Long-term yen weakness persists due to Fed–BoJ policy divergence and declining exports.

Technical analysis

Analysis by: Krisada Yoonaisil, Financial Markets Strategist at Exness

Technical analysis

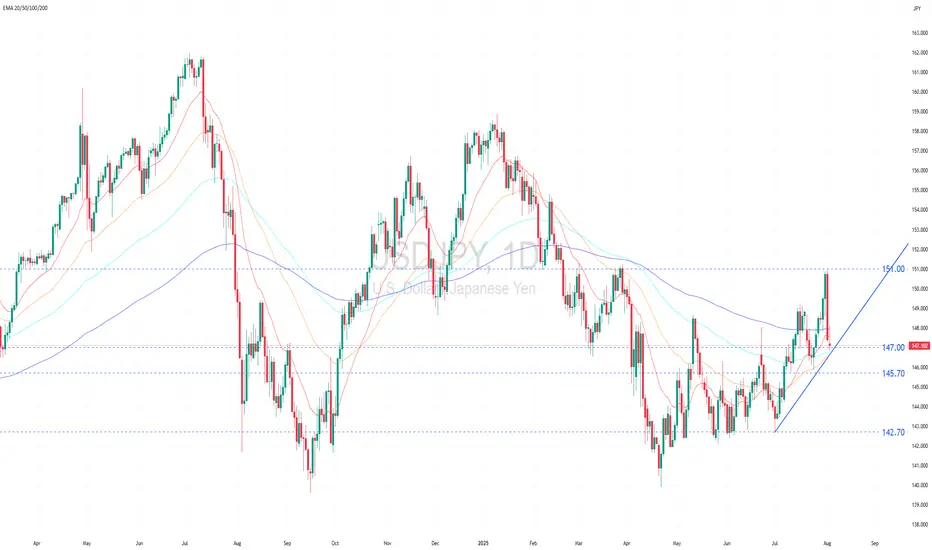

- USDJPY has formed a series of higher highs and higher lows, signaling the early stage of an uptrend. However, the strength of this trend remains uncertain, as each new high is followed by a pullback, indicating a fragile uptrend.

- If the price holds above 147.00 and prints a higher low, it would reinforce the bullish structure, with the next upside target near the previous swing high at 151.00.

- Conversely, a break below 145.70 would invalidate the bullish bias and could trigger a deeper decline toward the next support at 142.70.

Fundamental analysis - The easing of market concerns over retaliatory tariffs has recently supported a rise in USDJPY. However, weaker-than-expected U.S. nonfarm payroll data has fueled expectations of a more dovish Fed, placing short-term downward pressure on the dollar.

- Nonetheless, the BoJ’s cautious and persistently dovish stance limits the yen’s long-term support, while ongoing yen carry trade activity continues to exert downward pressure on the currency in the medium term.

- Additionally, Japan’s Jun export data showed a 0.5% YoY decline, the second consecutive monthly contraction, driven primarily by reduced exports of automobiles and steel. These declines reflect continued pressure from US import tariffs, particularly the 25% on Japanese cars, which remains a downside risk for the yen.

Analysis by: Krisada Yoonaisil, Financial Markets Strategist at Exness

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.