Upward opportunity in the bull-bear tug-of-war of gold

Current price: $3,360/ounce, yesterday's roller coaster market of $3,375-3,343

▶ Key driving factors

Bullish factors:

🔥 Trump tariff bomb: 30% tariff on EU/Mexico from August 1 (EU 21 billion euro counter-list to be issued)

🌪️ Geopolitical risks escalate: The United States issued a 50-day ultimatum to Russia, and NATO accelerated the arming of Ukraine

📉 Potential weakness of the US dollar: Market expectations for the Fed's September rate cut remain at 72%

Negative pressure:

💵 US dollar rebound: US dollar index hit 98.14 (three-week high)

📈 US Treasury yields: 10-year rose to 4.447% (four-week high)

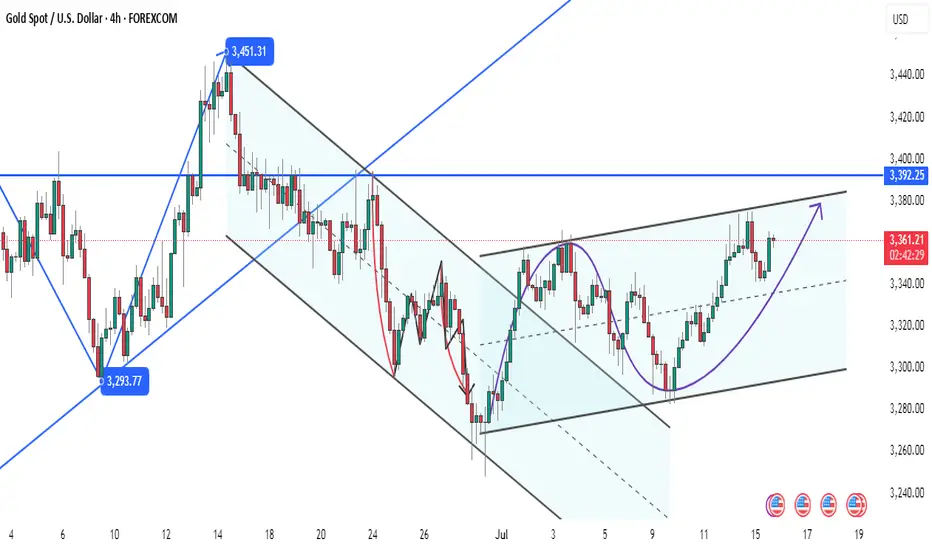

▶ Technical key framework (bullish perspective)

Trend structure:

• The daily line stands firm on the short-term moving average, and the 3325-30 area forms a bullish defense line

• Breaking through 3375 will open up the space of 3400-3450

• The 4-hour chart maintains an upward channel, and 3340-45 constitutes the first support of the day

Trading strategy:

① Aggressive long: light position at the current price of 3345 to try long, increase position at 3330, stop loss below 3317, target 3365-75

② Breakthrough trading: large volume breakthrough 3375 to chase long, stop loss 3360, target 3400

③ Hedge protection: buy 3300 put options to hedge against black swan risks

"Every callback caused by the trade war is a better entry point for bulls - this time will be no exception." - A senior gold trader

▶ Today's focus

⏰ 20:30 US June CPI data (expected to be 2.7% year-on-year)

• If the actual ≤2.5%: gold may go straight to 3400

• If the actual value is ≥3.0%, it may test the support of 3320

Personal opinion: In the context of the increasing tension in the trade war, the current support area of 3340-45 is very attractive. Although it is constrained by the rebound of the US dollar in the short term, the safe-haven property of gold will eventually prevail - it is recommended to arrange long orders on dips and wait for the CPI data to trigger the market.

Current price: $3,360/ounce, yesterday's roller coaster market of $3,375-3,343

▶ Key driving factors

Bullish factors:

🔥 Trump tariff bomb: 30% tariff on EU/Mexico from August 1 (EU 21 billion euro counter-list to be issued)

🌪️ Geopolitical risks escalate: The United States issued a 50-day ultimatum to Russia, and NATO accelerated the arming of Ukraine

📉 Potential weakness of the US dollar: Market expectations for the Fed's September rate cut remain at 72%

Negative pressure:

💵 US dollar rebound: US dollar index hit 98.14 (three-week high)

📈 US Treasury yields: 10-year rose to 4.447% (four-week high)

▶ Technical key framework (bullish perspective)

Trend structure:

• The daily line stands firm on the short-term moving average, and the 3325-30 area forms a bullish defense line

• Breaking through 3375 will open up the space of 3400-3450

• The 4-hour chart maintains an upward channel, and 3340-45 constitutes the first support of the day

Trading strategy:

① Aggressive long: light position at the current price of 3345 to try long, increase position at 3330, stop loss below 3317, target 3365-75

② Breakthrough trading: large volume breakthrough 3375 to chase long, stop loss 3360, target 3400

③ Hedge protection: buy 3300 put options to hedge against black swan risks

"Every callback caused by the trade war is a better entry point for bulls - this time will be no exception." - A senior gold trader

▶ Today's focus

⏰ 20:30 US June CPI data (expected to be 2.7% year-on-year)

• If the actual ≤2.5%: gold may go straight to 3400

• If the actual value is ≥3.0%, it may test the support of 3320

Personal opinion: In the context of the increasing tension in the trade war, the current support area of 3340-45 is very attractive. Although it is constrained by the rebound of the US dollar in the short term, the safe-haven property of gold will eventually prevail - it is recommended to arrange long orders on dips and wait for the CPI data to trigger the market.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.