Gold gained around 21 July as participants continued to focus on trade negotiations but the sequence of deals on 23 July challenged the narrative of rising trade tension somewhat. The base case of two more cuts this year by the Fed is broadly positive for the yellow metal but now there’s some intrigue about whether the Fed might even hold in September.

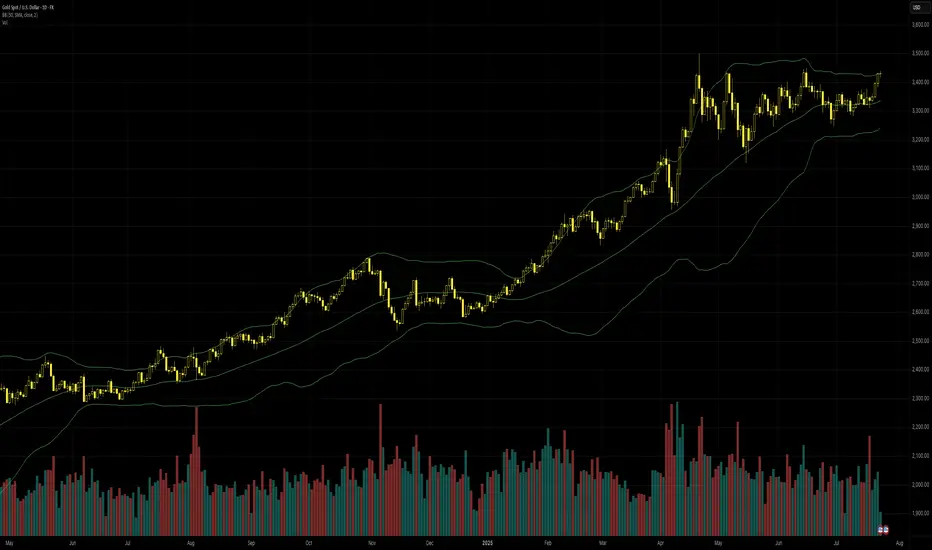

The record high daily close is about $3,450 and the main technical reference for now. A close above this area might indicate a false breakout rather than a new phase of the uptrend. However, if the price manages to close above intraday highs near $3,500, the signal of a continuation upward would probably be more reliable. The stochastic signals overbought and volume is relatively low, a normal situation for summer, so an immediate new high seems quite questionable or at the very least it’s a big risk for new buyers to enter here.

The main dynamic support in the near future is probably the value area between the 20 and 100 SMAs and perhaps specifically around $3,300. Volume might pick up around there and drive another attempt on the all-time highs.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

The record high daily close is about $3,450 and the main technical reference for now. A close above this area might indicate a false breakout rather than a new phase of the uptrend. However, if the price manages to close above intraday highs near $3,500, the signal of a continuation upward would probably be more reliable. The stochastic signals overbought and volume is relatively low, a normal situation for summer, so an immediate new high seems quite questionable or at the very least it’s a big risk for new buyers to enter here.

The main dynamic support in the near future is probably the value area between the 20 and 100 SMAs and perhaps specifically around $3,300. Volume might pick up around there and drive another attempt on the all-time highs.

This is my personal opinion, not the opinion of Exness. This is not a recommendation to trade.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.