📈 Strategic CALL Entry on VISA (V) – All 20 Criteria Met

Today I’m entering a CALL option on Visa (V) based on a comprehensive analysis that aligns with all of our 20-entry criteria, combining technical indicators, fundamental strength, and disciplined risk management.

But beyond that, we are also factoring in key macroeconomic catalysts and upcoming earnings, which strengthen the setup and give us a clear path for growth.

🔍 Why Visa – and why now?

✅ Meets all 20 internal criteria, including:

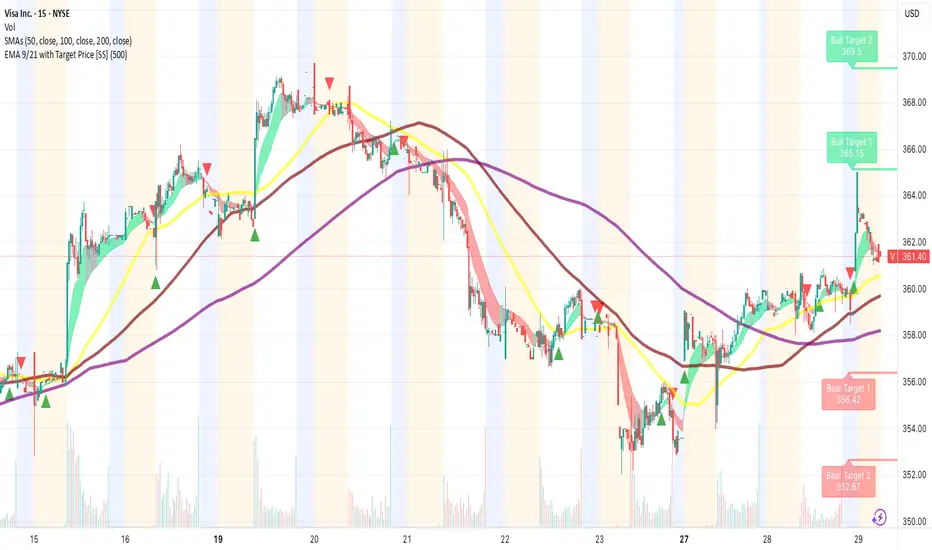

Price above both the 50- and 200-day moving averages (clear uptrend)

RSI in a healthy range (not overbought)

Volume confirms price action

Consistent earnings performance

Strong sector momentum (payments & fintech)

Sound risk-to-reward structure (<6% of portfolio risk)

Positive analyst sentiment

Solid balance sheet, low debt, global dominance, etc.

📊 Earnings expected in June

Visa is set to report earnings in June. Forecasts suggest strong performance backed by increasing digital transactions and resilient global spending. A positive surprise could trigger a sharp upward move.

🌍 Macroeconomic backdrop: US GDP data out today at 8:30 AM (EST)

GDP expectations stand at +2.2%. If confirmed, it signals continued economic strength — a bullish sign for consumer-facing companies like Visa that benefit directly from transaction volume growth.

💡 Why Visa stands out:

Stability

Steady growth

Low volatility

Strong technical and fundamental alignment

📌 Bottom line:

Visa not only checks all our boxes internally, but also benefits from a favorable macroeconomic context and key catalysts ahead. This is a high-conviction, low-emotion trade backed by structure, not hype.

Today I’m entering a CALL option on Visa (V) based on a comprehensive analysis that aligns with all of our 20-entry criteria, combining technical indicators, fundamental strength, and disciplined risk management.

But beyond that, we are also factoring in key macroeconomic catalysts and upcoming earnings, which strengthen the setup and give us a clear path for growth.

🔍 Why Visa – and why now?

✅ Meets all 20 internal criteria, including:

Price above both the 50- and 200-day moving averages (clear uptrend)

RSI in a healthy range (not overbought)

Volume confirms price action

Consistent earnings performance

Strong sector momentum (payments & fintech)

Sound risk-to-reward structure (<6% of portfolio risk)

Positive analyst sentiment

Solid balance sheet, low debt, global dominance, etc.

📊 Earnings expected in June

Visa is set to report earnings in June. Forecasts suggest strong performance backed by increasing digital transactions and resilient global spending. A positive surprise could trigger a sharp upward move.

🌍 Macroeconomic backdrop: US GDP data out today at 8:30 AM (EST)

GDP expectations stand at +2.2%. If confirmed, it signals continued economic strength — a bullish sign for consumer-facing companies like Visa that benefit directly from transaction volume growth.

💡 Why Visa stands out:

Stability

Steady growth

Low volatility

Strong technical and fundamental alignment

📌 Bottom line:

Visa not only checks all our boxes internally, but also benefits from a favorable macroeconomic context and key catalysts ahead. This is a high-conviction, low-emotion trade backed by structure, not hype.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.