Gold Weekly Review: Risk aversion supports gold prices to remain stable, and the focus next week will be on the Fed and tariff trends

This week, the gold market maintained a volatile trend under the dual support of a weaker dollar and geopolitical uncertainty. Spot gold finally closed at $3,353.25 per ounce, basically stabilizing around $3,350 during the week. Although the market once fluctuated due to the issue of whether Fed Chairman Powell would stay or go, safe-haven demand still provided solid bottom support for gold prices.

1. Weak dollar + geopolitical risks, gold received safe-haven buying

Due to lingering market concerns about global economic growth and the decline in U.S. bond yields, the U.S. dollar index was under pressure this week, providing upward momentum for gold. In addition, the uncertainty of the geopolitical situation - including the Iranian issue, the attack on the oil fields in Kurdistan, Iraq, and the continued fermentation of trade frictions between the United States and Europe and the United States and Japan - further consolidated gold's safe-haven status.

2. The shadow of the trade war lingers, and the IMF warns of economic risks

Although the US retail sales and unemployment data in June were strong, showing economic resilience, trade tensions remain the biggest source of uncertainty in the market. Tariff negotiations between the United States and Indonesia, Japan and the European Union are still ongoing, and the Trump administration's insistence on imposing high tariffs on EU cars has exacerbated market concerns about the global trade environment.

The International Monetary Fund (IMF) warned again this week that trade frictions remain the main downside risk to the global economy and may slightly raise growth expectations at the end of July, but the overall outlook remains unclear. If the trade situation worsens, the safe-haven properties of gold will be magnified again.

3. The internal divisions of the Federal Reserve have intensified, and the expectation of interest rate cuts remains uncertain

The most dramatic market episode this week was the rumor that "Powell may be fired." Although Trump quickly denied it, the incident exposed the tension between the White House and the Federal Reserve. What is more noteworthy is that the differences within the Federal Reserve on interest rate cuts are widening-board members Waller and Bowman have expressed support for interest rate cuts, while other members may still be cautious.

If two directors vote against the July FOMC meeting, it will be a rare disagreement since 1993, which may exacerbate market volatility. At present, the market is still betting that the Fed will cut interest rates in September, but if economic data remains strong, this expectation may be postponed, thus limiting the upside of gold prices.

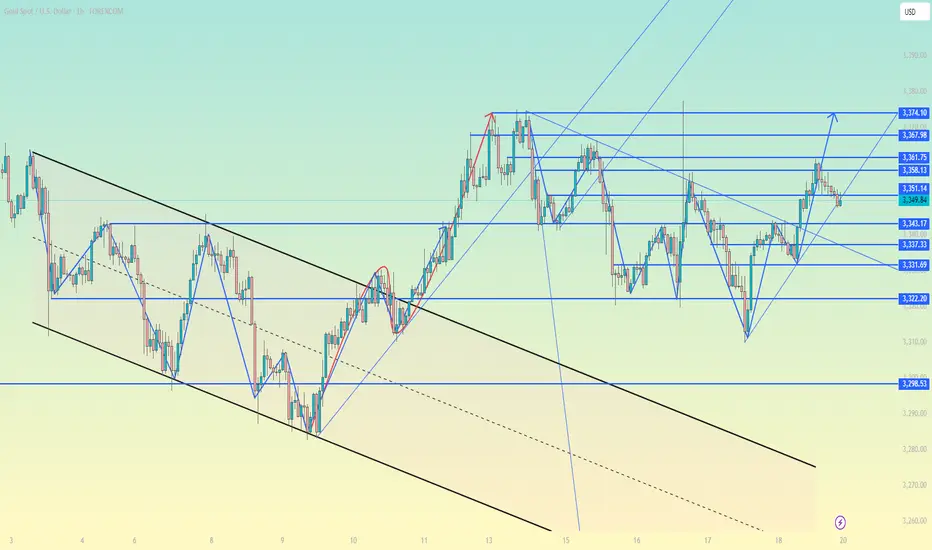

4. Technical aspect: $3,350 becomes a key battle position

From a technical perspective, gold prices formed short-term support around $3,350 this week, but the upward movement is still constrained by the strong resistance zone of $3,380-3,400. If it can stand above $3,350 next week and break through $3,380, it may open up further room for growth; conversely, if it falls below $3,330, the risk of a short-term correction will increase.

5. Outlook for next week: Tariffs, the Federal Reserve and geopolitics are still the focus

Next week, the trend of the gold market will still depend on three major factors:

Progress of trade negotiations (US-EU and US-Japan tariff trends);

Federal Reserve policy expectations (whether the interest rate cut signal is strengthened);

Geopolitical situation (whether tensions in the Middle East escalate).

If the Trump administration continues to exert pressure on trade issues, or the Federal Reserve sends clearer easing signals, gold prices are expected to break through the $3,380-3,400 range. On the contrary, if economic data is strong or trade tensions ease, gold may fall back to the $3,300 support.

(Personal opinion)

The gold market is currently in the "calm before the storm" - trade wars, Federal Reserve policies, geopolitical risks, any unexpected event may cause violent fluctuations. Although the short-term technical side is slightly entangled, in the medium and long term, gold is still a safe-haven asset worth holding against the backdrop of high global uncertainty. Near $3,350 may be the accumulation point before the start of a new round of market.

This week, the gold market maintained a volatile trend under the dual support of a weaker dollar and geopolitical uncertainty. Spot gold finally closed at $3,353.25 per ounce, basically stabilizing around $3,350 during the week. Although the market once fluctuated due to the issue of whether Fed Chairman Powell would stay or go, safe-haven demand still provided solid bottom support for gold prices.

1. Weak dollar + geopolitical risks, gold received safe-haven buying

Due to lingering market concerns about global economic growth and the decline in U.S. bond yields, the U.S. dollar index was under pressure this week, providing upward momentum for gold. In addition, the uncertainty of the geopolitical situation - including the Iranian issue, the attack on the oil fields in Kurdistan, Iraq, and the continued fermentation of trade frictions between the United States and Europe and the United States and Japan - further consolidated gold's safe-haven status.

2. The shadow of the trade war lingers, and the IMF warns of economic risks

Although the US retail sales and unemployment data in June were strong, showing economic resilience, trade tensions remain the biggest source of uncertainty in the market. Tariff negotiations between the United States and Indonesia, Japan and the European Union are still ongoing, and the Trump administration's insistence on imposing high tariffs on EU cars has exacerbated market concerns about the global trade environment.

The International Monetary Fund (IMF) warned again this week that trade frictions remain the main downside risk to the global economy and may slightly raise growth expectations at the end of July, but the overall outlook remains unclear. If the trade situation worsens, the safe-haven properties of gold will be magnified again.

3. The internal divisions of the Federal Reserve have intensified, and the expectation of interest rate cuts remains uncertain

The most dramatic market episode this week was the rumor that "Powell may be fired." Although Trump quickly denied it, the incident exposed the tension between the White House and the Federal Reserve. What is more noteworthy is that the differences within the Federal Reserve on interest rate cuts are widening-board members Waller and Bowman have expressed support for interest rate cuts, while other members may still be cautious.

If two directors vote against the July FOMC meeting, it will be a rare disagreement since 1993, which may exacerbate market volatility. At present, the market is still betting that the Fed will cut interest rates in September, but if economic data remains strong, this expectation may be postponed, thus limiting the upside of gold prices.

4. Technical aspect: $3,350 becomes a key battle position

From a technical perspective, gold prices formed short-term support around $3,350 this week, but the upward movement is still constrained by the strong resistance zone of $3,380-3,400. If it can stand above $3,350 next week and break through $3,380, it may open up further room for growth; conversely, if it falls below $3,330, the risk of a short-term correction will increase.

5. Outlook for next week: Tariffs, the Federal Reserve and geopolitics are still the focus

Next week, the trend of the gold market will still depend on three major factors:

Progress of trade negotiations (US-EU and US-Japan tariff trends);

Federal Reserve policy expectations (whether the interest rate cut signal is strengthened);

Geopolitical situation (whether tensions in the Middle East escalate).

If the Trump administration continues to exert pressure on trade issues, or the Federal Reserve sends clearer easing signals, gold prices are expected to break through the $3,380-3,400 range. On the contrary, if economic data is strong or trade tensions ease, gold may fall back to the $3,300 support.

(Personal opinion)

The gold market is currently in the "calm before the storm" - trade wars, Federal Reserve policies, geopolitical risks, any unexpected event may cause violent fluctuations. Although the short-term technical side is slightly entangled, in the medium and long term, gold is still a safe-haven asset worth holding against the backdrop of high global uncertainty. Near $3,350 may be the accumulation point before the start of a new round of market.

Free Signals:t.me/+CXftl_-QHEo2Yzc0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Free Signals:t.me/+CXftl_-QHEo2Yzc0

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.