US Treasury 10Y Technical Outlook for the week July 21-25 (updated daily)

Overnight

On Friday, the yield on the US 10-year Treasury note slightly declined to 4.44%, driven by investor reactions to the latest University of Michigan Consumer Sentiment data and remarks from Federal Reserve Governor Christopher Waller. The consumer sentiment index rose in July, accompanied by lower inflation expectations for both short- and long-term horizons. Waller expressed support for a potential rate cut in July, indicating he might dissent if the Federal Open Market Committee chooses to maintain current rates. However, market expectations remain focused on no rate changes this month, with two quarter-point cuts anticipated in September and December. Earlier data highlighted robust consumer spending through strong retail sales, alongside softer-than-expected core CPI and PPI figures.

Economic Release for the Week myfxbook.com/forex-economic-calendar

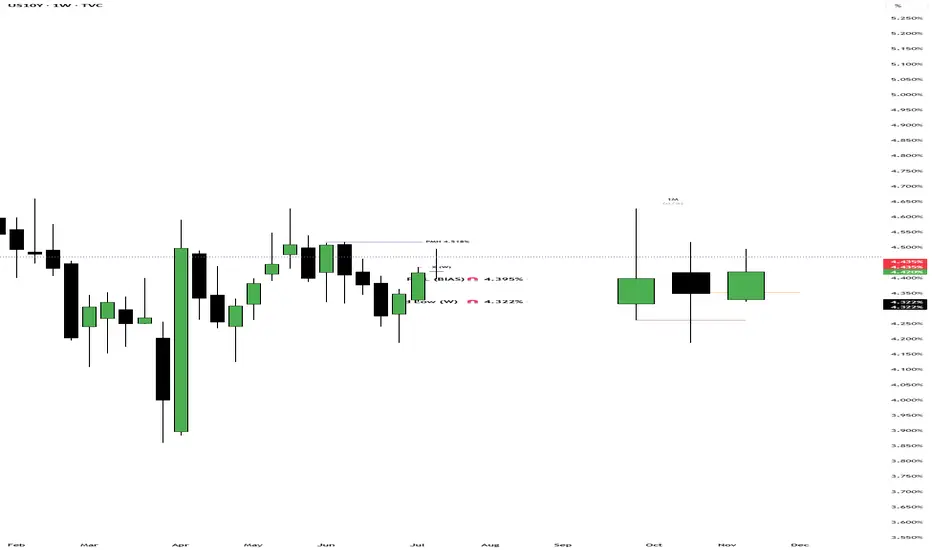

Weekly Bias

For the week I am expecting last weeks low of 4.395% to be mitigated to previous old low of 4.322%. I am basing this assumption based on the price action last week and how the weekly candle closed weekly (pin bar). Will start the analysis on daily bias on Tuesday.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Overnight

On Friday, the yield on the US 10-year Treasury note slightly declined to 4.44%, driven by investor reactions to the latest University of Michigan Consumer Sentiment data and remarks from Federal Reserve Governor Christopher Waller. The consumer sentiment index rose in July, accompanied by lower inflation expectations for both short- and long-term horizons. Waller expressed support for a potential rate cut in July, indicating he might dissent if the Federal Open Market Committee chooses to maintain current rates. However, market expectations remain focused on no rate changes this month, with two quarter-point cuts anticipated in September and December. Earlier data highlighted robust consumer spending through strong retail sales, alongside softer-than-expected core CPI and PPI figures.

Economic Release for the Week myfxbook.com/forex-economic-calendar

Weekly Bias

For the week I am expecting last weeks low of 4.395% to be mitigated to previous old low of 4.322%. I am basing this assumption based on the price action last week and how the weekly candle closed weekly (pin bar). Will start the analysis on daily bias on Tuesday.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Note

UST 10y Daily Technical July 22Overnight

The yield on the US 10-year Treasury note dropped nearly 5 basis points to 4.37% on Monday, hitting its lowest level in over a week and marking its fourth consecutive decline. Investor caution is growing due to uncertainties surrounding upcoming tariffs, with Commerce Secretary Howard Lutnick confirming August 1st as a “hard deadline” for countries to start paying tariffs, though negotiations will continue. Additionally, concerns about the Federal Reserve’s independence are rising following Treasury Secretary Scott Bessent’s call for a re-evaluation of the institution and President Trump’s ongoing criticism of Fed Chair Jerome Powell for not cutting interest rates. Speculation about Powell’s potential removal has surfaced, though Trump recently denied such plans.

Economic Release July 22 myfxbook.com/forex-economic-calendar

Daily Technical

As mentioned yesterday the previous week’s low was mitigated

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Note

UST 10y Daily Technical July 23Overnight

The yield on the US 10-year Treasury note dropped to 4.37% on Tuesday, marking its fifth consecutive decline and reaching the lowest level in over a week, according to Trading Economics. Investor caution persists due to ongoing trade uncertainties and concerns about the Federal Reserve’s independence. The US is engaged in trade talks with key partners like Japan, with the White House hinting at possible new trade agreements before the August 1st deadline, though no deals have been confirmed. Additionally, Treasury Secretary Scott Bessent addressed speculation about Fed leadership, defending Chair Powell while suggesting a potential re-evaluation of the Federal Reserve as an institution. The Fed’s next meeting is scheduled for next week, with no changes anticipated to the federal funds rate.

Economic Release July 23 myfxbook.com/forex-economic-calendar

Daily Bias

As mentioned yesterday, I was anticipating 4.352% to be targeted and closed below. For today I am looking at continuation and previous day low of 4.33% as a daily target and still looking at Old Week Low of 4.322% as well.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.