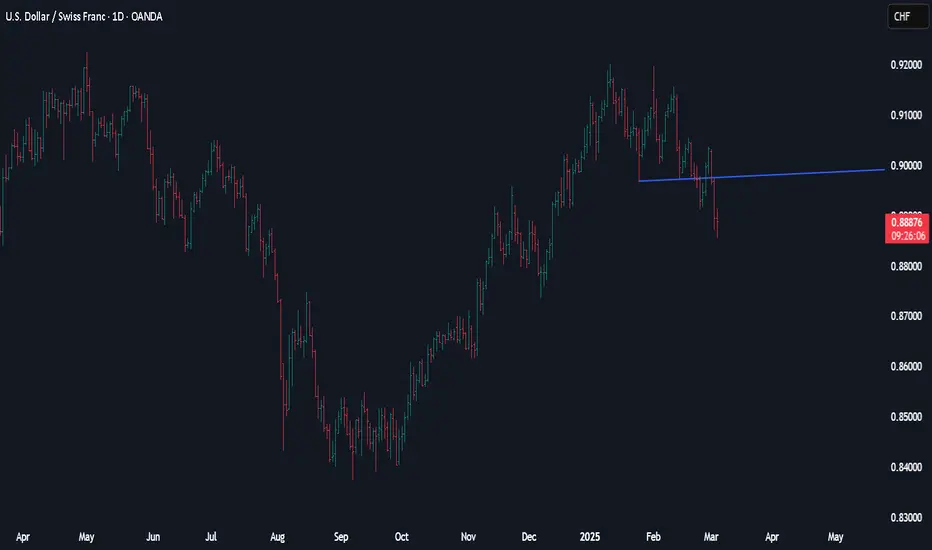

The CHF could not resist the EUR and the EUR/USD rallied to four-month highs above 1.0630 last night, as EUR/CHF ultimately jumped one big figure to 0.9450, still within its well-established 0.93-0.95 range. While global risk appetite should remain the primary CHF driver in the short term, attention could temporarily shift onto the domestic CPI release for February this morning. Headline inflation kept cooling into 2025, thanks in large part to negative base effects coming from electricity prices, while core inflation surprised to the upside with a pick-up to 0.9% YoY in January. This time around, the economists surveyed by Bloomberg look for a broader CPI slowdown which of special note may take the headline rate as low as 0.2% YoY in February. This is the SNB’s average CPI forecast for Q225 as well, and therefore only a tentative foray into negative territory could at this stage weigh on the CHF, while CHF money markets already expect a return of zero interest rate policy, or near. Such prospects contrast with the bulk of other developed central banks, which may in turn make the CHF a favoured funding currency once global uncertainties abate. At the same time, lower inflation differentials between Switzerland and other developed economies should also help cool the CHF’s real valuations in the long run (all else equal), as we only expect some modest nominal depreciation, with EUR/CHF aiming at 0.97 by the end of the year.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.