XAUUSD 03/07–Poor NFP Expectations,Gold Awaits Key Market Reaction

Macro Update

Today’s NFP release is anticipated to underperform, following a sharp miss in ADP employment data yesterday (-33K vs forecasted 99K).

This is also the final session ahead of the US Independence Day holiday, potentially triggering increased volatility.

Geopolitical tensions are elevated following former President Trump’s comments regarding tariffs and trade policy.

Technical Outlook

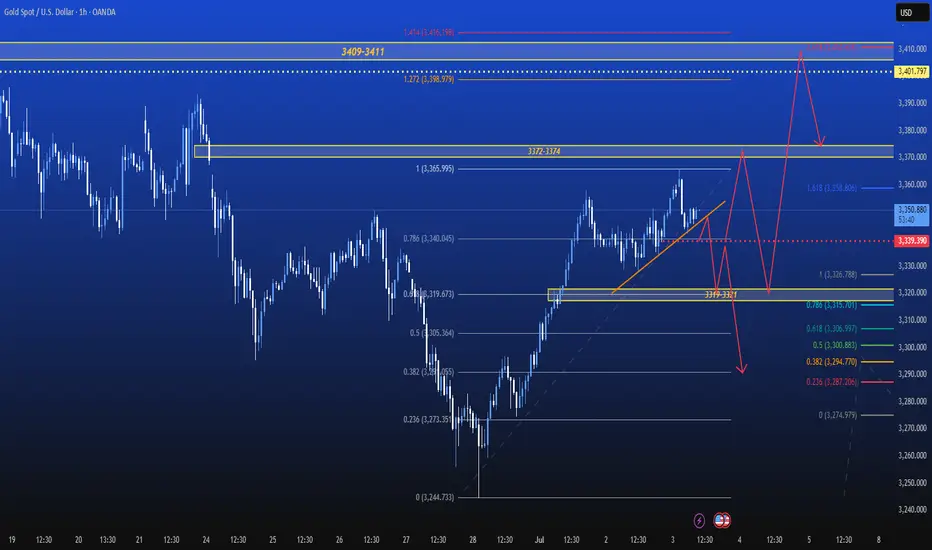

Gold declined nearly $24 in the Asian session, likely completing the 5th wave in Elliott Wave theory.

The medium-term structure remains bullish, with no decisive reversal observed.

An ascending trendline on H1 is key – a break below may trigger intraday selling setups in the European hours.

Trading Plan

Buy Entries

Entry 1: 3337 – 3339 | SL: 3333 | TP: 3346 – 3360 – 3372

Entry 2: 3319 – 3321 | SL: 3315 | TP: 3328 – 3335 – 3348 – 3360

Sell Triggers (on trendline break)

Entry 1: 3349

Entry 2: 3372 – 3374 | SL: 3378 | TP: 3360 – 3345 – 3330 – 3320

Entry 3: 3409 – 3411 | SL: 3415 | TP: 3392 – 3380 – 3360 – 3345

Summary

Gold faces pressure from both economic fundamentals and technical levels.

The upcoming NFP data could define market direction for July.

Overall strategy is to favour long positions while remaining alert for confirmed short setups.

Macro Update

Today’s NFP release is anticipated to underperform, following a sharp miss in ADP employment data yesterday (-33K vs forecasted 99K).

This is also the final session ahead of the US Independence Day holiday, potentially triggering increased volatility.

Geopolitical tensions are elevated following former President Trump’s comments regarding tariffs and trade policy.

Technical Outlook

Gold declined nearly $24 in the Asian session, likely completing the 5th wave in Elliott Wave theory.

The medium-term structure remains bullish, with no decisive reversal observed.

An ascending trendline on H1 is key – a break below may trigger intraday selling setups in the European hours.

Trading Plan

Buy Entries

Entry 1: 3337 – 3339 | SL: 3333 | TP: 3346 – 3360 – 3372

Entry 2: 3319 – 3321 | SL: 3315 | TP: 3328 – 3335 – 3348 – 3360

Sell Triggers (on trendline break)

Entry 1: 3349

Entry 2: 3372 – 3374 | SL: 3378 | TP: 3360 – 3345 – 3330 – 3320

Entry 3: 3409 – 3411 | SL: 3415 | TP: 3392 – 3380 – 3360 – 3345

Summary

Gold faces pressure from both economic fundamentals and technical levels.

The upcoming NFP data could define market direction for July.

Overall strategy is to favour long positions while remaining alert for confirmed short setups.

👑 Price Action - Simple Trade System - One Shot One Kill Style

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+S0kE2azug3IyOGRl

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+S0kE2azug3IyOGRl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

👑 Price Action - Simple Trade System - One Shot One Kill Style

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+S0kE2azug3IyOGRl

🔥 Get Real - Time (3-4 Free Call Daily) Trading Signals Here: t.me/+S0kE2azug3IyOGRl

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.