Hello awesome traders! 👑✨

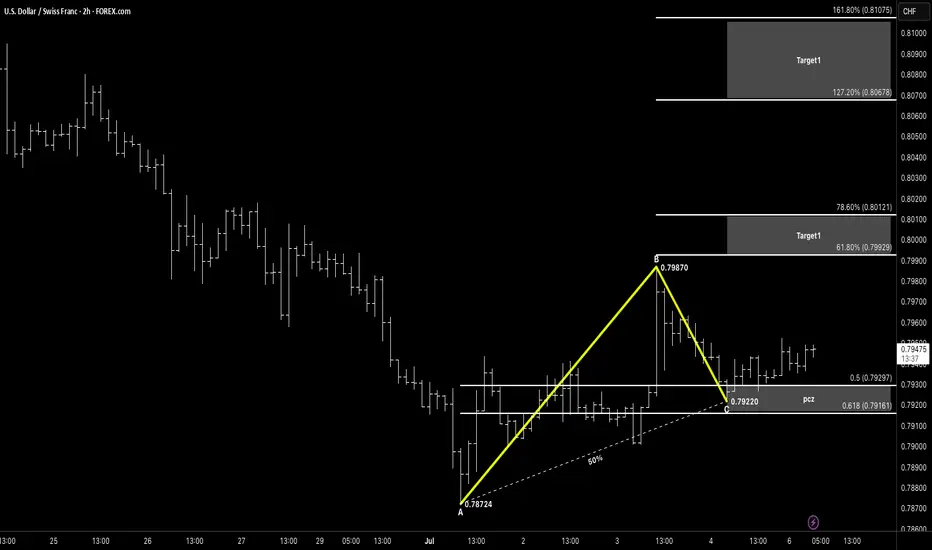

I hope you’ve had an amazing weekend and are ready to kick off the trading week like pros. Let’s dive straight into our USD/CHF 2-Hour chart — it’s shaping up to be a high-probability ABC Bullish reversal to start July strong.

🧠 Setup Breakdown

Pattern Type: ABC Bullish Reversal

A → B: Impulsive move from 0.78724 → 0.79870

B → C: Retracement down to 0.79220

Amplitude Symmetry:

AB ≈ BC in price distance (~120 pips)

BC retraces 50–61.8% of AB into the PCZ at 0.79297–0.79161

✅ Why This Works

Clean ABC structure with clear impulse & corrective legs

AB mirrors BC in amplitude—gives us a precise retracement zone

Horizontal support around 0.7925 converges into PCZ

⚔️ Entry & Risk Management

Entry Zone: Buy within 0.7916–0.7930 (PCZ)

Stop-Loss: Below C swing low at 0.79220, 5–10 pips lower (0.7910)

Risk: ≤ 1–2 % of account per trade

🎯 Profit Targets

TP1: 61.8 % retrace of B→C → 0.79929

TP2: 78.6 % retrace of B→C → 0.80121

TP3: 127.2 % extension of A→B → 0.80678

🔍 Confirmation & Invalid

Candlestick Rejection: Look for pin-bar or bullish engulfing at PCZ

Structure Break: Close back above the B→C trendline adds conviction

Invalidation: A decisive close below 0.7910 negates the setup — watch for further downside.

💡 Keep It Simple:

Pattern → Spot ABC with AB ≈ BC

PCZ → Wait for 50–61.8 % retracement of AB

Trigger → Bullish price action at C

Continuation → Ride the move toward TP zones

🔔 Watch USD drivers and SNB commentary for catalysts.

Wishing everyone a profitable week ahead — stay disciplined, manage risk like a sniper, and let structure lead, not emotions! 🚀

I hope you’ve had an amazing weekend and are ready to kick off the trading week like pros. Let’s dive straight into our USD/CHF 2-Hour chart — it’s shaping up to be a high-probability ABC Bullish reversal to start July strong.

🧠 Setup Breakdown

Pattern Type: ABC Bullish Reversal

A → B: Impulsive move from 0.78724 → 0.79870

B → C: Retracement down to 0.79220

Amplitude Symmetry:

AB ≈ BC in price distance (~120 pips)

BC retraces 50–61.8% of AB into the PCZ at 0.79297–0.79161

✅ Why This Works

Clean ABC structure with clear impulse & corrective legs

AB mirrors BC in amplitude—gives us a precise retracement zone

Horizontal support around 0.7925 converges into PCZ

⚔️ Entry & Risk Management

Entry Zone: Buy within 0.7916–0.7930 (PCZ)

Stop-Loss: Below C swing low at 0.79220, 5–10 pips lower (0.7910)

Risk: ≤ 1–2 % of account per trade

🎯 Profit Targets

TP1: 61.8 % retrace of B→C → 0.79929

TP2: 78.6 % retrace of B→C → 0.80121

TP3: 127.2 % extension of A→B → 0.80678

🔍 Confirmation & Invalid

Candlestick Rejection: Look for pin-bar or bullish engulfing at PCZ

Structure Break: Close back above the B→C trendline adds conviction

Invalidation: A decisive close below 0.7910 negates the setup — watch for further downside.

💡 Keep It Simple:

Pattern → Spot ABC with AB ≈ BC

PCZ → Wait for 50–61.8 % retracement of AB

Trigger → Bullish price action at C

Continuation → Ride the move toward TP zones

🔔 Watch USD drivers and SNB commentary for catalysts.

Wishing everyone a profitable week ahead — stay disciplined, manage risk like a sniper, and let structure lead, not emotions! 🚀

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.