7.28 Gold Analysis

📉 1. Daily Market Overview

Gold opened low at 3322 due to the impact of the 15% unified tariff agreement reached between the United States and Europe, but quickly rebounded to around 3340 US dollars, indicating a fierce game between long and short positions. After a three-day plunge of nearly 130 US dollars, the short-term potential was exhausted and the market entered a shock repair phase.

🌍 2. Core driving logic

1. Negative pressure

Safe-haven demand receded: The progress of trade negotiations between the United States and Europe, the United States and Japan, and the United States and the Philippines weakened the safe-haven appeal of gold;

US dollar resilience: The rebound in risk appetite drove the rebound of the US dollar and suppressed the pricing cost of gold.

2. Potential support

Technical oversold: There is a demand for rebound repair after a three-day sharp drop;

Event outlook: The market bets in advance that the Federal Reserve’s decision on Wednesday and the non-agricultural data on Friday may release dovish signals.

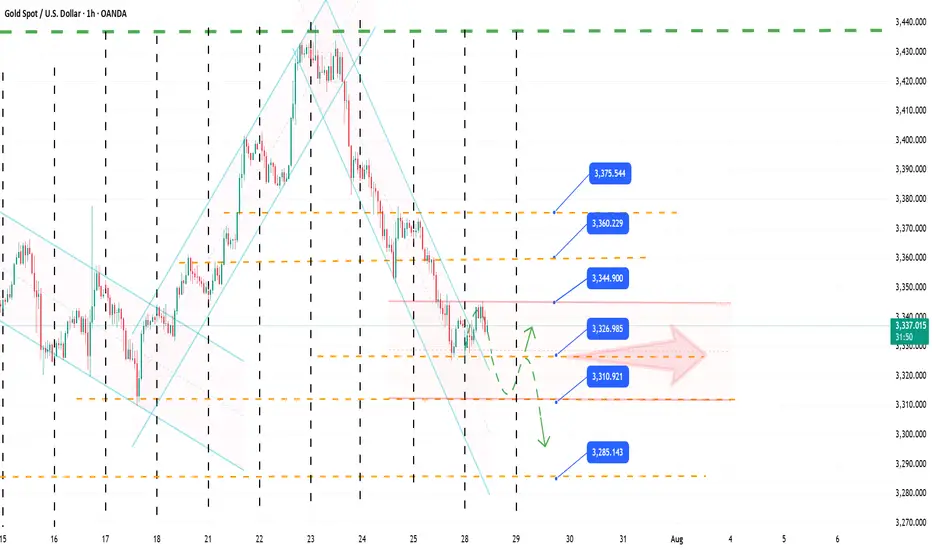

📊 3. Key technical positions

Pressure above:

▶ 3350-3370 USD (suppression by daily moving average + previous high resistance), safe high altitude area;

▶ A breakthrough requires a major catalyst (such as the Fed's unexpectedly dovish stance).

Support below:

▶ 3310 USD (lower edge of the daily range), the watershed between long and short positions at the beginning of the week;

▶ 3300-3290 USD (strong psychological barrier), a break may trigger a deep correction.

The pattern suggests: the opening "bottoming out and rebounding" establishes the core shock range of 3320-3340 USD.

🚨 4. Risk event axis this week

Wednesday ⏩ Small non-farm ADP ⏩ Non-farm forward signal

Thursday ⏩ Fed resolution + Powell speech ⏩ Core focus! Policy path set

Friday ⏩Non-farm employment + PCE inflation⏩ determines the probability of a rate cut in September

★ Key logic: If the Fed hints at a rate cut or non-farm is weak, it will suppress the US dollar and trigger gold bulls; on the contrary, strengthening the expectation of a rate hike will be bearish for gold prices.

💡 V. Operation strategy

1. At the beginning of this week (7/28-7/30):

Oscillation range: 3310-3340 US dollars, sell high and buy low, stop loss 5 US dollars;

Long order conditions: 3310 is not broken, try long with a light position, target 3340-3350;

Short order conditions: 3340-3350 area is under pressure to arrange short orders.

2. Mid-week turning event trading:

Conservatives: Clear positions and wait and see before Wednesday to avoid policy uncertainty;

Radicals: Break through 3345 to chase long (target 3400), break below 3305 to chase short (target 3285).

Tip: The real key to breaking the deadlock lies in Powell's hands - every word he says will ignite the market fuse.

❤️Be cautious when trading and control the risks! I wish you a smooth transaction!

📉 1. Daily Market Overview

Gold opened low at 3322 due to the impact of the 15% unified tariff agreement reached between the United States and Europe, but quickly rebounded to around 3340 US dollars, indicating a fierce game between long and short positions. After a three-day plunge of nearly 130 US dollars, the short-term potential was exhausted and the market entered a shock repair phase.

🌍 2. Core driving logic

1. Negative pressure

Safe-haven demand receded: The progress of trade negotiations between the United States and Europe, the United States and Japan, and the United States and the Philippines weakened the safe-haven appeal of gold;

US dollar resilience: The rebound in risk appetite drove the rebound of the US dollar and suppressed the pricing cost of gold.

2. Potential support

Technical oversold: There is a demand for rebound repair after a three-day sharp drop;

Event outlook: The market bets in advance that the Federal Reserve’s decision on Wednesday and the non-agricultural data on Friday may release dovish signals.

📊 3. Key technical positions

Pressure above:

▶ 3350-3370 USD (suppression by daily moving average + previous high resistance), safe high altitude area;

▶ A breakthrough requires a major catalyst (such as the Fed's unexpectedly dovish stance).

Support below:

▶ 3310 USD (lower edge of the daily range), the watershed between long and short positions at the beginning of the week;

▶ 3300-3290 USD (strong psychological barrier), a break may trigger a deep correction.

The pattern suggests: the opening "bottoming out and rebounding" establishes the core shock range of 3320-3340 USD.

🚨 4. Risk event axis this week

Wednesday ⏩ Small non-farm ADP ⏩ Non-farm forward signal

Thursday ⏩ Fed resolution + Powell speech ⏩ Core focus! Policy path set

Friday ⏩Non-farm employment + PCE inflation⏩ determines the probability of a rate cut in September

★ Key logic: If the Fed hints at a rate cut or non-farm is weak, it will suppress the US dollar and trigger gold bulls; on the contrary, strengthening the expectation of a rate hike will be bearish for gold prices.

💡 V. Operation strategy

1. At the beginning of this week (7/28-7/30):

Oscillation range: 3310-3340 US dollars, sell high and buy low, stop loss 5 US dollars;

Long order conditions: 3310 is not broken, try long with a light position, target 3340-3350;

Short order conditions: 3340-3350 area is under pressure to arrange short orders.

2. Mid-week turning event trading:

Conservatives: Clear positions and wait and see before Wednesday to avoid policy uncertainty;

Radicals: Break through 3345 to chase long (target 3400), break below 3305 to chase short (target 3285).

Tip: The real key to breaking the deadlock lies in Powell's hands - every word he says will ignite the market fuse.

❤️Be cautious when trading and control the risks! I wish you a smooth transaction!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.