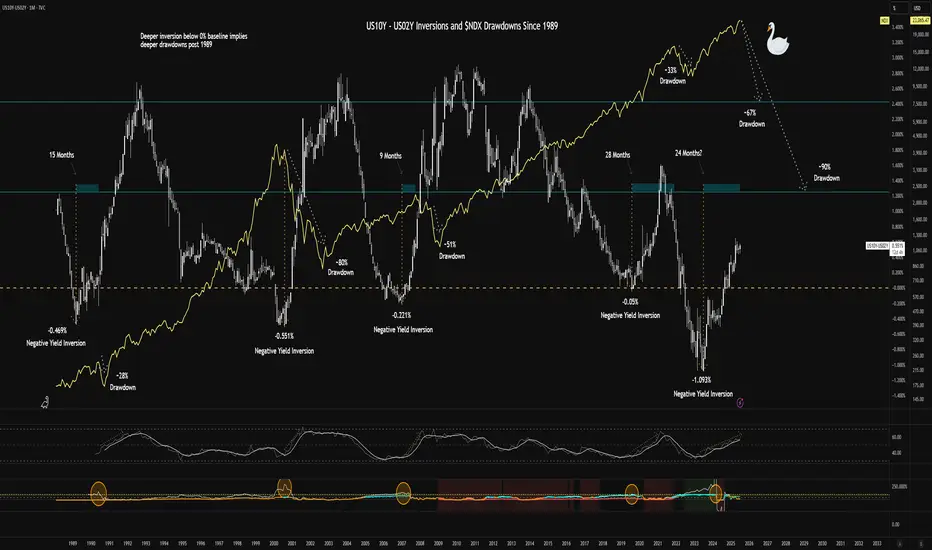

I cleaned the chart a bit for readability.

The chart shows historical inversions in the US10Y and

US10Y and  US02Y and the drawdowns in the

US02Y and the drawdowns in the  NDX that followed. The implication is that we should expect to see a >50% drawdown within 4 months. I'm not calling the "why" but only drawing parallels to historical price action following bond market environments.

NDX that followed. The implication is that we should expect to see a >50% drawdown within 4 months. I'm not calling the "why" but only drawing parallels to historical price action following bond market environments.

My current interpretation is that we're headed for stagflation - interest rates will be stickier than consensus takes driven by market uncertainty and increasing energy prices. The Trump administration seems to be pushing for policies that would alleviate pain from stagflation. The next revolution in technology promises massive productivity gains with respect to efficiencies in money transfers and back-end business operations in general. Unemployment will continue to rise as automation begins to increase.

The market will take time to find its bearings (upskilling and learning curves for employees and employers).

The Ai boom requires energy - more than we currently have capacity for. Companies will have to finance this build-out with vast sums of money. The reward will take time to harvest. Pain in the real economy will dampen consumption for a while.

Price action in Ai and technology companies has outpaced realized gains - we are at the front-end of this curve, much like the dotcom bubble.

Speculative bubbles like BTCUSD represent a direct threat to control over monetary policy for the reserve currency and hegemony. I am still very long USA (Dollar Milkshake).

BTCUSD represent a direct threat to control over monetary policy for the reserve currency and hegemony. I am still very long USA (Dollar Milkshake).  BTC has real value for struggling economies eclipsed by the majors, but for holders of this asset in the western world, large gains in

BTC has real value for struggling economies eclipsed by the majors, but for holders of this asset in the western world, large gains in  BTC would necessarily depend on the collapse of civilization as we know it, implying a logical paradox for people that expect outsized returns.

BTC would necessarily depend on the collapse of civilization as we know it, implying a logical paradox for people that expect outsized returns.  BTC.D demonstrates the loss of share of market cap well.

BTC.D demonstrates the loss of share of market cap well.

I invite comments with legitimate rational criticism as I'm always looking to improve my thinking about this topic.

Long ideas (comment additional tickers):

Short ideas:

I am employing long-expiry, OTM verticals to improve costs of trades or synthetic longs on moonshot names if not holding shares outright.

Share your comments. Good luck to all!

The chart shows historical inversions in the

My current interpretation is that we're headed for stagflation - interest rates will be stickier than consensus takes driven by market uncertainty and increasing energy prices. The Trump administration seems to be pushing for policies that would alleviate pain from stagflation. The next revolution in technology promises massive productivity gains with respect to efficiencies in money transfers and back-end business operations in general. Unemployment will continue to rise as automation begins to increase.

The market will take time to find its bearings (upskilling and learning curves for employees and employers).

The Ai boom requires energy - more than we currently have capacity for. Companies will have to finance this build-out with vast sums of money. The reward will take time to harvest. Pain in the real economy will dampen consumption for a while.

Price action in Ai and technology companies has outpaced realized gains - we are at the front-end of this curve, much like the dotcom bubble.

Speculative bubbles like

I invite comments with legitimate rational criticism as I'm always looking to improve my thinking about this topic.

Long ideas (comment additional tickers):

- Utility-driven tokens enabling this new paradigm -

XRPUSD

XLMUSD

ICPUSD

LINKUSD

XDCUSD

HBARUSD etc.

- Inelastic staples -

LLY

BUD

PM

- Energy and Ai infra -

ABAT

WWR

ENVX

PLUG

LAC

LEU

SMR

CHPT

KMI

QS

ITRI

ENPH

FSLR

CLSK

TSLA

EWTUSD

- Disruption Beneficiaries -

WU

UPW

OPEN

PYPL

FIS

XYZ

FIVN

BGM

Short ideas:

I am employing long-expiry, OTM verticals to improve costs of trades or synthetic longs on moonshot names if not holding shares outright.

Share your comments. Good luck to all!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.