over-year, with softness in Europe and China.

Earnings Pressure: Projected revenue of $24.98B (up 2%) but EPS of $0.39-$0.41, down from $0.91 in Q2 2024, due to declining profits and rising AI costs.

Valuation Concerns: Tesla’s P/E ratio of ~185x forward earnings is triple the Nasdaq-100, risking correction if AI progress disappoints.

Regulatory and Safety Risks: Robotaxi scaling faces regulatory hurdles and safety concerns, with no significant revenue until mid-2026.

Brand and Political Backlash: Musk’s political ties have led to protests and sales declines in key markets, contributing to a 9% stock drop since November 2024.

Insider Selling: Recent sales by Tesla insiders signal potential concerns.

Despite robotaxi optimism and analyst price targets up to $411, near-term challenges like an earnings miss, weak guidance, or AI delays could trigger a share price decline.

Awaken Soul🖤

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Awaken Soul🖤

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.