Market review

On Thursday (July 17) in the early Asian session, spot gold traded in a narrow range at $3346.50/ounce. The overnight market was dominated by news, and gold prices staged a "roller coaster" market: in the early New York market, it fell to an intraday low of $3319.58 due to the strengthening of the US dollar, and then soared by $50 to a three-week high of $3377.17 due to rumors that "Trump may fire Powell." As Trump refuted the rumors, gold prices gave up some of their gains and finally closed up 0.68% at $3347.38.

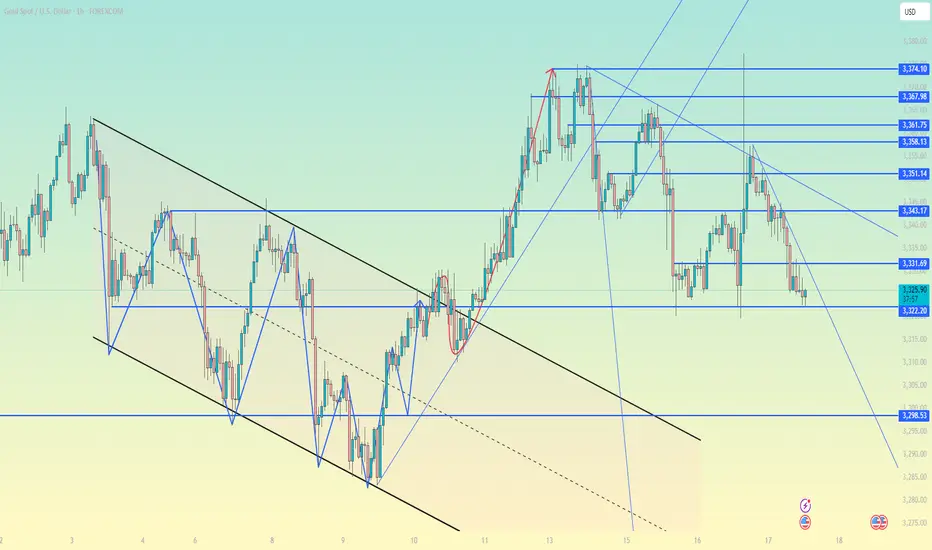

Technical analysis

Daily level

Range fluctuations: Prices continue to be limited to the $3320-3375 range, three times probing 3375 without breaking, and two times testing 3320 for support.

Indicator signal: KDJ is blunted, MACD double lines are glued together, and MA5-MA10 golden cross suggests a potential upward trend, but insufficient momentum restricts the unilateral market.

4-hour level

Short-term pressure: KDJ turns downward after golden cross, MACD dead cross continues, and the green kinetic energy column shows the need for callback.

Key position: Pay attention to the support of 3320 (lower track of Bollinger band) below, and look down to 3300-3285 if it breaks; the upper resistance is still 3375.

Operation suggestions

Strategy: Mainly low and long within the range, go long at 3320-3322 for the first time, stop loss at 3312, and target 3340-3350.

Risk warning: If it breaks through 3375 or breaks below 3320, be alert to the start of trend market.

Free Signals:t.me/+CXftl_-QHEo2Yzc0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals:t.me/+CXftl_-QHEo2Yzc0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.