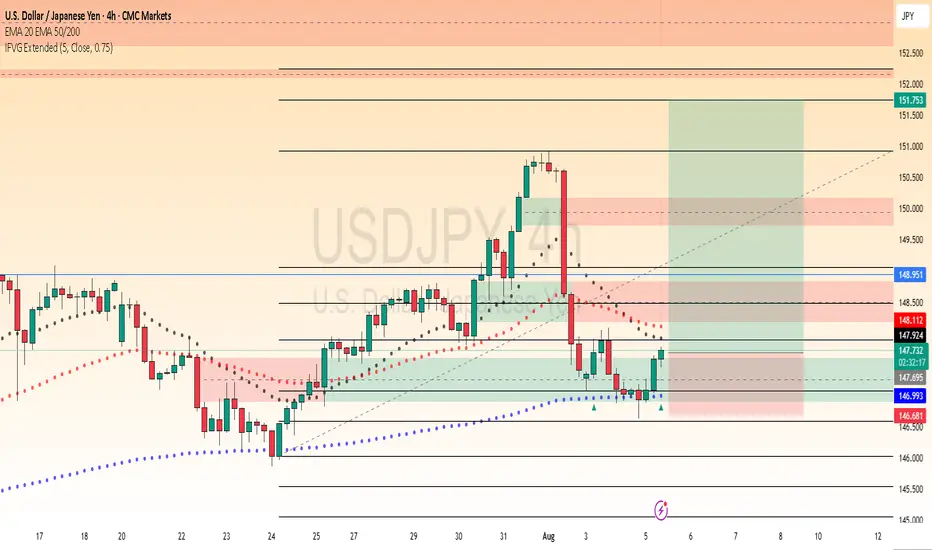

USD/JPY is presenting a compelling long opportunity after a healthy pullback from recent highs. Multiple technical confluences suggest we're setting up for another leg higher.

Fibonacci Retracement: Price has bounced perfectly from the 0.886 Fibonacci level, showing strong institutional buying interest at this deep retracement level. This is a classic reversal zone that often marks the end of corrective moves.

IFVG (Institutional Fair Value Gap): We've seen a clean bounce from the IFVG below, indicating that institutional orders have been filled and buyers are stepping back in. This gap has acted as strong support.

200 EMA Confluence: The 200 EMA is coming up beautifully on the 4-hour timeframe, providing additional dynamic support. This moving average often acts as a magnet for price and confirms the bullish bias.

Daily Confirmation: We have a strong confirmation candle on the daily timeframe, showing buyers are in control and ready to push higher.

Market Structure Analysis

Price previously broke through strong resistance levels

The recent pullback appears to be a healthy retracement rather than a reversal

Market structure remains bullish with higher lows being formed

Trade Outlook

With these multiple confluences aligning, USD/JPY looks primed for a new leg higher. The combination of Fibonacci support, IFVG bounce, 200 EMA confluence, and daily confirmation creates a high-probability setup for bulls.

Expectation: New highs incoming as buyers regain control and push through previous resistance turned support.

Risk management is key - always use proper position sizing and stop losses.

This is not financial advice. Trade at your own risk.

Fibonacci Retracement: Price has bounced perfectly from the 0.886 Fibonacci level, showing strong institutional buying interest at this deep retracement level. This is a classic reversal zone that often marks the end of corrective moves.

IFVG (Institutional Fair Value Gap): We've seen a clean bounce from the IFVG below, indicating that institutional orders have been filled and buyers are stepping back in. This gap has acted as strong support.

200 EMA Confluence: The 200 EMA is coming up beautifully on the 4-hour timeframe, providing additional dynamic support. This moving average often acts as a magnet for price and confirms the bullish bias.

Daily Confirmation: We have a strong confirmation candle on the daily timeframe, showing buyers are in control and ready to push higher.

Market Structure Analysis

Price previously broke through strong resistance levels

The recent pullback appears to be a healthy retracement rather than a reversal

Market structure remains bullish with higher lows being formed

Trade Outlook

With these multiple confluences aligning, USD/JPY looks primed for a new leg higher. The combination of Fibonacci support, IFVG bounce, 200 EMA confluence, and daily confirmation creates a high-probability setup for bulls.

Expectation: New highs incoming as buyers regain control and push through previous resistance turned support.

Risk management is key - always use proper position sizing and stop losses.

This is not financial advice. Trade at your own risk.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.