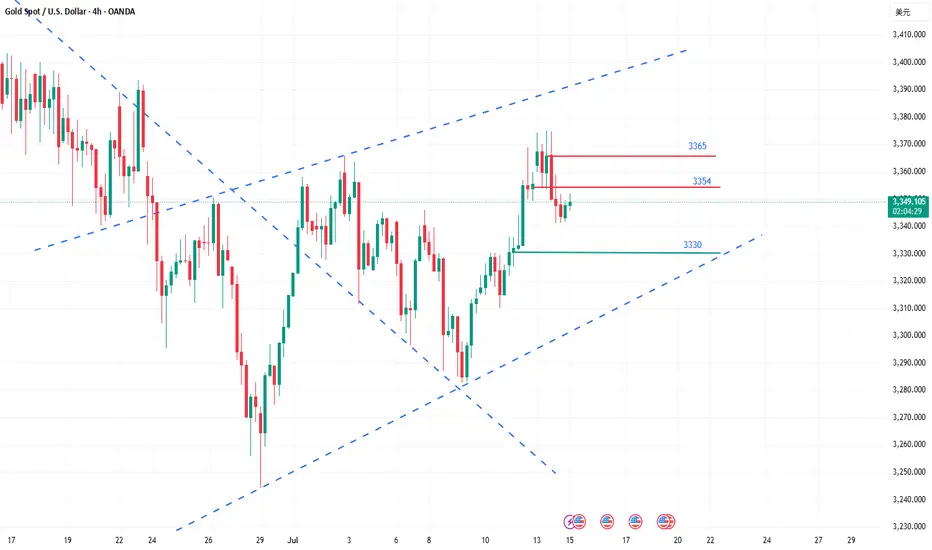

Yesterday, gold tested the 3375 line several times but failed to break through effectively. The selling pressure on the market was obvious, and the price immediately fell back, reaching a low of around 3341. The daily line closed with a long upper shadow, indicating that the bullish momentum has weakened and the short-term market has entered an adjustment phase. From the perspective of the 4-hour cycle, the continuous negative trend has led to the gradual closing of the Bollinger Bands, and the middle track position has temporarily gained support, but the overall market is volatile and weak. Today, we will focus on the 3354 watershed. If the rebound fails to effectively stand at this position, the pressure on the upper side will still be strong, and there is a risk of a short-term decline.

Key technical positions: upper resistance: 3365, 3354, lower support: 3340, 3330. In terms of operation rhythm, it is recommended to deal with it with a high-selling and low-buying, oscillating approach, and maintain flexible adjustments.

The operation suggestions are as follows: You can choose to short in the 3360-3365 area, with the target around 3350 and 3340; if the rebound is blocked below 3354, you can also enter the short order in advance. It is recommended to enter and exit quickly in the short-term weak market; strictly control the stop loss to avoid risks caused by sudden changes in the market.

The current market is obviously volatile, so don't blindly chase the rise and fall. It is particularly important to operate around the key pressure and support areas. The grasp of the rhythm will determine the final profit, and steady trading is the kingly way.

Key technical positions: upper resistance: 3365, 3354, lower support: 3340, 3330. In terms of operation rhythm, it is recommended to deal with it with a high-selling and low-buying, oscillating approach, and maintain flexible adjustments.

The operation suggestions are as follows: You can choose to short in the 3360-3365 area, with the target around 3350 and 3340; if the rebound is blocked below 3354, you can also enter the short order in advance. It is recommended to enter and exit quickly in the short-term weak market; strictly control the stop loss to avoid risks caused by sudden changes in the market.

The current market is obviously volatile, so don't blindly chase the rise and fall. It is particularly important to operate around the key pressure and support areas. The grasp of the rhythm will determine the final profit, and steady trading is the kingly way.

Trade active

Since we have come to the market, we must have the courage to fight the market. Cowardice will only make us retreat further. Only by moving forward bravely can we get what we want. Trading is tortuous and not so smooth. I think many people see through the beauty outside, but find out why the risks are always so great? Because they don't see the reality clearly! We can't change the risks of the market, but we can control the risks. Since I entered this market, I have always kept my original intention. Only by controlling the risks can we make profits, but as long as we can seriously grasp the opportunities and adhere to the correct trading logic, we can quickly turn losses into profits. Without a perfect system, once is a fluke, twice is also a fluke, and in the end, we will only face losses!Trade closed: target reached

Brothers who stick to the trading plan, the current gold short position has been held for a long time, and has been fluctuating in a narrow range around 3360, but the overall downward force has always been weak. At this stage, the market has finally fluctuated slightly. For brothers who stick to the strategy, it has fallen to around 3353 as expected, and the short position has the opportunity to fall back to the 3350-3340 area. It is recommended that short positions in this round can be closed and profited in time. The current market rhythm is slow, and long-term holding is not conducive to capital efficiency. Next, we will re-find a better entry point according to market changes, patiently wait for new opportunities, avoid invalid positions, execute strategies, respect the rhythm, lock in profits is the key, and wait for the next round of clear opportunities to intervene again.I treat every partner with my best efforts. I do not promise huge profits, but only pursue replicable and stable profits. Many people are already on this path, and you can too.Free witness telegram group t.me/TP_Daniel1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I treat every partner with my best efforts. I do not promise huge profits, but only pursue replicable and stable profits. Many people are already on this path, and you can too.Free witness telegram group t.me/TP_Daniel1

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.