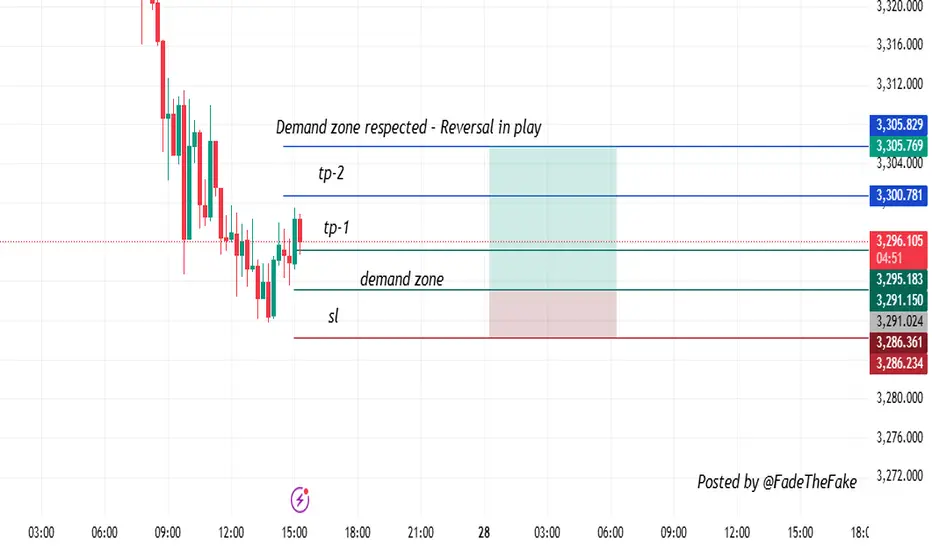

Price aggressively broke down recently but showed strong reaction near the 3,280–3,290 demand zone, reflecting potential buyer absorption at lower prices. Following several bearish attempts that failed, price started making higher lows, reflecting a change in short-term structure.

Trade Idea:

Expecting a bullish reversal from this demand zone with a clean RR setup.

Entry Zone: 3,290–3,292 (bullish confirmation candle or wick rejection)

Stop Loss: 3,280 (below liquidity sweep & structure low)

Take Profit Targets:

• TP1: 3,300 – intraday bounce zone

• TP2: 3,305 – mid-level resistance

• TP3: 3,310 – structural breakout area

Why this setup?

✅ Structure shift (higher lows)

✅ Demand zone tapped with strong wick rejection

✅ Clean RR with risk tightly managed

✅ No major macro resistance until 3,310

Risk Note:

Steer clear of early entries without confirmation. If price doesn't hold above 3,288, bearish continuation is still in play.

Trade Idea:

Expecting a bullish reversal from this demand zone with a clean RR setup.

Entry Zone: 3,290–3,292 (bullish confirmation candle or wick rejection)

Stop Loss: 3,280 (below liquidity sweep & structure low)

Take Profit Targets:

• TP1: 3,300 – intraday bounce zone

• TP2: 3,305 – mid-level resistance

• TP3: 3,310 – structural breakout area

Why this setup?

✅ Structure shift (higher lows)

✅ Demand zone tapped with strong wick rejection

✅ Clean RR with risk tightly managed

✅ No major macro resistance until 3,310

Risk Note:

Steer clear of early entries without confirmation. If price doesn't hold above 3,288, bearish continuation is still in play.

Unlock your winning setups Grab them FREE and level up your trades! 🔥 No strings attached, just pure profit potential! t.me/+MHVk0E7vVpxiOTc8

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Unlock your winning setups Grab them FREE and level up your trades! 🔥 No strings attached, just pure profit potential! t.me/+MHVk0E7vVpxiOTc8

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.