✅ USD/CHF Model Forecast - Results Now In

Forecast Published: 14 July 2025

Result Update: 15 July 2025

Model: Proprietary Distribution Cycle Model

Venue: IG

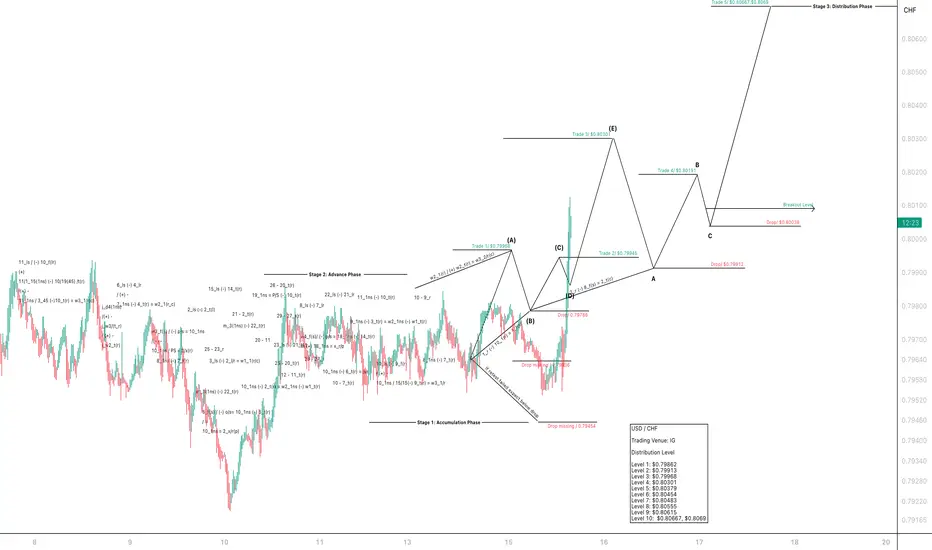

Yesterday’s cycle forecast identified a clean path from Accumulation → Advance → Distribution, and within 24 hours, USD/CHF has already reached Distribution Level 3 ($0.79981) - perfectly respecting the internal wave structure.

🔹 Trade 1 to Trade 3 executed with near-exact model timing

🔹 Stage 2 breakout triggered precisely from the forecasted (D) low

🔹 Price currently tracking toward Level 3 and beyond

🎯 Distribution Levels (as forecasted):

✅ Level 1: $0.79862

✅ Level 2: $0.79913

🔜 Level 3: $0.79981

🔜 Level 4: $0.80081

🔜 Level 5-10: Up to $0.8069

🔽 Drops Still Missing

0.79786

$0.79636

$0.79454

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

Forecast Published: 14 July 2025

Result Update: 15 July 2025

Model: Proprietary Distribution Cycle Model

Venue: IG

Yesterday’s cycle forecast identified a clean path from Accumulation → Advance → Distribution, and within 24 hours, USD/CHF has already reached Distribution Level 3 ($0.79981) - perfectly respecting the internal wave structure.

🔹 Trade 1 to Trade 3 executed with near-exact model timing

🔹 Stage 2 breakout triggered precisely from the forecasted (D) low

🔹 Price currently tracking toward Level 3 and beyond

🎯 Distribution Levels (as forecasted):

✅ Level 1: $0.79862

✅ Level 2: $0.79913

🔜 Level 3: $0.79981

🔜 Level 4: $0.80081

🔜 Level 5-10: Up to $0.8069

🔽 Drops Still Missing

0.79786

$0.79636

$0.79454

Disclaimer: The following forecast is derived from a proprietary, hand-crafted mathematical model developed independently over several years. It does not rely on traditional indicators, technical patterns, or third-party frameworks such as Elliott Wave Theory.

This model calculates price action based on distribution phases, economic timing cycles, and natural market imbalances.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Institutional Note:

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

For institutional review, independent verification, or strategic collaboration:

institutions@bmoses.com.au

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.