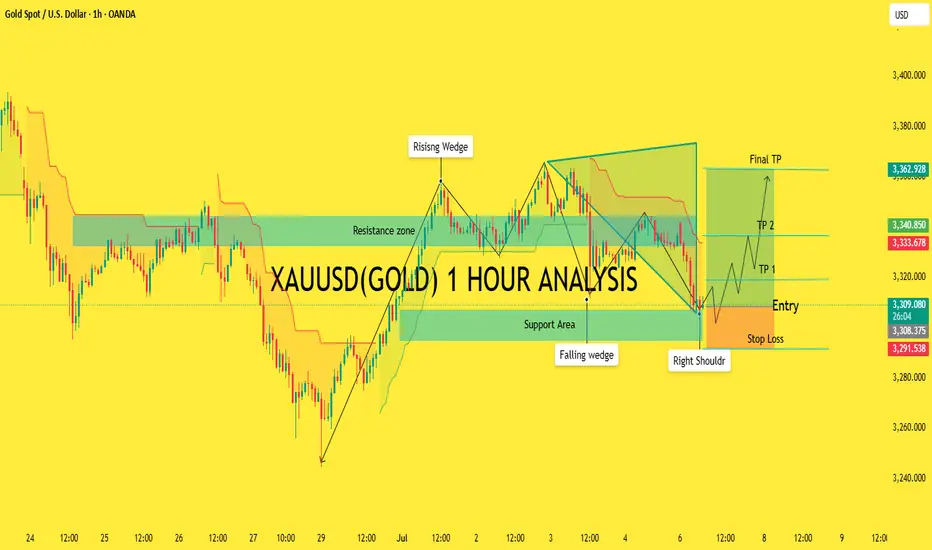

May be consolidation market bullish in uptrend .

Market Structure:

After a downtrend, price formed a falling wedge, followed by a potential inverse head and shoulders pattern (bullish reversal pattern).

Entry Zone: Marked just above the support area, right shoulder, and falling wedge breakout.

Targets:

TP1: ~3,332.545

TP2: ~3,340.850

Final TP: ~3,362.928

Stop Loss: Below the recent low (~3,291.538)

✅ Strengths in the Analysis

1. Multiple Bullish Patterns:

Falling Wedge (bullish reversal).

Inverse Head and Shoulders (strong reversal indication)

2. Well-defined Entry/Exit Levels:

Clear Entry, SL, and TP points.

3. Support Area Holds:

Price bounced from a strong historical support zone.

4. Confluence with Resistance Break:

If price breaks above the neckline (Entry), it confirms the bullish reversal.

📈 Trade Management Tips

Trail Your Stop: After TP1, move stop loss to break-even.

Partial Take Profits: Scale out at each TP level.

Watch for Fakeouts: Falling wedge breakouts can sometimes retrace before running

🔧 Suggestions for Improvement

1. Volume Confirmation:

Consider adding volume to confirm the breakout, especially from the falling wedge and neckline of the inverse H&S.

2. Ichimoku Context:

You are using part of the Ichimoku Cloud. It would help to clearly interpret it:

Is the price breaking above the cloud?

Are Tenkan-sen and Kijun-sen bullish aligned?

3. Candle Confirmation for Entry:

Wait for a strong bullish candle (engulfing or breakout) before entering.

4. Risk-Reward Ratio:

The RR looks good (~2.5:1), but clarify it in text for better decision-making.

5. Fundamental Context:

Consider macro factors affecting gold (e.g., USD strength, interest rates, geopolitical news).

🧠 Summary

You're trading a bullish reversal setup based on multiple chart patterns and a bounce off a key support zone. This is a well-structured plan with solid technical justification. Just ensure proper confirmation before entry and maintain discipline with risk management.

Market Structure:

After a downtrend, price formed a falling wedge, followed by a potential inverse head and shoulders pattern (bullish reversal pattern).

Entry Zone: Marked just above the support area, right shoulder, and falling wedge breakout.

Targets:

TP1: ~3,332.545

TP2: ~3,340.850

Final TP: ~3,362.928

Stop Loss: Below the recent low (~3,291.538)

✅ Strengths in the Analysis

1. Multiple Bullish Patterns:

Falling Wedge (bullish reversal).

Inverse Head and Shoulders (strong reversal indication)

2. Well-defined Entry/Exit Levels:

Clear Entry, SL, and TP points.

3. Support Area Holds:

Price bounced from a strong historical support zone.

4. Confluence with Resistance Break:

If price breaks above the neckline (Entry), it confirms the bullish reversal.

📈 Trade Management Tips

Trail Your Stop: After TP1, move stop loss to break-even.

Partial Take Profits: Scale out at each TP level.

Watch for Fakeouts: Falling wedge breakouts can sometimes retrace before running

🔧 Suggestions for Improvement

1. Volume Confirmation:

Consider adding volume to confirm the breakout, especially from the falling wedge and neckline of the inverse H&S.

2. Ichimoku Context:

You are using part of the Ichimoku Cloud. It would help to clearly interpret it:

Is the price breaking above the cloud?

Are Tenkan-sen and Kijun-sen bullish aligned?

3. Candle Confirmation for Entry:

Wait for a strong bullish candle (engulfing or breakout) before entering.

4. Risk-Reward Ratio:

The RR looks good (~2.5:1), but clarify it in text for better decision-making.

5. Fundamental Context:

Consider macro factors affecting gold (e.g., USD strength, interest rates, geopolitical news).

🧠 Summary

You're trading a bullish reversal setup based on multiple chart patterns and a bounce off a key support zone. This is a well-structured plan with solid technical justification. Just ensure proper confirmation before entry and maintain discipline with risk management.

Trade active

congratullation guys our TP 1 hit around 120+PIPS in profit .Best Analysis xauusd single

t.me/+SAB5y_Kpm8RjYjlk

VIP PREMIMUM ANALYSIS ROOM SIGNALS

t.me/+SAB5y_Kpm8RjYjlk

t.me/+SAB5y_Kpm8RjYjlk

VIP PREMIMUM ANALYSIS ROOM SIGNALS

t.me/+SAB5y_Kpm8RjYjlk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Best Analysis xauusd single

t.me/+SAB5y_Kpm8RjYjlk

VIP PREMIMUM ANALYSIS ROOM SIGNALS

t.me/+SAB5y_Kpm8RjYjlk

t.me/+SAB5y_Kpm8RjYjlk

VIP PREMIMUM ANALYSIS ROOM SIGNALS

t.me/+SAB5y_Kpm8RjYjlk

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.