XAUUSD 16/07 – Temporary Rebound or Trap Before the Next Drop?

🌍 Macro View – Calm Before the Volatility?

Gold is currently hovering around $3,334/oz after an aggressive sell-off earlier this week. While June's Core CPI data from the US came in lower than expected — easing immediate inflation concerns — the broader macro landscape remains far from stable:

New US tariffs are beginning to ripple through consumer prices.

Sectors like appliances and electronics are seeing early signs of inflation.

Shrinking inventories may lead to direct price pressures on consumers soon.

🔎 As the market digests these signals, gold remains a defensive play — but today's PPI release could flip sentiment quickly.

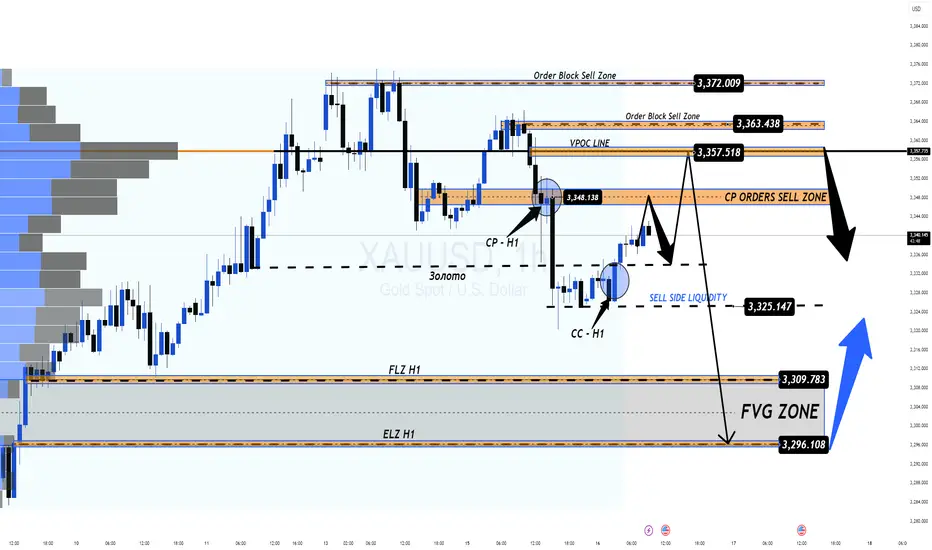

📉 Technical Outlook – Setup for a Deeper Pullback?

After CPI, gold retraced sharply and filled liquidity around 332x.

A clear Fair Value Gap (FVG) formed on the H1 chart, alongside a potential Continuation Pattern (CP) near 3347–3349.

Price action is likely to revisit the 334x–336x resistance zone, providing ideal short setups if rejection is confirmed.

🎯 Below lies a deep liquidity zone (FVG) near 3294, which could serve as the magnet for the next bearish move.

📊 Key Trade Zones to Watch

🔵 Buy Zone – Deep Liquidity Support: 3,296 – 3,294

SL: 3,290

TP: 3,300 → 3,304 → 3,308 → 3,312 → 3,316 → 3,320 → 3,330

🔴 Sell Scalp – CP Pattern Rejection: 3,347 – 3,349

SL: 3,353

TP: 3,343 → 3,340 → 3,336 → 3,330 → 3,325 → 3,320 → 3,310 → 3,300

🚨 Sell Zone – VPOC Level Resistance: 3,358 – 3,360

SL: 3,364

TP: 3,354 → 3,350 → 3,346 → 3,340 → 3,330 → 3,320 → 3,300

⚠️ What to Expect Today

All eyes are on the US PPI data, which could shake markets later in the session.

Look for a bullish fake-out during London or New York hours, especially toward 334x–336x zones.

Ideal strategy: wait for H1 candle confirmation before entering, and manage risk with clean TP/SL levels.

💬 Your Take?

Will gold revisit 329x this week, or are we setting up for a bullish reversal?

👇 Drop your thoughts in the comments and follow MMFlowTrading for high-probability setups and macro insights — daily!

🌍 Macro View – Calm Before the Volatility?

Gold is currently hovering around $3,334/oz after an aggressive sell-off earlier this week. While June's Core CPI data from the US came in lower than expected — easing immediate inflation concerns — the broader macro landscape remains far from stable:

New US tariffs are beginning to ripple through consumer prices.

Sectors like appliances and electronics are seeing early signs of inflation.

Shrinking inventories may lead to direct price pressures on consumers soon.

🔎 As the market digests these signals, gold remains a defensive play — but today's PPI release could flip sentiment quickly.

📉 Technical Outlook – Setup for a Deeper Pullback?

After CPI, gold retraced sharply and filled liquidity around 332x.

A clear Fair Value Gap (FVG) formed on the H1 chart, alongside a potential Continuation Pattern (CP) near 3347–3349.

Price action is likely to revisit the 334x–336x resistance zone, providing ideal short setups if rejection is confirmed.

🎯 Below lies a deep liquidity zone (FVG) near 3294, which could serve as the magnet for the next bearish move.

📊 Key Trade Zones to Watch

🔵 Buy Zone – Deep Liquidity Support: 3,296 – 3,294

SL: 3,290

TP: 3,300 → 3,304 → 3,308 → 3,312 → 3,316 → 3,320 → 3,330

🔴 Sell Scalp – CP Pattern Rejection: 3,347 – 3,349

SL: 3,353

TP: 3,343 → 3,340 → 3,336 → 3,330 → 3,325 → 3,320 → 3,310 → 3,300

🚨 Sell Zone – VPOC Level Resistance: 3,358 – 3,360

SL: 3,364

TP: 3,354 → 3,350 → 3,346 → 3,340 → 3,330 → 3,320 → 3,300

⚠️ What to Expect Today

All eyes are on the US PPI data, which could shake markets later in the session.

Look for a bullish fake-out during London or New York hours, especially toward 334x–336x zones.

Ideal strategy: wait for H1 candle confirmation before entering, and manage risk with clean TP/SL levels.

💬 Your Take?

Will gold revisit 329x this week, or are we setting up for a bullish reversal?

👇 Drop your thoughts in the comments and follow MMFlowTrading for high-probability setups and macro insights — daily!

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+IMP0jWwLSGNmYTRl

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+IMP0jWwLSGNmYTRl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

⚜️ Trade with Money Market Flow, logic, Price action 📉📈

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+IMP0jWwLSGNmYTRl

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 15 Signals VIP

Get quality daily trading signals and plans here

JOIN NOW

t.me/+IMP0jWwLSGNmYTRl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.