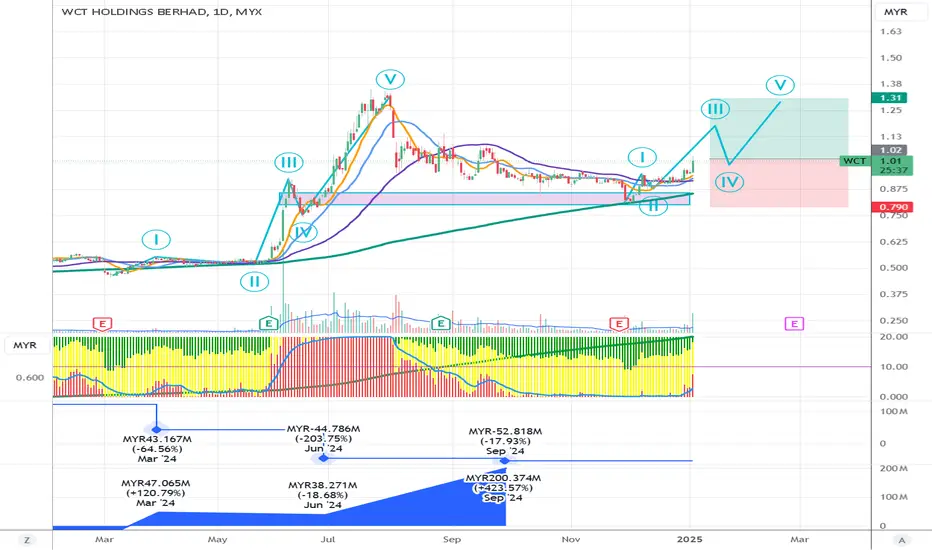

Looking at the chart for WCT Holdings Berhad, here's my analysis:

Current Price Action:

- Trading at RM1.00, down 2.91%

- Currently in consolidation after recent breakout

- Price above key moving averages indicating bullish trend

Elliott Wave Analysis:

- Completed waves I through IV

- Setting up for wave V move higher

- Wave V target projected around RM1.31

Key Technical Levels:

1. Support:

- Strong support at RM0.790 (wave IV low)

- Secondary support at RM0.875 (previous resistance turned support)

- Moving averages providing dynamic support around RM0.95

2. Resistance:

- Immediate resistance at RM1.06 (recent high)

- Major target at RM1.31 (wave V projection)

- Psychological level at RM1.00

Notable Events:

- September 2024: MYR-52.818M (-17.93%)

- June 2024: MYR-44.786M (-203.75%)

- MYR200.374M (-423.57%) significant movement in September

Trading Considerations:

- Currently testing support at moving averages

- Stop loss could be placed below RM0.90

- Risk/reward favorable for wave V target

- Volume profile showing potential accumulation

Current Price Action:

- Trading at RM1.00, down 2.91%

- Currently in consolidation after recent breakout

- Price above key moving averages indicating bullish trend

Elliott Wave Analysis:

- Completed waves I through IV

- Setting up for wave V move higher

- Wave V target projected around RM1.31

Key Technical Levels:

1. Support:

- Strong support at RM0.790 (wave IV low)

- Secondary support at RM0.875 (previous resistance turned support)

- Moving averages providing dynamic support around RM0.95

2. Resistance:

- Immediate resistance at RM1.06 (recent high)

- Major target at RM1.31 (wave V projection)

- Psychological level at RM1.00

Notable Events:

- September 2024: MYR-52.818M (-17.93%)

- June 2024: MYR-44.786M (-203.75%)

- MYR200.374M (-423.57%) significant movement in September

Trading Considerations:

- Currently testing support at moving averages

- Stop loss could be placed below RM0.90

- Risk/reward favorable for wave V target

- Volume profile showing potential accumulation

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.