✅Gold price action for Wednesday is nearing its end. Looking back on today's performance, we successfully entered multiple long positions around the 3327–3330 support zone, all of which hit their profit targets.

✅Given the increased volatility in recent sessions and the fact that this week is NFP (Non-Farm Payroll) week with heavy fundamental releases, we maintained a cautious and disciplined approach to secure profits efficiently.

✅As many of you following my updates may have seen, I repeatedly emphasized not to chase long positions above the 3350 level, both Yesterday and Today. The market has since proven that chasing longs above 3350 carries higher risk. As anticipated, gold pulled back after testing that zone, and we took advantage of the retracement to enter longs at better prices, aligning with our ongoing strategy of "buying the dip in an uptrend" — resulting in yet another round of successful trades.

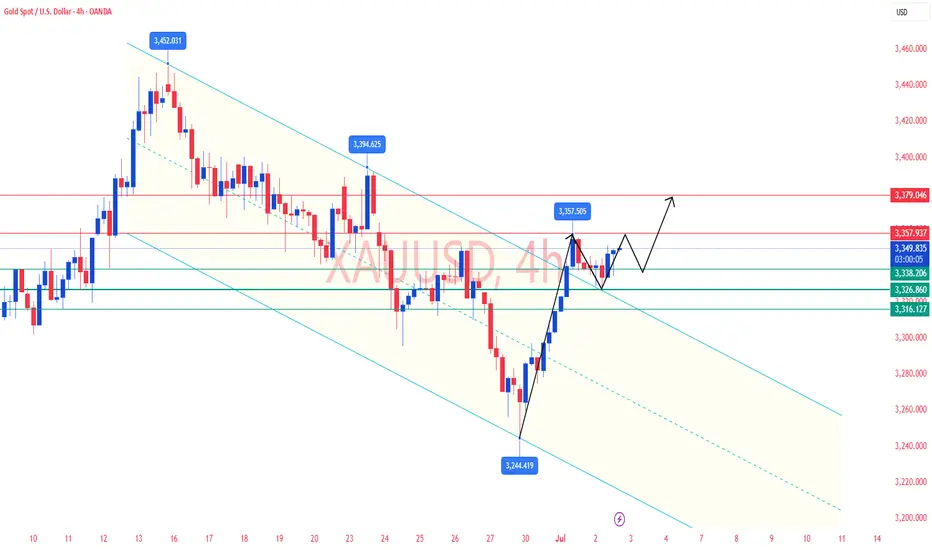

✅Technical Outlook (4H and Daily Timeframes):

🔶On the 4-hour chart, initial support is seen around 3324. If prices pull back and hold above this level, the bullish bias remains intact.

Key short-term support lies between 3314 and 3316, and a break below this area may lead to a test of the 3295–3301 zone, which serves as a crucial bull-bear dividing line.

🔶From a daily chart perspective, as long as gold remains firmly above the 3300 psychological support level, the broader structure remains bullish, and we continue to favor buying on dips.

✅Gold Trading Strategy:

🔰Buy zone: 3326–3333

⛔Stop-loss: Below 3319

🎯Take-profit targets: 3355–3363;If 3363 is broken, consider holding for further upside potential.

✅If your recent trading results haven’t been ideal, feel free to reach out. I’d be happy to help you avoid common pitfalls and improve your performance.

🔴I will provide real-time strategy updates during market hours based on price action — stay tuned.

✅Given the increased volatility in recent sessions and the fact that this week is NFP (Non-Farm Payroll) week with heavy fundamental releases, we maintained a cautious and disciplined approach to secure profits efficiently.

✅As many of you following my updates may have seen, I repeatedly emphasized not to chase long positions above the 3350 level, both Yesterday and Today. The market has since proven that chasing longs above 3350 carries higher risk. As anticipated, gold pulled back after testing that zone, and we took advantage of the retracement to enter longs at better prices, aligning with our ongoing strategy of "buying the dip in an uptrend" — resulting in yet another round of successful trades.

✅Technical Outlook (4H and Daily Timeframes):

🔶On the 4-hour chart, initial support is seen around 3324. If prices pull back and hold above this level, the bullish bias remains intact.

Key short-term support lies between 3314 and 3316, and a break below this area may lead to a test of the 3295–3301 zone, which serves as a crucial bull-bear dividing line.

🔶From a daily chart perspective, as long as gold remains firmly above the 3300 psychological support level, the broader structure remains bullish, and we continue to favor buying on dips.

✅Gold Trading Strategy:

🔰Buy zone: 3326–3333

⛔Stop-loss: Below 3319

🎯Take-profit targets: 3355–3363;If 3363 is broken, consider holding for further upside potential.

✅If your recent trading results haven’t been ideal, feel free to reach out. I’d be happy to help you avoid common pitfalls and improve your performance.

🔴I will provide real-time strategy updates during market hours based on price action — stay tuned.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.