📊 USD/CHF Q3 Forecast

Model Type: Proprietary Distribution Cycle Model

Instrument: USD/CHF

Trading Venue: IG

Published: July 2025

🔍 Market Phases Identified

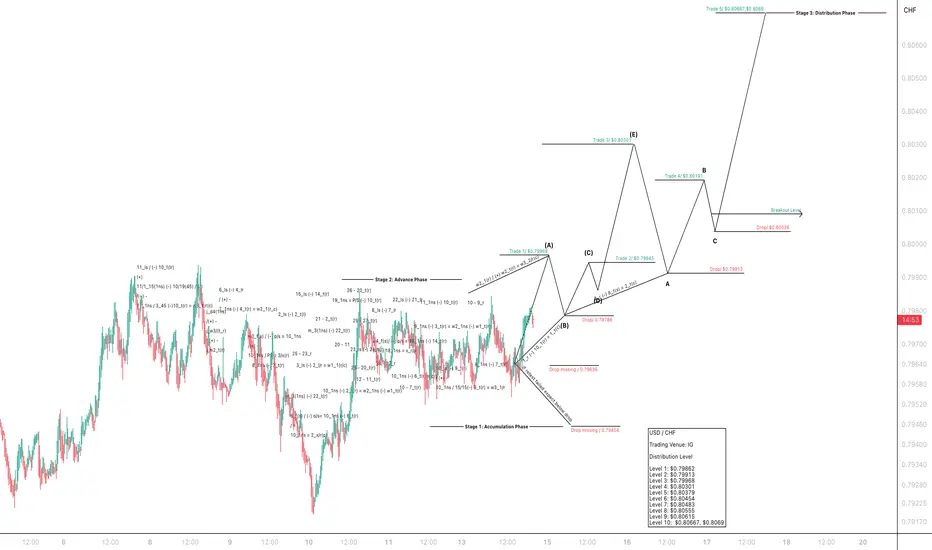

Stage 1: Accumulation Phase

Accumulation is complete, with structural support forming near:

$0.79454 (drop missed)

$0.79636 (drop missed)

Stage 2: Advance Phase

Breakout structure unfolding with five internal legs mapped as:

Trade 1: $0.79968 (Wave A)

Trade 2: $0.79945 (Wave D pullback)

Trade 3: $0.80301 (Wave E high)

Trade 4: $0.80119 (Re-entry into Wave B-C zone)

Stage 3: Distribution Phase (Projected)

Model forecasts breakout above $0.80038 targeting:

Distribution Level 5 and above (see distribution table below)

🧮 Forecasted Distribution Levels:

Level 1: $0.79862

Level 2: $0.79913

Level 3: $0.79968

Level 4: $0.80301

Level 5: $0.80379

Level 6: $0.80454

Level 7: $0.80483

Level 8: $0.80555

Level 9: $0.80615

Level 10: $0.80667, $0.8069

🧠 Structural Commentary:

The market is responding to each inflection point with high accuracy to the cycle model.

Drop levels ($0.79912, $0.80038) act as short-term liquidity checks during retracement phases.

Missed drops near $0.794–$0.796 remain potential tail risks if a distribution rejection occurs before L5.

✅ Execution Strategy Summary

4 trades forecasted with near-perfect cycle timing.

Breakout confirmation is anticipated above $0.80038 toward L5–L10.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

Model Type: Proprietary Distribution Cycle Model

Instrument: USD/CHF

Trading Venue: IG

Published: July 2025

🔍 Market Phases Identified

Stage 1: Accumulation Phase

Accumulation is complete, with structural support forming near:

$0.79454 (drop missed)

$0.79636 (drop missed)

Stage 2: Advance Phase

Breakout structure unfolding with five internal legs mapped as:

Trade 1: $0.79968 (Wave A)

Trade 2: $0.79945 (Wave D pullback)

Trade 3: $0.80301 (Wave E high)

Trade 4: $0.80119 (Re-entry into Wave B-C zone)

Stage 3: Distribution Phase (Projected)

Model forecasts breakout above $0.80038 targeting:

Distribution Level 5 and above (see distribution table below)

🧮 Forecasted Distribution Levels:

Level 1: $0.79862

Level 2: $0.79913

Level 3: $0.79968

Level 4: $0.80301

Level 5: $0.80379

Level 6: $0.80454

Level 7: $0.80483

Level 8: $0.80555

Level 9: $0.80615

Level 10: $0.80667, $0.8069

🧠 Structural Commentary:

The market is responding to each inflection point with high accuracy to the cycle model.

Drop levels ($0.79912, $0.80038) act as short-term liquidity checks during retracement phases.

Missed drops near $0.794–$0.796 remain potential tail risks if a distribution rejection occurs before L5.

✅ Execution Strategy Summary

4 trades forecasted with near-perfect cycle timing.

Breakout confirmation is anticipated above $0.80038 toward L5–L10.

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.