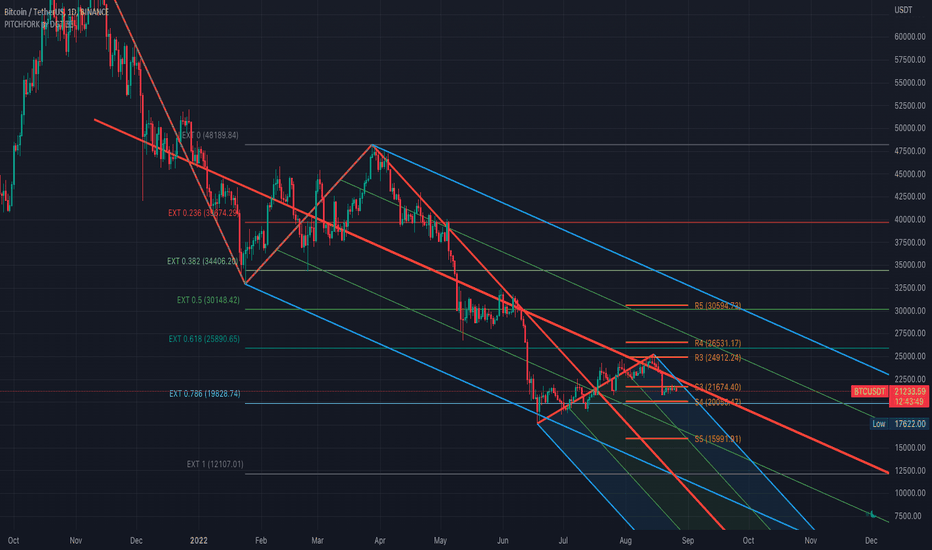

The Raff Regression Channel (RRC)

The Raff Regression Channel, developed by Gilbert Raff, is based on a linear regression, which is the least-squares line-of-best-fit for a price series, with evenly spaced trend lines above and below. The width of the channel is set by determining the high or low that is the furthest from the linear regression.

Because the channel distance is based off the largest pullback or highest peak within a trend, for effectively drawing and using a Raff Regression Channel it is recommend/required that a Raff Regression Channel is applied to “mature” trends.

Once The Raff Regression Channel is drawn, covering an existing trend, EXTENSION LINES are drawn to identify support, resistance, reversal points, mean reversion

Effectively drawing and using a Raff Regression Channel

The trend is up as long as prices rise within this channel. An uptrend may be reversing (not always, but likely) when price breaks below the channel extension. The trend is down as long as prices decline within the channel. Similarly, a downtrend may be reversing (not always, but likely) when price breaks above the channel extension. Moves outside the channel extensions can be indication of a reversal or can denote overbought or oversold conditions

breakout example

reversal example

█ LINK to AUTOMATED INDICATOR VERSION of RAFF REGRESSION CHANNEL

█ OTHER CHANNEL CONSEPTS

Linear Regression Channels,

Fibonacci Channels,

Andrews’ Pitchfork,

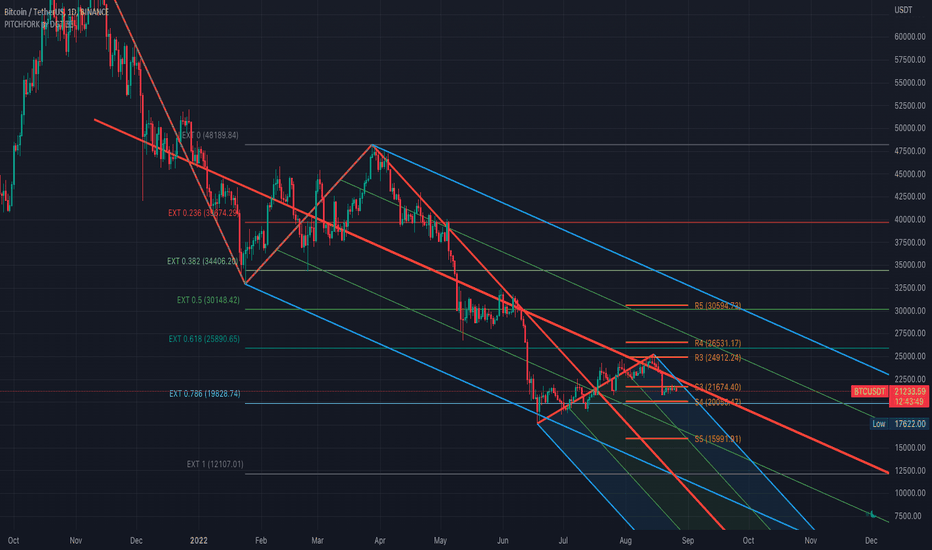

The Raff Regression Channel, developed by Gilbert Raff, is based on a linear regression, which is the least-squares line-of-best-fit for a price series, with evenly spaced trend lines above and below. The width of the channel is set by determining the high or low that is the furthest from the linear regression.

Because the channel distance is based off the largest pullback or highest peak within a trend, for effectively drawing and using a Raff Regression Channel it is recommend/required that a Raff Regression Channel is applied to “mature” trends.

Once The Raff Regression Channel is drawn, covering an existing trend, EXTENSION LINES are drawn to identify support, resistance, reversal points, mean reversion

Effectively drawing and using a Raff Regression Channel

The trend is up as long as prices rise within this channel. An uptrend may be reversing (not always, but likely) when price breaks below the channel extension. The trend is down as long as prices decline within the channel. Similarly, a downtrend may be reversing (not always, but likely) when price breaks above the channel extension. Moves outside the channel extensions can be indication of a reversal or can denote overbought or oversold conditions

breakout example

reversal example

█ LINK to AUTOMATED INDICATOR VERSION of RAFF REGRESSION CHANNEL

█ OTHER CHANNEL CONSEPTS

Linear Regression Channels,

Fibonacci Channels,

Andrews’ Pitchfork,

Our Premium Indicators: sites.google.com/view/solemare-analytics

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Our Premium Indicators: sites.google.com/view/solemare-analytics

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.