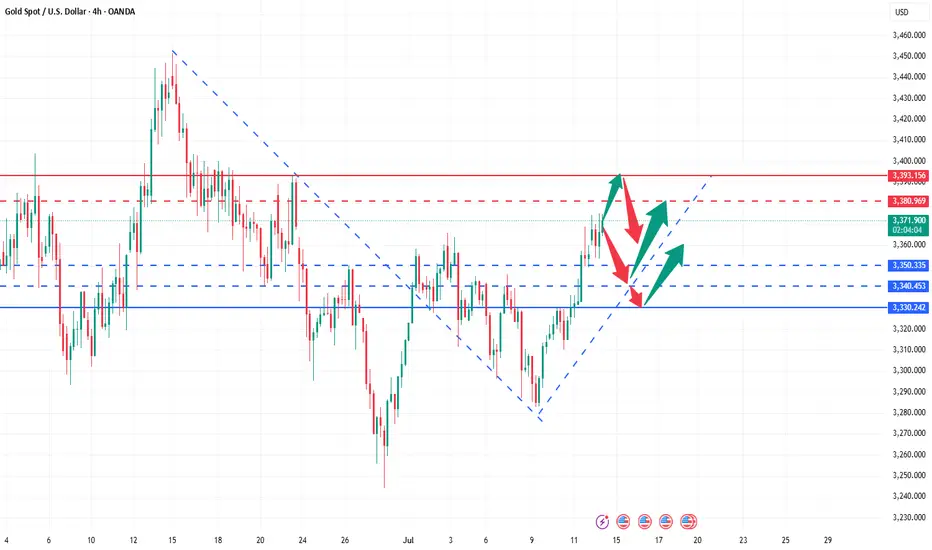

Last Friday, gold continued to rise strongly, breaking through 3320 in the Asia-Europe session and accelerating its rise. The European session broke through the 3340 mark continuously. The US session broke through 3369 and then fell back. The daily line closed with a big positive line. It broke through the high for three consecutive days and returned to above 3360. The unilateral bullish pattern was re-established. Today, the gold price jumped high and broke through 3370 and then fluctuated at a high level. Although it rushed up, the strength was limited. It must be adjusted after a short-term retracement before it can continue to rise. Therefore, in terms of operation, we continue to maintain the main idea of retreating and multiplying. Pay attention to the 3340-3345 area for short-term support during the day, and look at the 3330 line for strong support. If it does not break, it will continue to be a good opportunity to buy low and do more. Taking advantage of the trend is still the current main tone. As long as the daily level does not break 3330, the bullish structure will not be destroyed.

🔹Support focus: 3340-3345, key support level 3330

🔹Resistance focus: 3380-3393 area

[Operation strategy reference]

1️⃣ If the price falls back to 3340-3350, a light long position will be intervened, with the target of 3365-3370. A strong breakthrough can see a new high;

2️⃣ If the price rises to 3380-3393 and is under pressure, a short-term short position adjustment can be tried, with a short-term target of around 3360.

The specific real-time points and position arrangements will be updated at the bottom. Interested friends are advised to pay attention to my strategy tips in a timely manner and seize every opportunity reasonably.

🔹Support focus: 3340-3345, key support level 3330

🔹Resistance focus: 3380-3393 area

[Operation strategy reference]

1️⃣ If the price falls back to 3340-3350, a light long position will be intervened, with the target of 3365-3370. A strong breakthrough can see a new high;

2️⃣ If the price rises to 3380-3393 and is under pressure, a short-term short position adjustment can be tried, with a short-term target of around 3360.

The specific real-time points and position arrangements will be updated at the bottom. Interested friends are advised to pay attention to my strategy tips in a timely manner and seize every opportunity reasonably.

Trade active

At present, the price of gold is fluctuating downward in the short term. Although the overall trend is still bullish, from a technical point of view, the price is expected to make a technical correction after the continuous upward surge. At this time, it is best not to blindly chase highs, and long orders need to be carefully arranged. The key is to wait for reasonable low-level signals to be confirmed. The bullish structure is still there, but the rhythm needs to wait for the retracement to confirm the support; the key support level focuses on the 3340-3345 area, and the strong support is 3330; before the stabilization signal appears, keep waiting and try with a light position; the real good opportunity often appears when most people "can't see clearly".Trading is not impulsive, but waiting for the rhythm to step on is more important than the direction. The strategy focuses on execution, and position control and entry timing are the core. If you want to grasp this wave of gold rhythm, it is recommended to continue to pay attention to strategy updates, and wait for the market to "give a position" before we follow up decisively.

Trade closed: target reached

This round of gold trend has once again verified the effectiveness of the strategy prediction. The key support point near 3340 accurately triggered the long-order layout. Then the market rebounded upward as expected. The current position has a steady floating profit, and the overall rhythm is highly consistent with the deployment. The core of trading has never been just predicting the direction, but whether it can intervene decisively in key areas, wait patiently in the rhythm, and advance steadily in floating profits. The market often rewards those who are prepared, rather than emotional traders who chase ups and downs at the last minute. The real advantage is not "seeing more than others", but whether you can execute what you can see clearly. Behind every successful entry is the advance deployment of strategies and the adherence to discipline. If the rhythm is right, profits are just the result of following the trend. The market is not that complicated, but human nature is complicated. Stay calm, execute firmly, and opportunities will naturally belong to you.I treat every partner with my best efforts. I do not promise huge profits, but only pursue replicable and stable profits. Many people are already on this path, and you can too.Free witness telegram group t.me/TP_Daniel1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I treat every partner with my best efforts. I do not promise huge profits, but only pursue replicable and stable profits. Many people are already on this path, and you can too.Free witness telegram group t.me/TP_Daniel1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.