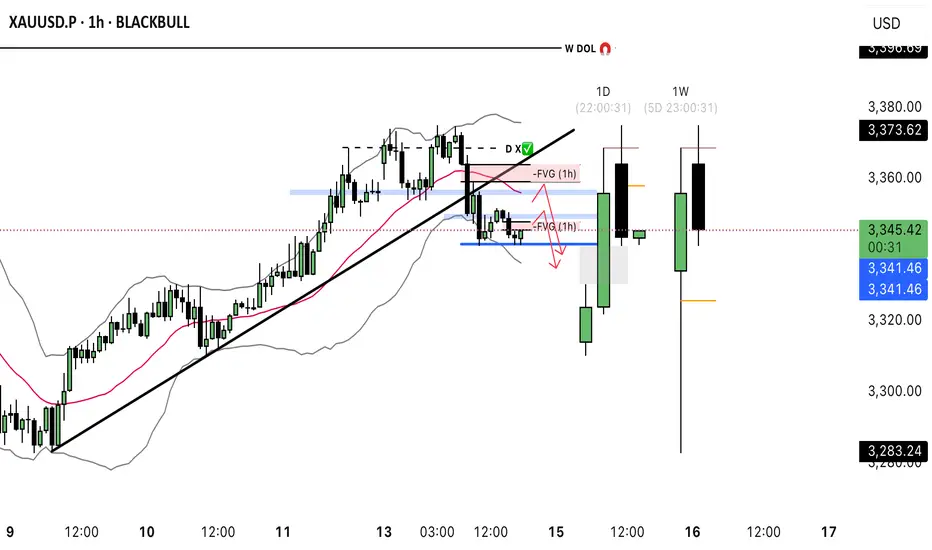

Gold-Are we going to expand lower or higher this week

Chart 1hour with daily and weekly overlay

(Indicator bollinger band 20,2)

Tonight is CPI and Inflation numbers

myfxbook.com/forex-economic-calendar

Chart 1hour with daily and weekly overlay

(Indicator bollinger band 20,2)

Tonight is CPI and Inflation numbers

myfxbook.com/forex-economic-calendar

Note

this is AI generatedThe U.S. Consumer Price Index (CPI) release is a significant economic event that can influence gold prices, primarily through its impact on inflation expectations, U.S. dollar strength, and Federal Reserve monetary policy outlooks. Below, I outline two scenarios based on whether the CPI comes in stronger or weaker than expected, drawing on economic principles and market dynamics observed in historical trends and recent analyses.[](investopedia.com/financial-edge/0311/what-drives-the-price-of-gold.aspx)[](reuters.com/markets/commodities/trump-policy-uncertainty-lifts-gold-us-data-focus-2025-01-14/)[](goldpriceforecast.com/explanations/cpi-gold/)

### Scenario 1: Stronger-Than-Expected CPI

- **CPI Outcome**: The CPI figure comes in higher than forecasted (e.g., above the expected 2.6% annual rate, perhaps at 2.8% or higher).

- **Impact on Gold Prices**:

- **Downward Pressure on Gold**: A stronger-than-expected CPI signals higher inflation, which could lead markets to anticipate a tighter Federal Reserve policy, such as delayed or reduced rate cuts, or even potential rate hikes. Higher interest rates increase the opportunity cost of holding non-yielding assets like gold, as investors may prefer interest-bearing assets like bonds.[](investopedia.com/financial-edge/0311/what-drives-the-price-of-gold.aspx)[](pimco.com/us/en/resources/education/understanding-gold-prices)[](learn.apmex.com/investing-guide/consumer-price-index-and-gold/)

- **Stronger U.S. Dollar**: A higher CPI often strengthens the U.S. dollar, as traders expect the Fed to maintain or increase rates to combat inflation. Since gold is priced in U.S. dollars, a stronger dollar makes gold more expensive for foreign buyers, reducing demand and exerting downward pressure on prices.[](investopedia.com/financial-edge/0311/what-drives-the-price-of-gold.aspx)[](learn.apmex.com/investing-guide/how-the-u-s-dollar-influences-precious-metals-prices/)[](investopedia.com/articles/forex/111015/how-cpi-affects-dollar-against-other-currencies.asp)

- **Market Sentiment**: Posts on X suggest that a higher CPI could "pressure gold" by reinforcing expectations of sustained high real yields, making gold less attractive in the short term.

- **Magnitude**: The extent of the price movement depends on how much the CPI exceeds expectations. A modest overrun (e.g., 2.7% vs. 2.6%) might lead to a mild decline in gold prices (e.g., 0.5–1% drop, potentially from $3,343/oz to around $3,320–$3,300/oz). A significant overrun (e.g., 3.0%) could trigger a sharper correction, possibly 1–2% or more, especially if markets adjust Fed rate cut expectations significantly.[](tradingeconomics.com/commodity/gold)

- **Caveats**: Gold’s role as a safe-haven asset could mitigate losses if the higher CPI is accompanied by geopolitical uncertainty or fears of stagflation, as investors might still flock to gold despite rising yields.[](investopedia.com/financial-edge/0311/what-drives-the-price-of-gold.aspx)[](gold.org/goldhub/research/gold-market-commentary-february-2025)

### Scenario 2: Weaker-Than-Expected CPI

- **CPI Outcome**: The CPI figure comes in lower than forecasted (e.g., below 2.6%, perhaps at 2.2% or lower).

- **Impact on Gold Prices**:

- **Upward Pressure on Gold**: A weaker-than-expected CPI suggests cooling inflation, increasing the likelihood of Federal Reserve rate cuts, possibly as early as September. Lower interest rates reduce the opportunity cost of holding gold, making it more attractive to investors.[](reuters.com/markets/commodities/trump-policy-uncertainty-lifts-gold-us-data-focus-2025-01-14/)[](nasdaq.com/articles/gold-prices-forecast:-will-upcoming-cpi-data-trigger-market-volatility)[](reuters.com/markets/commodities/gold-languishes-near-more-than-1-week-low-after-us-china-tariff-truce-2025-05-13/)

- **Weaker U.S. Dollar**: A softer CPI typically weakens the dollar, as markets anticipate looser monetary policy. A weaker dollar makes gold cheaper for foreign buyers, boosting demand and supporting higher prices.[](investopedia.com/financial-edge/0311/what-drives-the-price-of-gold.aspx)[](learn.apmex.com/investing-guide/how-the-u-s-dollar-influences-precious-metals-prices/)[](goldprice.org/gold-price-history.html)

- **Market Sentiment**: Recent X posts indicate that a weaker CPI could "trigger a breakout in gold above $3,375 toward $3,400+," reflecting bullish sentiment driven by expectations of a dovish Fed.

- **Magnitude**: A modestly weaker CPI (e.g., 2.4%) could push gold prices up by 0.5–1% (e.g., from $3,343/oz to $3,360–$3,375/oz). A significantly lower CPI (e.g., 2.0%) might spark a stronger rally, potentially 1–2% or more, especially if markets fully price in an imminent rate cut.[](tradingeconomics.com/commodity/gold)[](reuters.com/markets/commodities/gold-languishes-near-more-than-1-week-low-after-us-china-tariff-truce-2025-05-13/)

- **Caveats**: If the lower CPI is interpreted as a sign of economic weakness (e.g., potential recession), gold could see even stronger demand as a safe-haven asset, amplifying the price increase. However, if the market perceives the Fed as overly dovish, leading to concerns about currency devaluation, gold could benefit further as a hedge.[](investopedia.com/financial-edge/0311/what-drives-the-price-of-gold.aspx)[](chicagofed.org/publications/chicago-fed-letter/2021/464)

### Additional Considerations

- **Real Yields**: Gold prices are closely tied to real yields (nominal interest rates minus inflation). A stronger CPI could increase real yields if the Fed signals tighter policy, pressuring gold prices. Conversely, a weaker CPI could lower real yields, supporting gold.[](pimco.com/us/en/resources/education/understanding-gold-prices)[](pimco.com/hk/en/resources/education/understanding-gold-prices)

- **Geopolitical and Structural Factors**: Gold’s price is not solely driven by CPI. Geopolitical risks, central bank buying (forecasted at 900 tonnes in 2025), and ETF demand can offset CPI-driven pressures. For instance, sustained central bank purchases or trade war fears could limit downside risks in a high-CPI scenario.[](jpmorgan.com/insights/global-research/commodities/gold-prices)[](gold.org/goldhub/research/gold-market-commentary-february-2025)

- **Historical Context**: Gold’s relationship with CPI is not always consistent. While it’s often seen as an inflation hedge, moderate inflation changes may not significantly impact prices unless real yields shift dramatically.[](goldpriceforecast.com/explanations/cpi-gold/)[](blogs.cfainstitute.org/investor/2024/06/05/gold-and-inflation-an-unstable-relationship/)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.