1. Labor Market Data

Average Hourly Earnings m/m:

Actual: 0.3%

Forecast: 0.3%

Previous: 0.2%

Interpretation: In-line with forecast and slightly above the prior period, indicating stable wage growth. This suggests inflationary pressures from labor costs remain steady, not accelerating unexpectedly.

Non-Farm Employment Change:

Actual: 73,000

Forecast: 106,000

Previous: 14,000

Interpretation: A clear downside surprise; job gains are well below expectations, and while up from a low previous period, this points to softening labor demand—an early sign of slack in the job market.

Unemployment Rate:

Actual: 4.2%

Forecast: 4.2%

Previous: 4.1%

Interpretation: Matches the forecast but marks a slight uptick, reinforcing mild labor market weakness.

Fed View: The Fed will interpret softer than expected job growth and a higher unemployment rate as evidence of easing labor market pressures—a dovish signal that could support future policy easing if the trend continues.

2. Manufacturing and Industry

Final Manufacturing PMI (S&P Global):

Actual: 49.8

Forecast: 49.7

Previous: 49.5

Interpretation: Slightly above forecast but still below the 50 threshold, indicating contraction persists but is less severe.

ISM Manufacturing PMI:

Actual: 48.0

Forecast: 49.5

Previous: 49.0

Interpretation: Below both forecast and prior; contraction in the manufacturing sector is deepening.

ISM Manufacturing Prices:

Actual: 64.8

Forecast: 69.9

Previous: 69.7

Interpretation: Lower than both forecast and previous, signaling input price pressures are easing—positive for the Fed’s inflation outlook.

Fed View: Ongoing contraction in manufacturing and lower input prices support the argument that inflation risks are cooling from the supply side, allowing for a more dovish stance.

3. Consumer and Construction

Revised UoM Consumer Sentiment:

Actual: 61.7

Forecast: 62.0

Previous: 61.8

Interpretation: Slightly below forecast, little change—consumer confidence remains relatively subdued.

Construction Spending m/m:

Actual: -0.4%

Forecast: 0.0%

Previous: -0.4%

Interpretation: Same as previous, misses forecast—ongoing weakness in construction and real estate investment.

Fed View: Weak consumer sentiment and persistent soft construction data reinforce slower demand-side dynamics, an argument in favor of pausing or even cutting rates.

4. Inflation Expectations

Revised UoM Inflation Expectations:

Actual: 4.5%

Forecast: Not directly listed (prior 4.4%)

Interpretation: Ticks up slightly, indicating that consumers expect inflation to remain higher. This could temper the Fed’s willingness to cut rates too soon—if expectations become unanchored, the Fed may have to stay hawkish.

Overall Fed Interpretation

Labor market: Softer than forecast, unemployment up—dovish for rates.

Manufacturing/industry: Slight improvement in PMI, but ISM shows contraction; input prices are easing—dovish.

Consumer/construction: Little improvement, still weak—dovish.

Inflation expectations: Up slightly—potential hawkish caution.

Net result: The data is mostly dovish—except for the higher inflation expectation which remains a concern. The Fed will likely see this data as supporting a “watchful pause” and adopt a more flexible stance: no immediate rate cut, but the case for easing is growing unless inflation expectations keep drifting higher. Sustained weak jobs or further easing in prices would increase the chances of a rate cut in coming months. Elevated inflation expectations will keep the Fed cautious about acting too quickly.

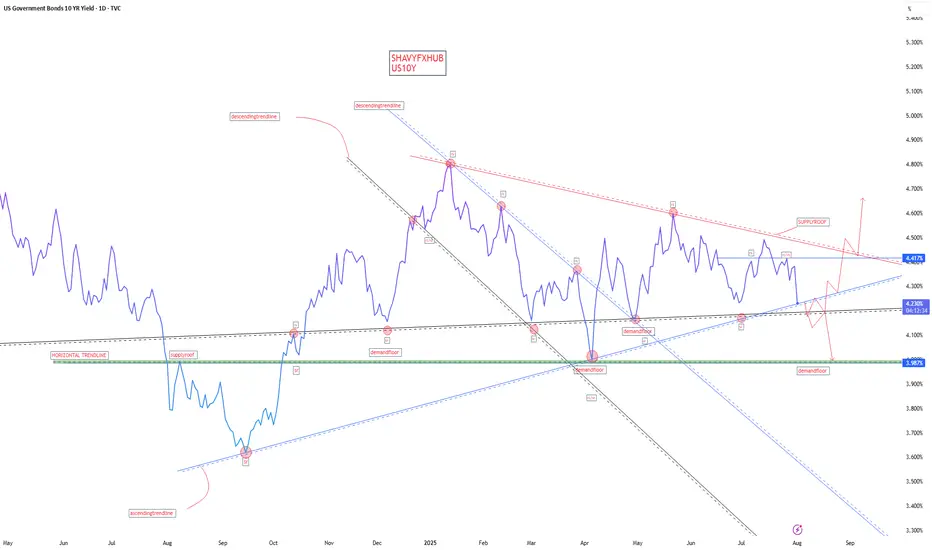

#DOLLAR #US10Y #STOCKS #BONDS #YIELD

Average Hourly Earnings m/m:

Actual: 0.3%

Forecast: 0.3%

Previous: 0.2%

Interpretation: In-line with forecast and slightly above the prior period, indicating stable wage growth. This suggests inflationary pressures from labor costs remain steady, not accelerating unexpectedly.

Non-Farm Employment Change:

Actual: 73,000

Forecast: 106,000

Previous: 14,000

Interpretation: A clear downside surprise; job gains are well below expectations, and while up from a low previous period, this points to softening labor demand—an early sign of slack in the job market.

Unemployment Rate:

Actual: 4.2%

Forecast: 4.2%

Previous: 4.1%

Interpretation: Matches the forecast but marks a slight uptick, reinforcing mild labor market weakness.

Fed View: The Fed will interpret softer than expected job growth and a higher unemployment rate as evidence of easing labor market pressures—a dovish signal that could support future policy easing if the trend continues.

2. Manufacturing and Industry

Final Manufacturing PMI (S&P Global):

Actual: 49.8

Forecast: 49.7

Previous: 49.5

Interpretation: Slightly above forecast but still below the 50 threshold, indicating contraction persists but is less severe.

ISM Manufacturing PMI:

Actual: 48.0

Forecast: 49.5

Previous: 49.0

Interpretation: Below both forecast and prior; contraction in the manufacturing sector is deepening.

ISM Manufacturing Prices:

Actual: 64.8

Forecast: 69.9

Previous: 69.7

Interpretation: Lower than both forecast and previous, signaling input price pressures are easing—positive for the Fed’s inflation outlook.

Fed View: Ongoing contraction in manufacturing and lower input prices support the argument that inflation risks are cooling from the supply side, allowing for a more dovish stance.

3. Consumer and Construction

Revised UoM Consumer Sentiment:

Actual: 61.7

Forecast: 62.0

Previous: 61.8

Interpretation: Slightly below forecast, little change—consumer confidence remains relatively subdued.

Construction Spending m/m:

Actual: -0.4%

Forecast: 0.0%

Previous: -0.4%

Interpretation: Same as previous, misses forecast—ongoing weakness in construction and real estate investment.

Fed View: Weak consumer sentiment and persistent soft construction data reinforce slower demand-side dynamics, an argument in favor of pausing or even cutting rates.

4. Inflation Expectations

Revised UoM Inflation Expectations:

Actual: 4.5%

Forecast: Not directly listed (prior 4.4%)

Interpretation: Ticks up slightly, indicating that consumers expect inflation to remain higher. This could temper the Fed’s willingness to cut rates too soon—if expectations become unanchored, the Fed may have to stay hawkish.

Overall Fed Interpretation

Labor market: Softer than forecast, unemployment up—dovish for rates.

Manufacturing/industry: Slight improvement in PMI, but ISM shows contraction; input prices are easing—dovish.

Consumer/construction: Little improvement, still weak—dovish.

Inflation expectations: Up slightly—potential hawkish caution.

Net result: The data is mostly dovish—except for the higher inflation expectation which remains a concern. The Fed will likely see this data as supporting a “watchful pause” and adopt a more flexible stance: no immediate rate cut, but the case for easing is growing unless inflation expectations keep drifting higher. Sustained weak jobs or further easing in prices would increase the chances of a rate cut in coming months. Elevated inflation expectations will keep the Fed cautious about acting too quickly.

#DOLLAR #US10Y #STOCKS #BONDS #YIELD

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.