✅Fundamental Analysis:

During the U.S. session on July 1, spot gold moved higher in a choppy manner, reaching a peak of $3,357.88/oz, the highest level in the past three trading days. The recent rebound in gold prices has been primarily driven by the following factors:

🔶A weaker U.S. dollar, providing direct support for gold;

🔶Rising uncertainty around the U.S.-China trade agreement, fueling safe-haven demand;

🔶Expectations for Federal Reserve rate cuts continue to strengthen, with traders now pricing in at least two rate cuts in 2025;

🔶Reports that former President Trump is considering replacing Fed Chair Jerome Powell with someone more supportive of rate cuts, intensifying expectations for looser monetary policy;

🔶Heightened global economic uncertainty, further reinforcing gold’s role as a safe-haven asset.

✅Technical Analysis:

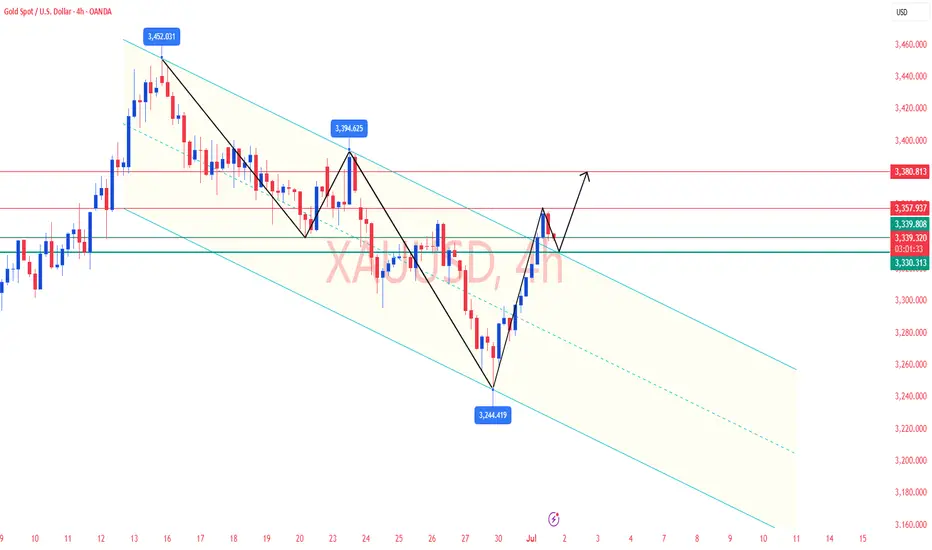

🔹 4-Hour Chart:

The MACD indicator is showing bullish divergence at the bottom, accompanied by increasing volume, signaling a potential price bottom and rebound. Prices are trending above short-term moving averages and have broken through a previous consolidation resistance zone, indicating a short-term bullish bias.

Watch for a potential secondary rally after a pullback toward the end of the session. Immediate resistance is seen in the $3,375–$3,380 range.

🔹 1-Hour Chart:

Gold is consolidating in a narrow high-level range with limited pullback strength. Candlesticks remain supported by short-term moving averages, suggesting continued upside potential.

Be alert for a resumption of the uptrend once the short-term technical indicators finish their consolidation.

✅Short-Term Trading Strategy:

📌 Buy on dips, sell on rebounds.

🔰Consider entering long positions in the $3,330–$3,335 range;

🔰Stop-loss: $3,327;

🔰Target: $3,350–$3,360, with a potential extension to $3,375–$3,380 if resistance is broken.

✅In the fast-moving gold trading market, many traders often feel overwhelmed and uncertain when prices break through key support or resistance levels. That’s where I come in.

✅I offer real-time guidance to help you navigate every important market trend—whether you're managing breakouts or adjusting your strategy. I’ll be there through every critical moment to provide professional advice and support, making your trading more secure, efficient, and confident.

During the U.S. session on July 1, spot gold moved higher in a choppy manner, reaching a peak of $3,357.88/oz, the highest level in the past three trading days. The recent rebound in gold prices has been primarily driven by the following factors:

🔶A weaker U.S. dollar, providing direct support for gold;

🔶Rising uncertainty around the U.S.-China trade agreement, fueling safe-haven demand;

🔶Expectations for Federal Reserve rate cuts continue to strengthen, with traders now pricing in at least two rate cuts in 2025;

🔶Reports that former President Trump is considering replacing Fed Chair Jerome Powell with someone more supportive of rate cuts, intensifying expectations for looser monetary policy;

🔶Heightened global economic uncertainty, further reinforcing gold’s role as a safe-haven asset.

✅Technical Analysis:

🔹 4-Hour Chart:

The MACD indicator is showing bullish divergence at the bottom, accompanied by increasing volume, signaling a potential price bottom and rebound. Prices are trending above short-term moving averages and have broken through a previous consolidation resistance zone, indicating a short-term bullish bias.

Watch for a potential secondary rally after a pullback toward the end of the session. Immediate resistance is seen in the $3,375–$3,380 range.

🔹 1-Hour Chart:

Gold is consolidating in a narrow high-level range with limited pullback strength. Candlesticks remain supported by short-term moving averages, suggesting continued upside potential.

Be alert for a resumption of the uptrend once the short-term technical indicators finish their consolidation.

✅Short-Term Trading Strategy:

📌 Buy on dips, sell on rebounds.

🔰Consider entering long positions in the $3,330–$3,335 range;

🔰Stop-loss: $3,327;

🔰Target: $3,350–$3,360, with a potential extension to $3,375–$3,380 if resistance is broken.

✅In the fast-moving gold trading market, many traders often feel overwhelmed and uncertain when prices break through key support or resistance levels. That’s where I come in.

✅I offer real-time guidance to help you navigate every important market trend—whether you're managing breakouts or adjusting your strategy. I’ll be there through every critical moment to provide professional advice and support, making your trading more secure, efficient, and confident.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.