TSLA Breaks Bull Structure — Gamma Trap or Breakdown? Watch 315/300 Closely!

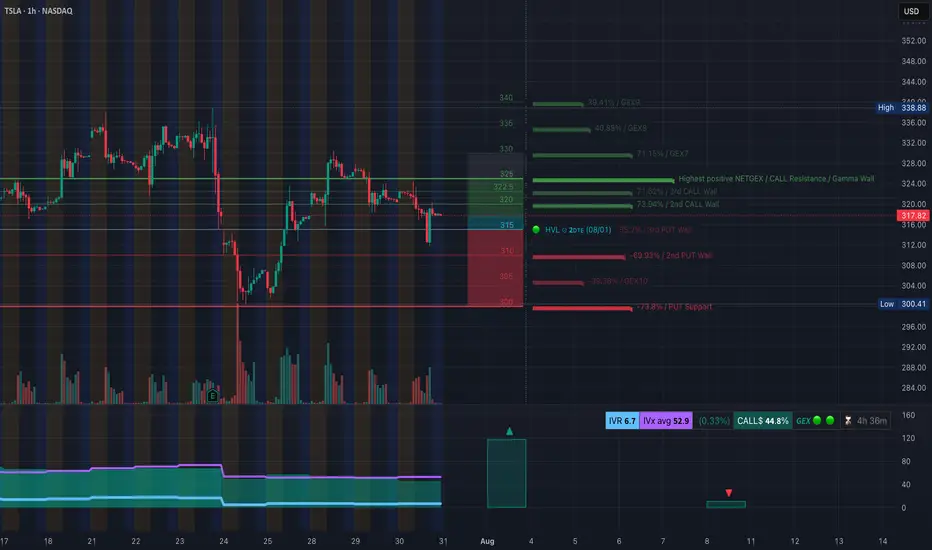

🔍 GEX & Options Flow Insight (1st Image Analysis)

TSLA is trading at $317.82, having just lost support at the 2nd Call Wall ($322.5) and now hovering near key PUT Wall clusters. Options positioning reveals strong downside pressure unless bulls reclaim 321+.

* Call Walls / Resistance:

* 📍 $322.5 → 2nd Call Wall (73.94%) — recently rejected

* 📍 $324.5–328 → Heavy net GEX zones and dealer resistance

* 📍 $336–338 → 3rd Call Wall + GEX9 — parabolic ceiling

* Put Walls / Gamma Risk Zone:

* 🔻 $316.0 / $312.0 → GEX transition zone (dealer flip risk)

* 🔻 $305.0 / $300.4 → Major PUT Support (73.87%) and HVL demand

* Extreme risk below $300 → Gamma cascade toward $290

* Volatility Insight:

* IVR 6.7, IVx Avg 52.9 → Low relative IV = cheap options

* Call Bias: 44.8% → Dealers still net short calls, but flows are softening

✅ Option Trading Suggestion:

Bias: Leaning bearish below 321.2, bearish confirmation under 315 Strategy: Bearish vertical or put debit spread

* Entry Idea: Buy 315P / Sell 305P for Aug 2 or Aug 9 expiry

* Aggressive alt: Naked 310P or 305P if breakdown confirmed

* Invalidation: Reclaim 321.20 with volume = close or reverse

Why this works: Dealer gamma exposure has flipped to negative under 316. If TSLA fails to hold above 315, dealers must hedge by selling into weakness, potentially accelerating downside toward 300.4–305.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* 🟥 Recent CHoCH confirmed on July 30 — bearish shift

* ❌ Failed to hold BOS structure from July 29 → trendline break

* ⚠️ Currently retesting broken structure as resistance (321.20–324.50)

Trendline Dynamics:

* 📉 Break below upward sloping trendline confirmed → downside pressure

* New bearish structure forming lower highs under OB zone

SMC Zones & Reversal Blocks:

* 🔴 Supply Zone (Purple Box): 321.2–324.5 → Rejected twice, now acting as resistance

* 🟩 Demand Zone (Green Box): 312–315.25 → Minor bounce zone; if fails, opens flush to 305–300

🔄 Price Action & Key Levels

* Support Levels:

* 🔻 315.25 → 312.00 → Minor demand + retest zone

* ⚠️ 300.41 → PUT Support + HVL zone (gamma wall)

* 🚨 Below 300 = fast move to 290

* Resistance Levels:

* 🚫 321.20 → 324.50 → Supply zone (order block + 2nd Call Wall)

* 🧱 330.48 → 336 → Next upside wall if bulls reclaim trend

🧭 Scalping / Intraday Trade Setup

🟥 Bearish Scenario (Preferred for Now):

* Entry: 316.00–317.00 rejection

* Target 1: 312.00

* Target 2: 305.00

* Stop: 321.50 reclaim

🟩 Bullish Reversal Scenario (Low Probability):

* Entry: Only on breakout and close above 324.50

* Target: 330.00 → 336.00

* Stop: 321 intraday flip back down

🔁 Summary Thoughts

* TSLA broke bullish market structure with a clean CHoCH and is now trading under OB resistance.

* Gamma positioning supports further downside if price stays under 321.

* Strong Put Walls at 305–300 create a natural magnet if breakdown continues.

* Option premiums are relatively cheap — attractive for directional plays.

* Scalpers and swing traders can ride the downside with tight stops; bulls must wait for reclaim above 324.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

🔍 GEX & Options Flow Insight (1st Image Analysis)

TSLA is trading at $317.82, having just lost support at the 2nd Call Wall ($322.5) and now hovering near key PUT Wall clusters. Options positioning reveals strong downside pressure unless bulls reclaim 321+.

* Call Walls / Resistance:

* 📍 $322.5 → 2nd Call Wall (73.94%) — recently rejected

* 📍 $324.5–328 → Heavy net GEX zones and dealer resistance

* 📍 $336–338 → 3rd Call Wall + GEX9 — parabolic ceiling

* Put Walls / Gamma Risk Zone:

* 🔻 $316.0 / $312.0 → GEX transition zone (dealer flip risk)

* 🔻 $305.0 / $300.4 → Major PUT Support (73.87%) and HVL demand

* Extreme risk below $300 → Gamma cascade toward $290

* Volatility Insight:

* IVR 6.7, IVx Avg 52.9 → Low relative IV = cheap options

* Call Bias: 44.8% → Dealers still net short calls, but flows are softening

✅ Option Trading Suggestion:

Bias: Leaning bearish below 321.2, bearish confirmation under 315 Strategy: Bearish vertical or put debit spread

* Entry Idea: Buy 315P / Sell 305P for Aug 2 or Aug 9 expiry

* Aggressive alt: Naked 310P or 305P if breakdown confirmed

* Invalidation: Reclaim 321.20 with volume = close or reverse

Why this works: Dealer gamma exposure has flipped to negative under 316. If TSLA fails to hold above 315, dealers must hedge by selling into weakness, potentially accelerating downside toward 300.4–305.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* 🟥 Recent CHoCH confirmed on July 30 — bearish shift

* ❌ Failed to hold BOS structure from July 29 → trendline break

* ⚠️ Currently retesting broken structure as resistance (321.20–324.50)

Trendline Dynamics:

* 📉 Break below upward sloping trendline confirmed → downside pressure

* New bearish structure forming lower highs under OB zone

SMC Zones & Reversal Blocks:

* 🔴 Supply Zone (Purple Box): 321.2–324.5 → Rejected twice, now acting as resistance

* 🟩 Demand Zone (Green Box): 312–315.25 → Minor bounce zone; if fails, opens flush to 305–300

🔄 Price Action & Key Levels

* Support Levels:

* 🔻 315.25 → 312.00 → Minor demand + retest zone

* ⚠️ 300.41 → PUT Support + HVL zone (gamma wall)

* 🚨 Below 300 = fast move to 290

* Resistance Levels:

* 🚫 321.20 → 324.50 → Supply zone (order block + 2nd Call Wall)

* 🧱 330.48 → 336 → Next upside wall if bulls reclaim trend

🧭 Scalping / Intraday Trade Setup

🟥 Bearish Scenario (Preferred for Now):

* Entry: 316.00–317.00 rejection

* Target 1: 312.00

* Target 2: 305.00

* Stop: 321.50 reclaim

🟩 Bullish Reversal Scenario (Low Probability):

* Entry: Only on breakout and close above 324.50

* Target: 330.00 → 336.00

* Stop: 321 intraday flip back down

🔁 Summary Thoughts

* TSLA broke bullish market structure with a clean CHoCH and is now trading under OB resistance.

* Gamma positioning supports further downside if price stays under 321.

* Strong Put Walls at 305–300 create a natural magnet if breakdown continues.

* Option premiums are relatively cheap — attractive for directional plays.

* Scalpers and swing traders can ride the downside with tight stops; bulls must wait for reclaim above 324.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.