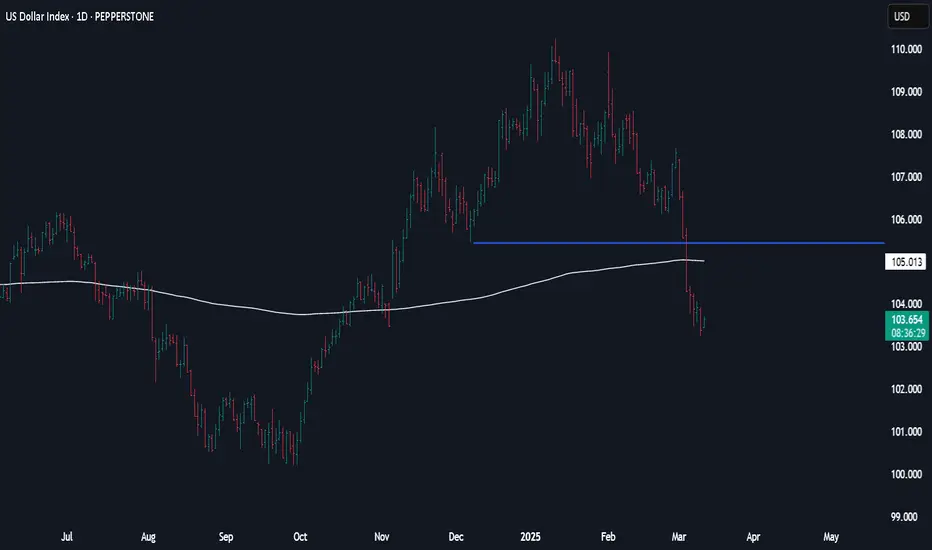

A fixation on US recession risks has reduced the likely potency of today’s US CPI release. In recent months, the market was fixated on US inflation, parsing some of the data to the third decimal point. Barring a notable outlier, today’s data is likely to be met with a shrug if it matches consensus expectations for a modest drift towards target at both the headline and core level. Instead, the market seems more inclined to fret that the US is somehow teetering on the brink of recession. President Trump’s bullish prognosis for the US economy provided some relief to risk appetite yesterday, but his reassurances came on the same day that he raised import taxes on steel and aluminium, so the market nervousness is likely to return. However, while Wall St. forecasts for US equity markets are on the retreat, it is less clear that economists’ forecasts for US GDP growth have shifted materially. This may also be the case at the Fed, which means the March FOMC (with its updated forecasts) could be critical.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

1. AccuTrade System:

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

tradingview.com/v/yDFPnb1J/

2. Signal Performance:

thedailyfx.com/performance/

3. Best Forex EA:

thedailyfx.com/beetle-ea/

4. Free Forex VPS:

myfxvps.com/get-it-free/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.