Good morning folks,

TheTradingRoom here,

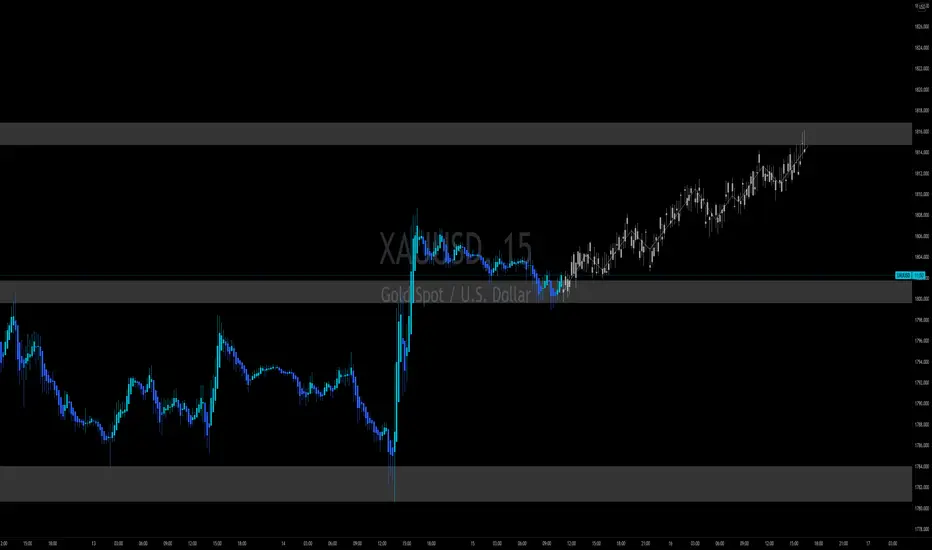

Yesterday saw safehaven capital flow from the USD into Gold as the United States CPI data came in at a miss across the board.

CPI data can have both a positive and negative affect at the same time in our financial markets given that CPI is a strong indication of inflation which is actually a sign (should data come out higher than forecasted) as a strengthening economy. However, countries combat inflation by tightening monetary policy and raising interest rates which makes investing in something like the stock market, more expensive which puts investors off investing and puts them on the side of saving instead which has a negative affect on the stock market.

However, in yesterdays case, as explained above, the CPI data missed expectations which sent the USD down and in turn, sent Gold higher.

What we are expecting no as a continuation with this momentum in Gold looking for potential key levels above price at approximately 1812-1816 which has been previously used as an equilibrium zone.

Should the USD decline lower to 92.200 and beyond, we believe Gold could make it even higher.

Wait for a breakout of the descending level positioned at approximately 1804 before considering your long triggers and ride the wave to the key level above.

There is a road block situated at approximately 1808.00 which could cause price to stumble.

Good luck out there!

TheTradingRoom here,

Yesterday saw safehaven capital flow from the USD into Gold as the United States CPI data came in at a miss across the board.

CPI data can have both a positive and negative affect at the same time in our financial markets given that CPI is a strong indication of inflation which is actually a sign (should data come out higher than forecasted) as a strengthening economy. However, countries combat inflation by tightening monetary policy and raising interest rates which makes investing in something like the stock market, more expensive which puts investors off investing and puts them on the side of saving instead which has a negative affect on the stock market.

However, in yesterdays case, as explained above, the CPI data missed expectations which sent the USD down and in turn, sent Gold higher.

What we are expecting no as a continuation with this momentum in Gold looking for potential key levels above price at approximately 1812-1816 which has been previously used as an equilibrium zone.

Should the USD decline lower to 92.200 and beyond, we believe Gold could make it even higher.

Wait for a breakout of the descending level positioned at approximately 1804 before considering your long triggers and ride the wave to the key level above.

There is a road block situated at approximately 1808.00 which could cause price to stumble.

Good luck out there!

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.